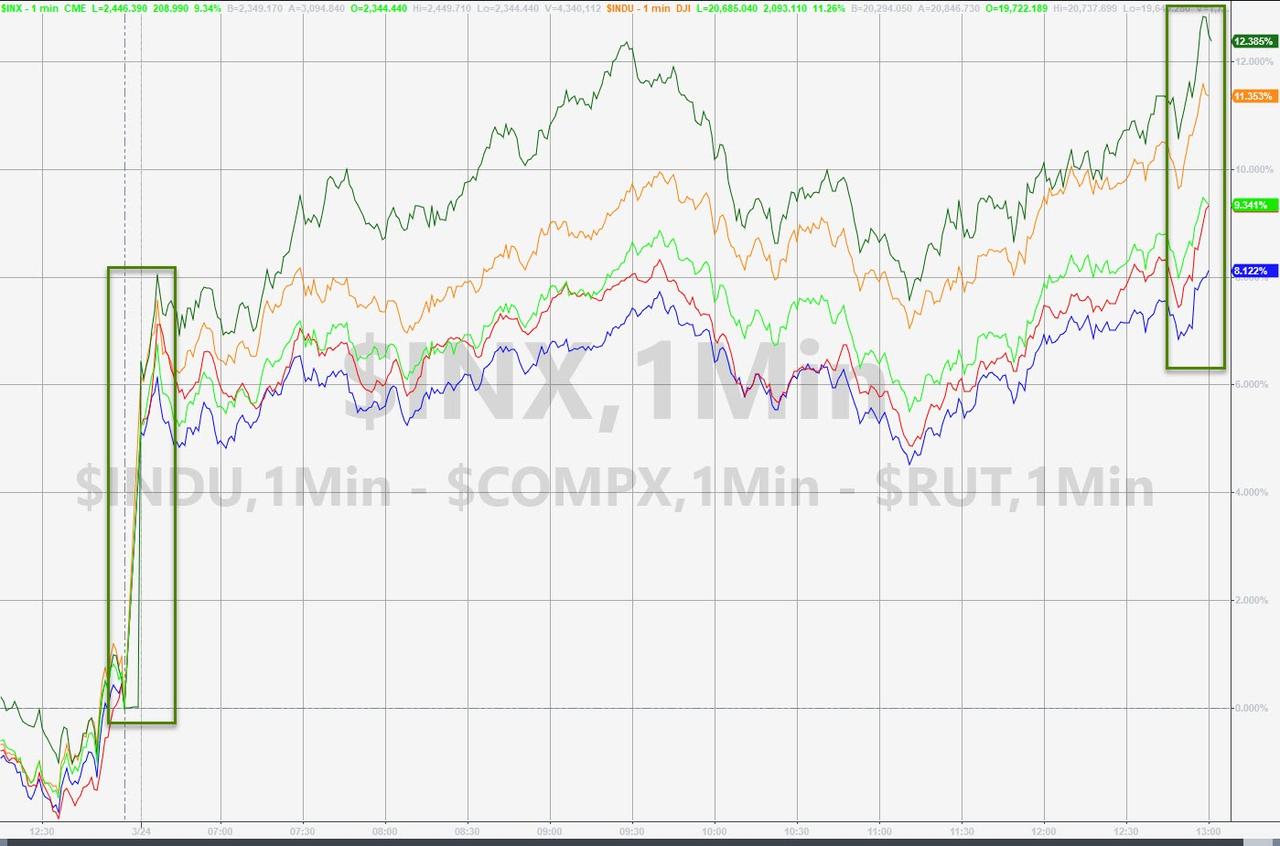

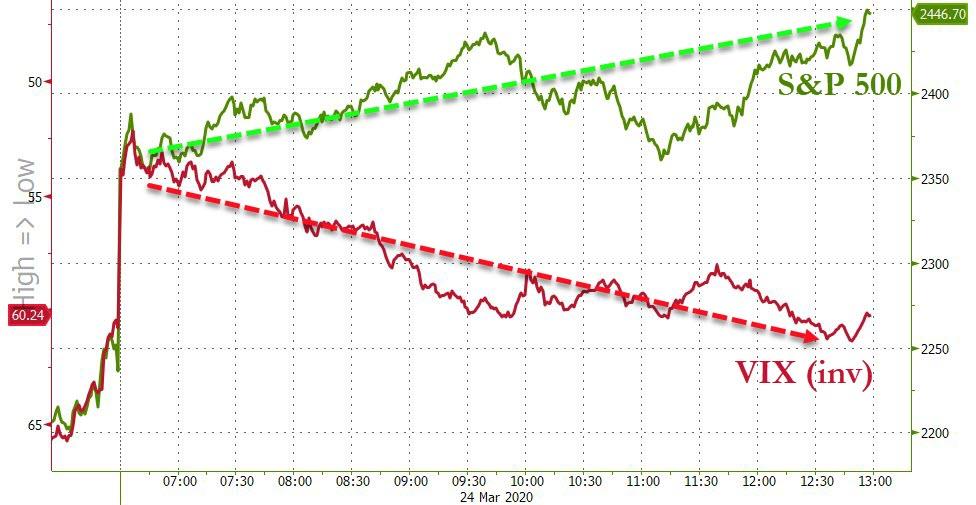

The result was initial euphoria as the S&P jumped to 2,499 - the exact same high hit last on quad-witching Friday last week... before it rolled over as the news was sold...

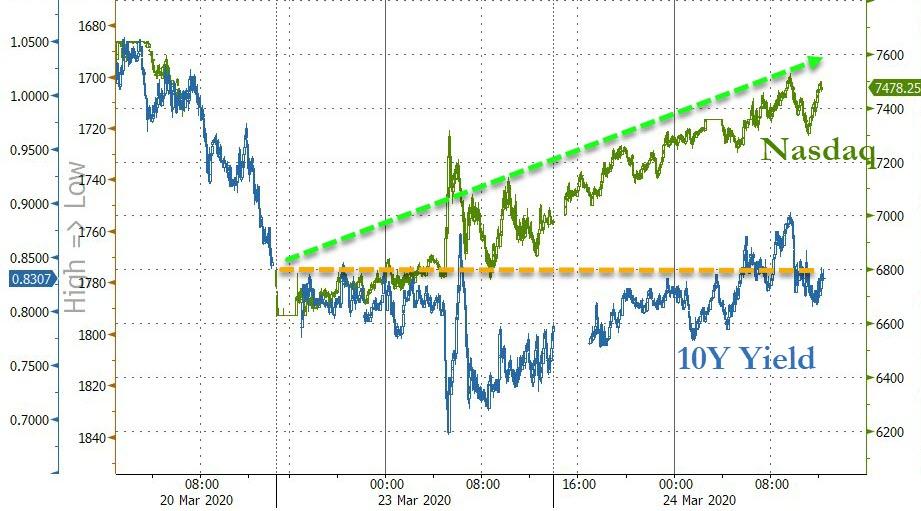

... while Treasuries did the mirror image and rebounded with yields sliding to 0.81% as investors waited for details on government rescue packages to counter the hit from the coronavirus.

