When Reality and Sentiment Diverge

The Hopium versus Doomium Model

The Hopium vs. Doomium model is initiating today. We first came across the word Hopium in the aftermath of the financial crisis. It was typically used by 'doomers' who believed markets were far ahead of themselves and were betting on hope rather than reality.

This model attempts to pit what we view as reality versus what view as sentiment. The scoring system is partly objective (technical indicating overbought or oversold, fund flows, positioning reports, etc.) and partly subjective (largely me trolling the media and social media trying to uncover true sentiment shifts).

What this is meant to do, is to identify opportunities where sentiment and reality diverge. If sentiment and reality are roughly lined up, then there is no obvious trade to me, but when one is very different than the other, we can identify underweight or overweight opportunities (or even long vs short ideas depending on your mandate).

Macro Hopium/Doomium

VIX

Let's start with volatility, or more specifically, the VIX index. It briefly spiked above 13 on Wednesday as global bond selling, concerns about the next Fed Chairperson and even some pre-earnings anxiety swept through the market. It finished the week at 9.8 which was lower than where it closed the prior Friday. VXN, a measure of the Nasdaq volatility, also dropped significantly as the Nasdaq composite surged more than 2%.

We do believe that the biggest risk facing the market is a spike in correlation and volatility – but I don't see that risk as very high right now. We have VIX showing up as barely in the green – meaning it might be a buy, but it isn't that compelling.

Reasons VIX can stay low

Seasonality. With fewer trading days as we start the U.S. holiday season can often push VIX lower. There have been instances, like the fiscal cliff and around elections, that hasn't been the case, but anyone looking to buy VIX must take seasonality into account.

Expectations for Tax Reform in 2017 are low. Anything short of killing all possibility of tax reform is likely to be largely ignored by the market. The market does expect Tax Reform, but not until early next year. So long as it looks like it is grinding towards that conclusion, there is little need for markets to react – keeping VIX low. Any setback that can be framed as 'negotiations' will be muted. We are not sure what will constitute derailment, but we suspect we will know it if we see it.

Surprisingly Nervous Volatility Sellers

No Rush to Sell VIX. When VIX dropped into the close on Wednesday I expect to see large inflows into the short VIX ETFs and ETNs. When VIX spiked in August, we saw extremely large inflows into those stocks. We didn't see anything like this, which is an indicator that the sellers of volatility are more cautious here, which as a contrarian, means there is less likelihood of a VIX spike.

SVXY Shares Outstanding Aug vs Oct

We did see a significant reduction in shares outstanding in UVXY – an ETF that is double long the VIX short term futures index. It looks like either profit taking, or more accurately, investors happy to get out with less of a loss than they had, but nothing so dramatic to indicate volatility bulls (market bears) have given up yet.

From a technical standpoint, the VIX futures curve is relatively flat. The 3rd VIX futures contract (January) closed at 13.35 versus the 1st VIX futures contract (November) which closed at 11.45. That spread of 1.9 is almost exactly the average for the year between the 3rd and 1st VIX futures contract (UX3 vs UX1 are the tickers on Bloomberg).

Geopolitical Tail Risk

VIX has responded most violently to increased geopolitical risk. More than any other asset class, VIX has responded when geopolitical risk has increased. Academy Securities hosted a client conference call on October 18th (replays are available) where Major General (retired) Spider Marks analyzed the White House Chief of Staff's assertion that the North Korea threat is 'manageable' and largely agreed with that assessment. We will update you as our views on current geopolitical risk evolve, but in the meantime, for those concerned about it, the best hedges are either VIX call options of long dated European Sovereign Debt – which leads us to our next asset classes.

Bunds and Treasuries

As of the initial writing of this report, we do not know who President Trump will name as next Fed Chairperson, but like everyone else, we await that decision as it should provide some clarity. We view that while there will be an initial price reaction to any decision, the market will quickly rule out the possibility of a major change in policy. The reality is that the head of the Fed is virtually forced to be dovish. If they are dovish and the economy does well – they are lauded. If they are dovish and the economy does poorly – they can just get even more dovish. The only thing that really hurts them, is being hawkish and the economy slowing. Why risk that? Draghi didn't risk that this week!