How will COVID-19 impact airlines long term?

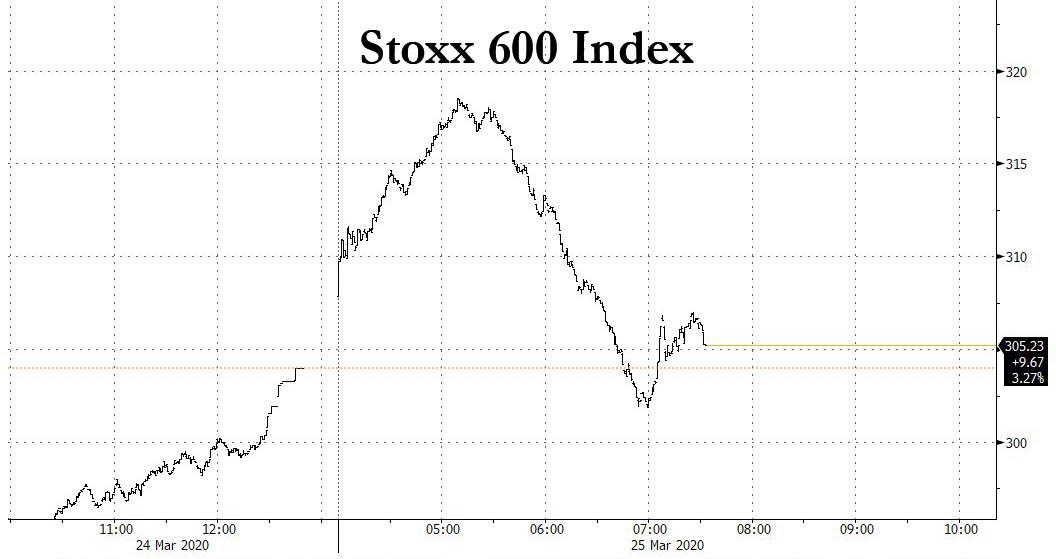

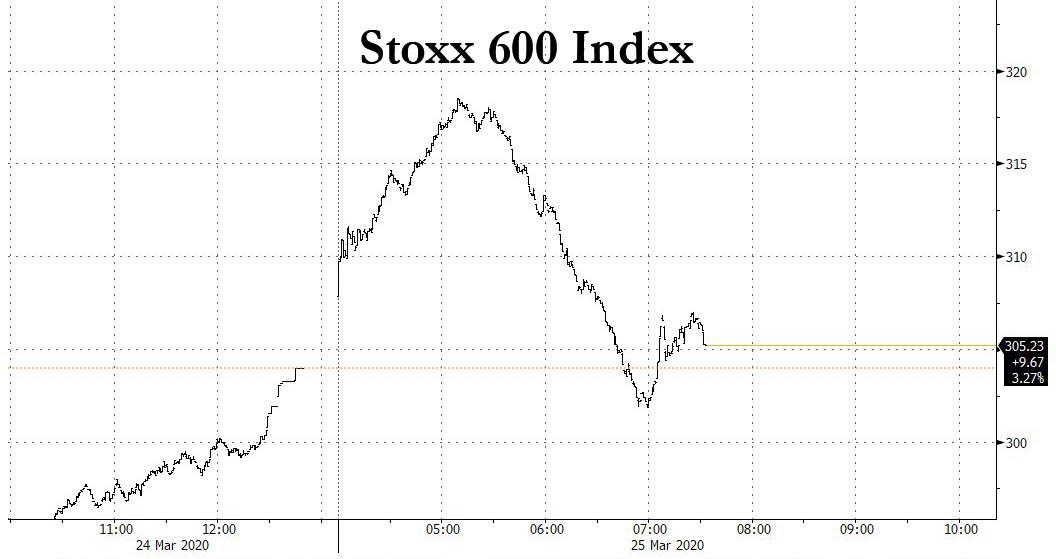

As US futures faded the news, equity markets across Europe and the U.K. also lost steam from an earlier surge as euro-region leaders inched toward a stimulus accord. The Stoxx 600 index turned red after earlier rising almost 5%

Earlier, Asian stocks fared better, posting their best one-day increase since 2008. All markets in the region were up, with Japan's Topix Index gaining 6.9% and India's S&P BSE Sensex Index rising 6.5%. The Topix gained 6.9%, with UT Group and AD Works rising the most. The Shanghai Composite Index rose 2.2%, with Eastern Gold Jade and Shanghai Yimin Commerce Group posting the biggest advances.

However, the mood reversed shortly after 5am ET, perhaps once investors realized that the deal bans buybacks for the foreseeable future, as the top Senate democrate, Chuck Schumer said the bill will "ban stock buybacks for the term of the government assistance plus 1 year on any company receiving a government loan from the bill."

For a market where buybacks have been the primary buyer of stocks in the past decade, this was hardly welcome news.

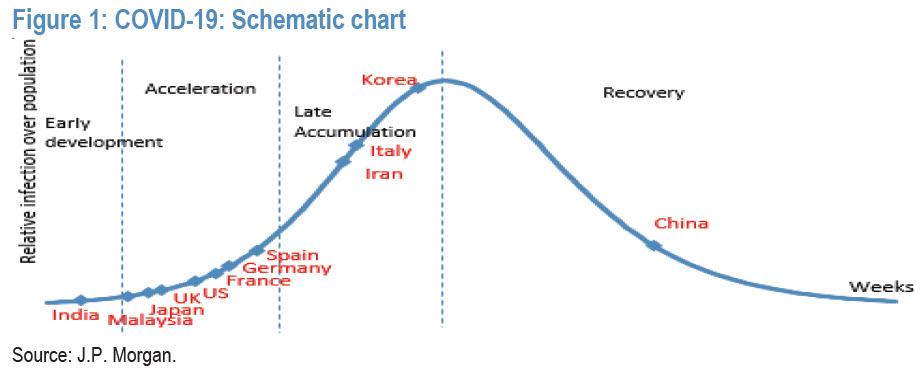

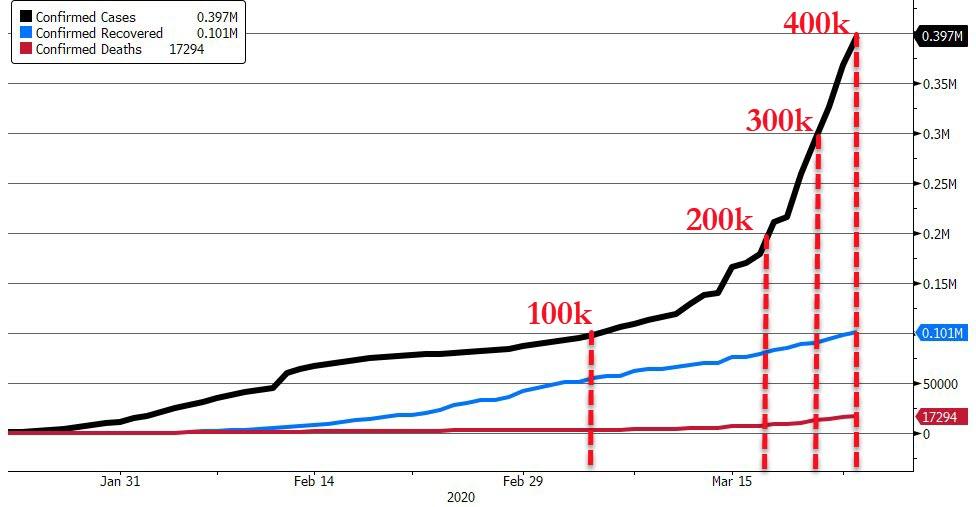

As such, investors - who were hoping for U.S. and global equity indexes to post their first back-to-back daily gains since the rout began a month ago, even as economies from Delhi to Milan and Seattle reel from the deepening pandemic - were set to be disappointed. Meanwhile, the number of infections globally continues to mount and Spain reported the largest number of deaths yet in a day, as the world still has a long way way to go before containing the pandemic.

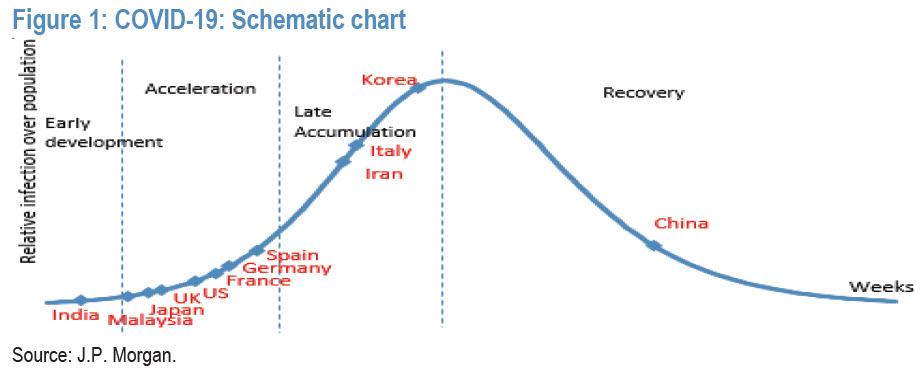

"We still need to see a slowing of the virus cases and a peaking in the U.S.," Carol Pepper, chief executive officer at Pepper International, told Bloomberg TV. "Because until then we'll have these huge relief-rally days -- then we'll get a scary day and the market will plunge down again."

As a result, in addition to risk sliding, WTI crude oil turned lower and Treasuries erased a decline. The dollar initially fell for a second day versus its biggest peers including the euro, however it has since rebounded and threatens to turn green again. The single currency added to Tuesday's gain as Germany took a step toward declaring a state of emergency to unlock a historic rescue package. A Bloomberg gauge of financial conditions loosened for the first time in six sessions.

Meanwhile, Wall Street analysts who have now shed all pretense of actually analyzing stuff and admitting they are just bailout cheerleaders did what they do best:

"The actions of monetary and fiscal policymakers should help us prevent a Global Financial Crisis-style credit crunch," Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote to investors. "Tuesday's sharp equity rally shows that the combination of central banks' entire playbook and substantial, direct fiscal support can be well-received by markets."

We wonder what he will say about Wednesday's action once we close red.

Elsewhere, the greenback weakened against all G-10 peers apart from the yen, which hovered near a one-month low reached against the dollar on Tuesday. Norway's krone led Group-of-10 gains, rising more than 2% versus the dollar, supported by better risk sentiment and higher oil prices. The pound extended its recovery into a second day; the Australian and New Zealand dollars also gained as speculative funds flipped short positions.

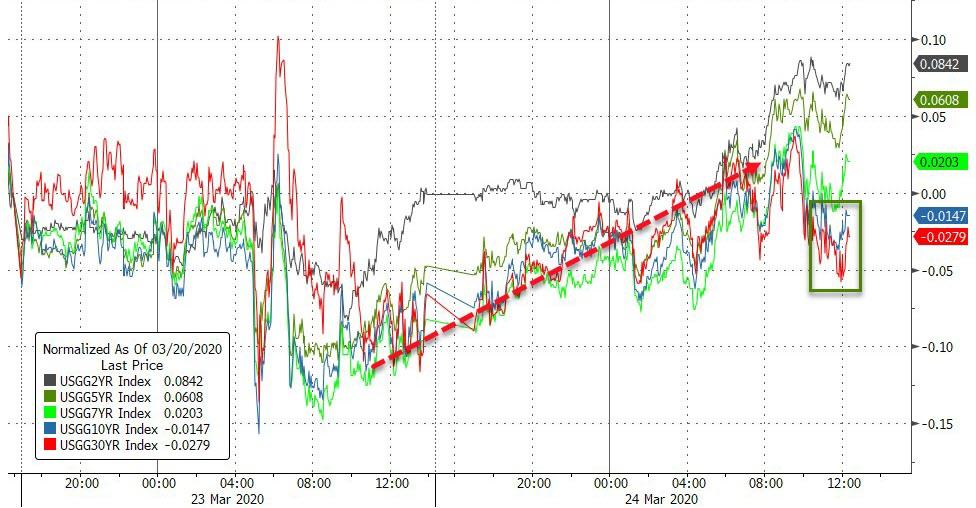

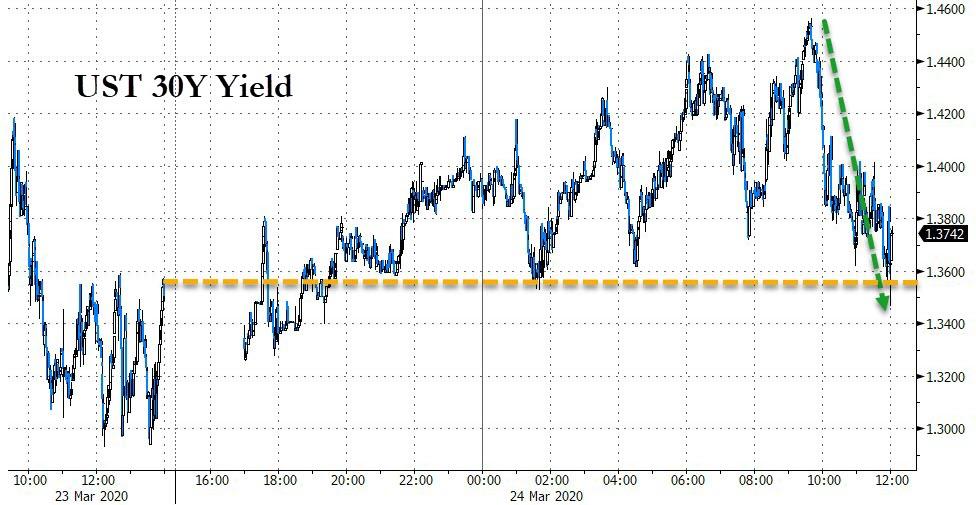

In rates, yields on Treasuries and Bunds edged higher while the curve came off an earlier flattening move.

Market Snapshot

- S&P 500 futures down 1.5% to 2,400

- STOXX Europe 600 up 3.3% to 314.07

- MXAP up 5.6% to 134.49

- MXAPJ up 4.6% to 427.28

- Nikkei up 8% to 19,546.63

- Topix up 6.9% to 1,424.62

- Hang Seng Index up 3.8% to 23,527.19

- Shanghai Composite up 2.2% to 2,781.59

- Sensex up 6.5% to 28,417.57

- Australia S&P/ASX 200 up 5.5% to 4,998.07

- Kospi up 5.9% to 1,704.76

- German 10Y yield rose 3.6 bps to -0.286%

- Euro up 0.3% to $1.0824

- Italian 10Y yield fell 1.5 bps to 1.394%

- Spanish 10Y yield fell 0.3 bps to 0.878%

- Brent futures up 1.2% to $27.47/bbl

- Gold spot down 1.3% to $1,611.50

- U.S. Dollar Index down 0.6% to 101.39

Top Overnight News

- The Trump administration is debating whether to defer payments of duties on imported goods from around the world for three months, people familiar with the talks said

- German business confidence collapsed the most in three decades after restrictions to slow the spread of the coronavirus forced mass closures of companies and stores across Europe's largest economy

- Germany Finance Minister Olaf Scholz urged lawmakers to open up debt limits to combat a crisis that threatens modern life. New borrowing of 156 billion euros ($169 billion), equivalent to half of Germany's normal annual spending, will be used to fund social benefits and direct aid to virus-hit companies It's a period of wait-and-see for money markets after the Federal Reserve's barrage of actions halted a further blow-out in funding spreads. But many problems remain, including the hoarding of dollars

- The squeeze on U.S. currency is putting pressure on emerging Asia debt. Southeast Asian and Indian government and corporate payments are set to jump 67% in 2022 to $41.9 billion, according to data compiled by Bloomberg. Dollar payments are expected to peak at $44.4 billion in 2024

- The Federal Reserve tapped BlackRock Inc. to shepherd several debt- buying programs as the U.S. central bank works to revive an economy reeling from the spread of coronavirus

- China's central bank could announce cuts to its benchmark deposit rate in the coming days, the Financial Times, reported, citing two people familiar with the matter

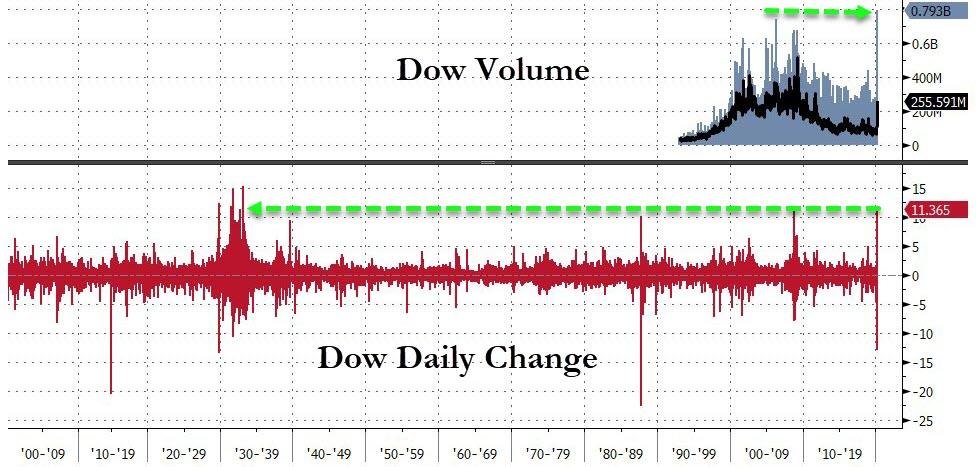

Asian equity markets traded with firm gains as the region took impetus from the historic rally on Wall St where the DJIA jumped by over 2100 points or around 11.4% for its largest daily point gain on record and biggest percentage jump since 1933, with sentiment underpinned by hopes of a stimulus breakthrough which eventually materialized as negotiators reached a deal on the coronavirus stimulus bill and with US President Trump touting a reopen of the US economy by Easter. ASX 200 (+5.5%) surged as the stellar performance stateside reverberated across the region with Real Estate, Industrials and Financials front-running the gains which briefly saw the index notch its biggest intraday gain since October 2008 to briefly surmount the 5k level, while Nikkei 225 (+8.0%) was lifted by the recent JPY-weakness and with the BoJ Summary of Opinions from last week's emergency meeting suggesting the central bank was flexible and open to another off-schedule meeting. Elsewhere, Hang Seng (+3.8%) and Shanghai Comp. (+2.2%) benefitted from the heightened global risk tone and amid reports the Trump administration is said to mull a 90-day deferral of tariffs on all imported goods from around the world, although the gains were somewhat capped as White House Trade Adviser Navarro refuted the prospects of a tariff deferral and following continued PBoC liquidity inaction. Finally, 10yr JGBs were relatively flat with demand subdued by gains in stocks and in the absence of BoJ purchases in the market today, while the announcement of a coronavirus bill agreement later weighed on prices and to break down support at the 152.00 level.

Top Asian News

- China's Central Bank Considering Benchmark Deposit Rate Cut: FT

- China Auto Shares Pare Gains as Beijing Denies Stimulus Report

- Pandemic Flags Risks Posed by Share-Backed Debt in India

- Worldwide Dollar Crunch Raises Red Flags in Asia's Debt Market

- India Weighs New Credit Line For Mutual Funds Hit by Cash Crunch

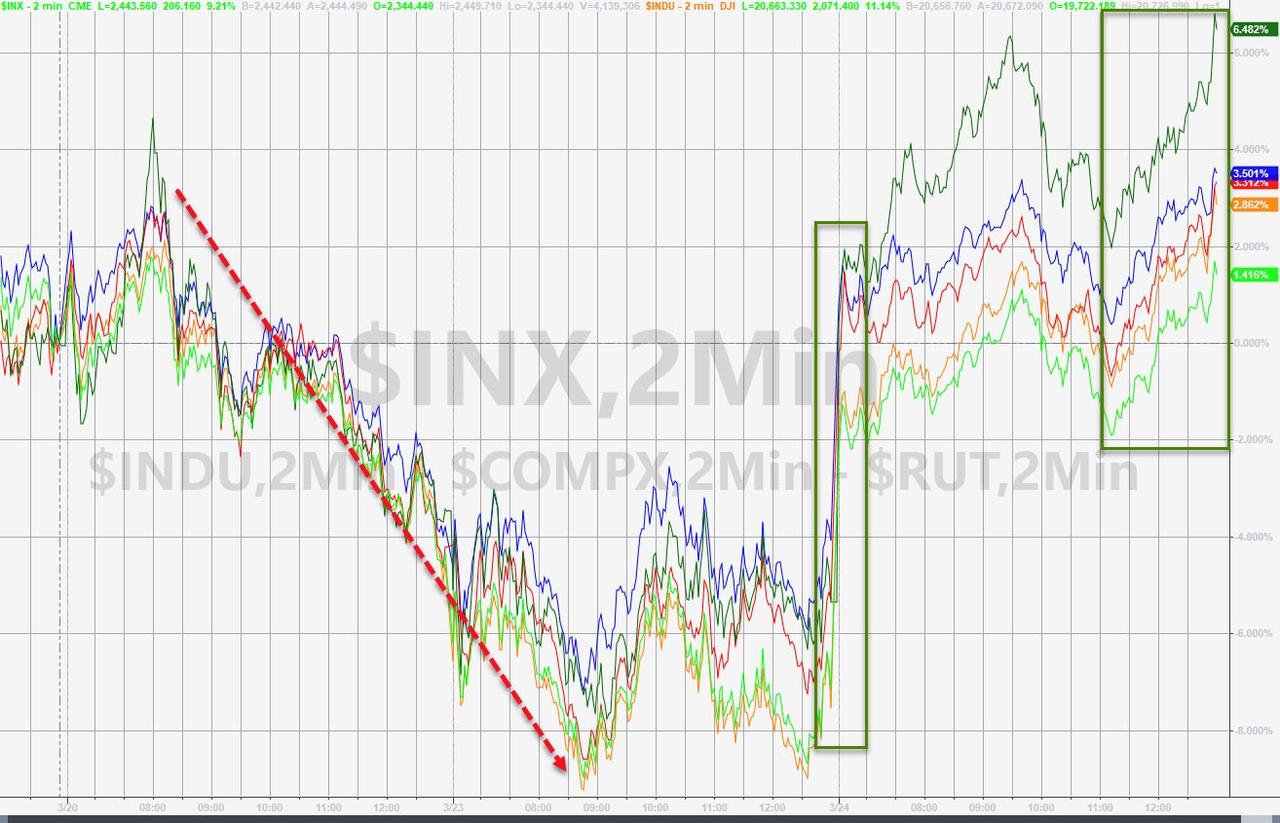

As we stand, European equities have wiped out earlier gains (Eurostoxx 50 -1.4%) following the monumental upside seen on Wall Street and in the APAC session overnight amid a concoction of stimulus announcements from the regions. Focus remains on the States after Senators agreed to the Trump administration's virus rescue bill – which sources note could be worth USD 2.5tln, and with voting to take place later today although details remain light. Back to Europe, the positive sentiment initally resonated across the region, with Germany's DAX (-2.2%) reclaiming the 10k milestone. However, the 10k level was conceded therafter alongside reports that ECB's Lagarde asked EZ Finance Ministers yesterday to seriously consider a one-off joint debt issue of coronabonds; a request that was rejected by northern European nation, however, support came from beyond just the southern states. UK's FTSE (-1.0%) initially underperformed the region before later receiving a boost due to its large financial, mining and energy exposures. European sectors now mostly red, with the exception of Energy names. Airlines experience a bout of reprieve – potentially on back of the anticipated US stimulus package support for domestic carriers acting as a catalyst; easyJet (+8.7%), Ryanair (+1.5%), and Air France-KLM (+5.7%) all trade closer to the top of the Stoxx 600. Elsewhere, E.ON (+9.2%) was bolstered at the open amid YY improvements in results and underlying utility demand from nations working from home. Finally, Adidas (+3.4%), Puma (+5.6%) and Sports Direct (+10.0%) all see tailwinds emanating from Nike earnings – whose shares show gains in excess of 12% pre-market. In terms of bank calls, UBS sees Stoxx 600 index at 340 by year-end and sees a greater upside in UK equities amid cheaper valuations. The Swiss Bank targets FTSE 100 at 6400. As earning season looms, UBS sees European companies reporting a 33% drop in 2020 EPS, with the expectations incorporating a deep recession forecast.

Top European News

- German Business Outlook Collapses With Economy Largely Shut Down

- France Pushes $4.3 Billion Support Package for Startups

- Spain Thinks Coronabonds Are a Good Idea, Foreign Minister Says

- Credit Suisse Cut Thiam's Pay by 15% in Wake of Spy Scandal

- Thyssenkrupp Expands Job Cuts in Overhaul of Weak Steel Unit

In FX, the Aussie has extended recovery gains vs its US counterpart and outperformance against most G10 peers amidst another broad upturn in risk sentiment or sheer relief that the US Senate has resolved differences on the circa Usd2 tn Stimulus C bill, including Usd400 bn for the TSF that can be multiplied up to 10 times by the Fed. Aud/Usd has now breached the psychological 0.6000 mark on the way through 0.6050 as Aud/Nzd approaches 1.0300 and the Kiwi meets some resistance around 0.5900 in wake of NZ declaring a state of emergency due to COVID-19. Meanwhile, corrective trade and short covering has carried Cable up beyond 1.1900 and over last year's 1.1959 low, with Eur/Gbp retreating well below 0.9100 as the single currency stumbles into 1.0850 vs the Greenback in wake of more pronounced weakness in Germany's final Ifo survey compared to preliminary prints. However, Eur/Usd appears well supported above 1.0800 where decent option expiries roll off (1.2 bn), and with the DXY slipping back from 101.920 to 101.150 within a slightly wider 102.000-101.00 range. Elsewhere, the Loonie is also taking advantage of relative weakness in the Buck, but losing impetus alongside WTI between 1.4297-1.4482 parameters.

- CHF/JPY - The Franc and Yen are narrowly mixed against the US Dollar either side of 0.9800 and 111.00 respectively, but the former holding up better despite waning risk appetite and a sharp deterioration in Swiss investor sentiment.

- SCANDI/EM - The Norwegian and Swedish Crowns are still in bear retracement mode with Eur/Nok sub-12.0000 and Eur/Sek under 11.0000, while EM currencies are also benefiting from less acute angst over the adverse impact of the coronavirus, for the time being at least as global Central Banks and Governments expend even more efforts to counteract the economic contagion.

In commodities, WTI and Brent front-month futures continued their sentiment-driven climb off near-multi-decade lows, before paring gains amid a broader pullback in sentiment in recent trade. Desks continue to highlight that underlying fundamentals remain largely unchanged, but stimulus hopes provide support for the complex, in the short term at least. Although data has been overshadowed, last night's Private Inventory data was seemingly constructive for the market – having printed a surprise draw of 1.2mln barrels vs. Exp. build of 2.8mln - traders will now eye the DoE figures for confirmation. That being said, the inventory numbers later today are unlikely to have a sustained impact in prices as the complex takes its cue from macro themes/sentiment. In terms of metals, spot gold trades on either side of USD 1600/oz and re-eyes its 21 DMA to the downside at ~USD 1591.90, with losses seemingly triggered due to increasing flows into riskier assets. Copper prices initially conformed to the risk appetite but have since waned off highs, with relatively uneventful price action in the red metal below 2.25/lb.

US Event Calendar

- 8:30am: Durable Goods Orders, est. -0.95%, prior -0.2%; Durables Ex Transportation, est. -0.4%, prior 0.8%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. -0.4%, prior 1.1%; Cap Goods Ship Nondef Ex Air, est. -0.2%, prior 1.0%

- 9am: FHFA House Price Index MoM, est. 0.4%, prior 0.6%

DB's Jim Reid concludes the overnight wrap

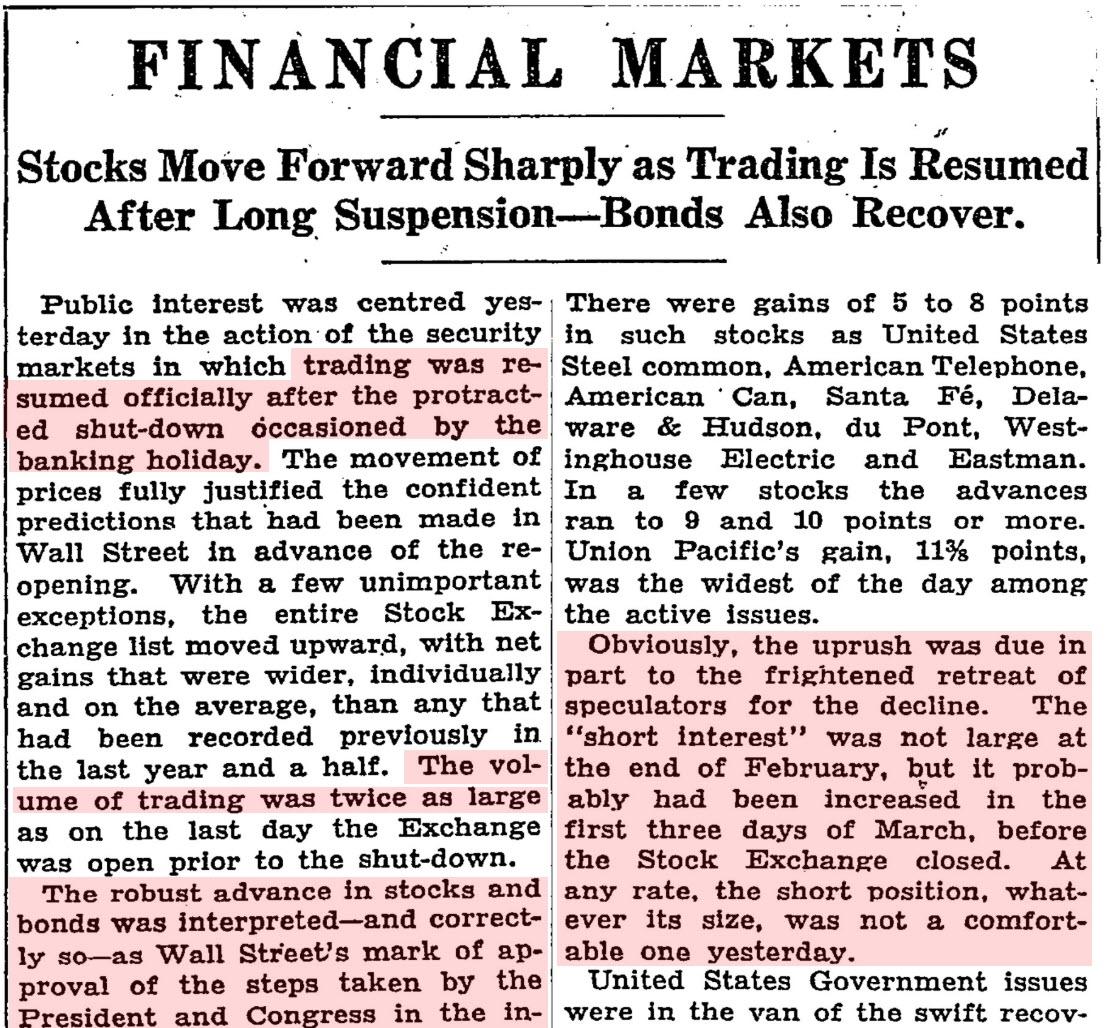

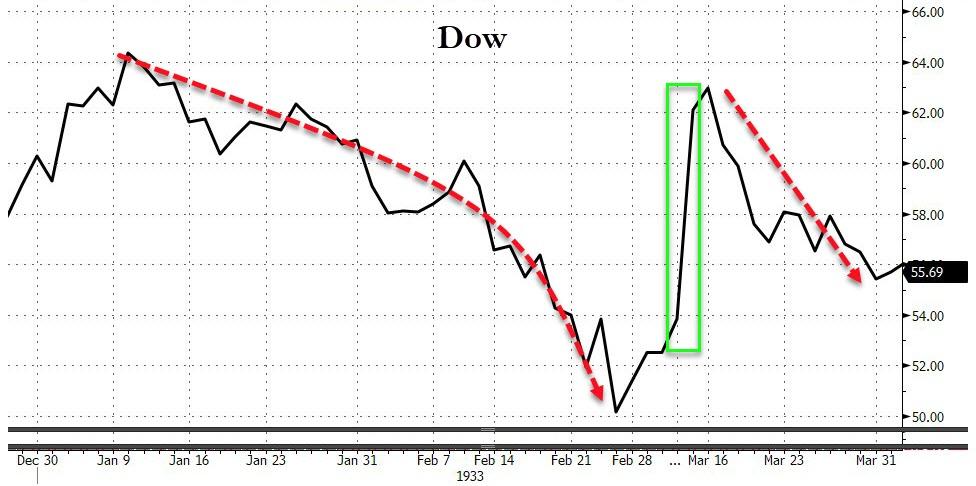

We're at a fascinating point in markets now as on one hand Europe is on almost total non-essential shutdown mode without an easy exit strategy whereas the US is straddling between this and the sentiment in Donald Trump's words that we reported yesterday that the country "was not built to be shutdown". It seems to us that a large part of yesterday's huge rally was a legacy of Trump taking a more aggressive stance against prolonged shutdowns in his Monday news conference than his Sunday equivalent where his tone was more towards defeating the virus. He expanded on this theme yesterday by repeating a phrase in a tweet that he'd used the previous day that "The cure cannot be worse (by far) than the problem!". Larry Kudlow, the Director of the National Economic Council, also said to Fox Business that the Trump Administration would look at whether it was possible to reopen places that weren't "hot zones". Mr Trump later said he'd like to have economy open by Easter which confirmed a change in tack. Perhaps he was emboldened by an exceptionally strong session that ended with the S&P 500 at the day's highs and up +9.38% - the tenth best day on record out of 24,067 trading sessions since daily data started in 1927. It was also the best day since 28 October 2008. The Dow rallied +11.37%, which is best daily performance since March 1933 and the 5th best day since the data starts in 1920 (26,149 trading days).

Taking this all in, the US is at a fork in a road that might mean they escape the worst of the savage economic slump coming down the pike if Mr Trump continues with such a policy. Alternatively they might end up doing what Europe is doing, but later, and in both cases having to deal with the political and human fall out. It would be a gamble of epic proportions but the reality is that Easter is a long way away in terms of virus news so a lot can change.

Not so far away is more US stimulus with headlines out as we go to print saying that the Senate has finally reached an agreement on the near $2tn bill. We don't have any details yet however the bill is expected to be circulated later today. The general thought though is that this will include checks to most Americans, deferrals of taxes, loans for small businesses, hospital spending and unemployment insurance measures as well as the huge $500bn fund for industries, cities and states.

S&P 500 futures are down -1.13% as we type after paring a slightly bigger decline prior to the stimulus news being released. Asian markets are stronger following the huge gains on Wall Street last night with the Nikkei (+6.93%), Hang Seng (+2.28%), Shanghai Comp (+1.57%) and Kospi (+3.96%) all making headway. The US dollar index is down -0.45% this morning which if holds will be its 3rd continuous decline. As for commodities, Brent crude oil prices are up +2.39% this morning while most base metals are also trading up with iron ore advancing by +3.40%.

Coming back the virus, yesterday afternoon the FT reported that researchers out of the University of Oxford believe that the virus may have already infected as much as half of the UK population or at least more than previously estimated. This would indicate that less than 0.1% of all cases would require hospitalization. The leading epidemiologist on the study cited the need for widespread antibody testing of the British people to have a fuller picture of the epidemic. This has a significantly more sanguine view to the now famous Imperial College report from a couple of weeks back. It brings back the concept of herd immunity into the debate but the reality is that it doesn't change the near-term stresses on healthcare systems. The antibody test is an interesting one though and something the U.K. government discussed last week. If we can prove that large parts of the population have already had it or have immunity then economies can get back to work quicker. For now we have to treat this study with a high degree of caution but at least it puts a bit of two way into the epidemiology debate.

In terms of the latest numbers, Spain saw its worst day of the pandemic so far, recording 514 deaths on Tuesday, with the total number of cases now at 39,673 according to the health ministry. After being on an overall downward trajectory in recent days, Italy saw a 2pp increase in reported deaths with 743 new deaths from the coronavirus yesterday and confirmed cases in the country now totaling 69,176. Overall new % case growth remained in single digits for the second day as even more stringent protocols were put in place. In the US, case growth in raw numbers continues to increase massively, especially in NY where the 25,665 cases represent over 6% of all cases globally and over half of all cases in the US. Governor Cuomo announced that the state is now testing at a higher per capita rate than both South Korea and China. See the pdf for the latest charts.

Back to markets and Europe was also strong yesterday. The STOXX 600 was up +8.40% for the 3rd best day on record over 8670 sessions since 1987, and the best day since 24 November 2008. The DAX was up +11.04%, the 4th best day in 15,778 trading days we have data for and the best daily gain since 28 October 2008. The FTSE 100 rallied +10.62%, the 2nd best day in 9,457 observations, with only 11 November 2008 seeing a better daily gain.

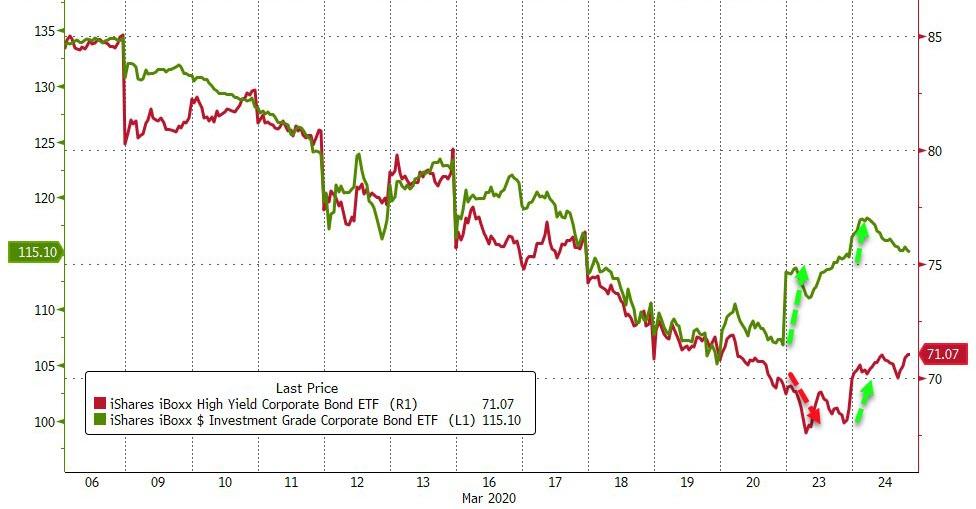

There were a number of big moves in other markets as well yesterday. Credit saw a very strong day after the Fed buying package gained some traction. In CDS, US CDX IG and HY were -14bps and -154bps tighter and in Europe the equivalent was -16bps and -97bps tighter. In cash we had the first day where there was some positive traction in what feels like a very long time. US IG and HY were -19bps and -32bps tighter while in Europe HY was -27bps tighter.

Meanwhile, Gold saw its largest daily gain (+5.09%) since the day after September 11th, while silver (+7.66%) had its strongest day since November 2008. And this came in spite of the fact that safe havens in other asset classes like US Treasuries or the Japanese Yen moved lower, while the Bloomberg Dollar index ended its run of 10 successive advances to fall -0.72%.

Speaking of which, sovereign bonds sold off throughout the day yesterday, with 10yr Treasury yields up 6.0bps to 0.85% and a level they have held onto this morning in Asia. 10yr bunds were up +5.3bps at -0.32%. However, peripheral spreads in Europe were moving in different directions. While the spread of Italian 10yr yields over bunds fell by -6.8bps to a 3-week low, they continued to widen in Spain and Portugal, up by +7.0bps and +6.1bps respectively as sovereign bonds in both countries underperformed the rest of Europe.

Our economics team published a note trying to assess the damage to Q2 yesterday ahead of more thorough updates later in the week. They conclude that it is possible that the level of GDP falls by 15-30% (non-annualised) on both sides of the Atlantic under various lockdown assumptions. All of this impact may not be felt in Q2. The contraction in Q2 will be a function of how long lockdowns remain in place and how economies recover following being turned back on. Large parts of continental Europe are already on lockdown, which could already mean Q1 sees a contraction of 4-6% qoq.. (For more details see Link here).

Talking of economic impacts, the return of risk appetite in markets yesterday came even though the PMI releases signaled that the global economy was heading for a sharp contraction, with the readings collapsing right across the board. However most people would have expected this but the numbers were still generally weaker than expected. In the Euro Area, the composite PMI fell to 31.4 (vs. 38.8 expected), the lowest level since comparable data was collected going back to July 1998, and below the previous low of 36.2 set in February 2009 at the depths of the financial crisis. There was no respite in the individual country readings either, with France's composite PMI falling to a record low of 30.2, the UK at a record low of 37.1, and Germany's down to 37.2, which was "only" its lowest since February 2009.

In terms of the breakdown between manufacturing and services, the general pattern across countries was that services were much harder hit, with the Euro Area services PMI falling to 28.4 (vs. 39.5 expected), which was also a record low going back to 1998. Manufacturing saw far less of a decline though, falling to 44.8 (vs. 39.0 expected) which was "just" its lowest since April 2009. Some of the forward looking measures were more negative in the manufacturing numbers so expect this to go notably lower going forward.

By comparison to Europe, the PMIs from the US were fairly strong reflecting being behind in the lockdown process. The composite PMI did fall to 40.5, the lowest in the series since comparable data began in October 2009, but this was still significantly above the 31.4 reading from the Euro Area. Similarly to the Euro Area, services fell by more-than-expected to 39.1 (vs. 42.0 expected), while manufacturing held up surprisingly well at 49.2 (vs. 43.5 expected), albeit still its worst reading since August 2009.

Other data was similarly dire. We got a glimpse of what could happen to unemployment across the globe from Norway, where data showed that the number of people seeking unemployment benefit has more than tripled over the last two weeks, with registered unemployment now at 10.4%, the highest since WWII.

To the day ahead, and data releases out include the UK's CPI inflation reading for February as well as the CBI's distributive trades survey for march. From Germany, there'll be the final Ifo business climate reading for March, while from the US we'll get the preliminary readings for durable goods orders and nondefence capital goods orders ex air for February. In addition, the US will also see the release of the MBA's weekly mortgage applications and January's FHFA house price index.