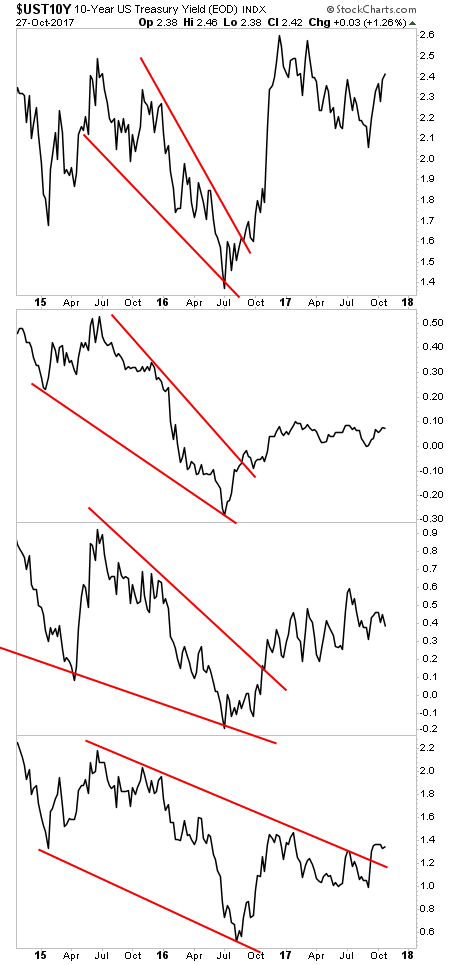

We continue to view Treasuries as a good candidate to be underweight as my ongoing target for the 10-year treasury is 2.60% with a chance of briefly spiking above that. The fundamentals for treasury investors are poor – improving economic data, D.C. trudging its way towards a near term deficit increasing tax plan, etc. There seems to be more denial in the bond market than the equity market on the potential for sustained economic growth.

We struggle with the positioning of the bond market as many surveys indicate extreme bearish positioning, yet we find relatively few bears and a disproportionate number of bulls – who are bulls because everyone else is bearish – despite my inability to find that overwhelming bearish community.

Draghi does it again – crafting every action to be as dovish as possible.

German 10 Year Bund Yields

Bunds bounced right at the 0.49% yield level again. That is the 4th time this year that bunds have failed to rally though that level.

While it is hard to like European yields here, they are universally hated. That puts them into the 'yellow' or neutral area – at least until some more of the short positions are closed post Draghi.

It is difficult to disentangle emotions from true market impact regarding what is occurring in Spain and Catalonia. The headlines and images are awful, but it is difficult to form a direct and near-term path that impact all European markets, let alone global markets. It needs to be watched and while the market's muted reaction may 'feel' wrong, it seems correct from a trading viewpoint.

Bunds (and other high credit quality EU Sovereign Debt) can provide excellent protection from North Korean Geopolitical risk. Any risk-off trading emanating from Korea should help sovereign debt yields, but should also strengthen the Euro versus the Yen and versus the Dollar – adding an extra kicker to those bonds.

Dollar Weakness

DXY, a dollar index has rebounded sharply since threatening to break through multi-year lows in early September. While there is nothing that changes my view that this administration wants a weaker dollar and is capable of jawboning it down, the clear diversion between a Fed that seems intent on hiking and an ECB that figured out how to renew its dovish bias, could support the dollar.

DXY Bounce on Support & Retakes Moving Averages

DXY broke the 100-day moving average last week as it closed at 94.9. That puts the 200-day moving average of 96.9 as a possible target. The model is biased towards weaker dollar, but with very limited conviction.

Domestic Stocks

After last week's surge, both U.S. Large Cap and U.S. Small Cap stocks looked stretched. Sentiment is clearly high for both groups by virtually any measure, but the fundamentals seem to warrant the valuations here. If something occurs to really disrupt the Tax Reform than look for significant pullbacks as that would dramatically shift the fundamental outlook.

Credit

Boring. Not sure that we can put a better description than boring on the overall credit market. Individual companies and sectors are exhibiting some idiosyncratic risk, but overall, risks and rewards seem balanced. Credit spreads are tight, but with the global economy marching along and volatility suppressed – there is little need for credit spreads to widen. In fact, while equities are hitting all-time highs, credit spreads are still above their pre-crisis lows.

Tax Reform can create some winners and losers – especially once Washington decides what to do, if anything, about the deductibility of interest expenses.

We will run a full Fixed Income Hopium/Doomium Report next where we will delve deeper into the fixed income markets while drilling down into high yield, investment grade, bonds versus loans, structured credit, etc.

Oil

For much of the year, we had a range on oil of $40 to $55, but we think we could support higher oil prices here. Sentiment does seem bullish, but may be behind the bullish case. We have a bias towards domestic energy companies – equities and high yield bonds – as there is still an undercurrent in Washington that wants to focus on energy selfsufficiency. Tax Reform and Decreased Regulations should help these companies, especially if it releases any pent-up demand for M&A activity (high yield bonds tend to do better than IG bonds during periods of M&A and the high yield energy bonds could do very well if we get that combination of higher prices and reduced regulation.

Bottom Line

Relatively few obvious trades out there, at least as generated by this model. We really want to see outliers and as much as we stare at this, it is currently difficult to identify outliers.

Short treasuries and short USD might be an interesting pair.

Long oil versus short gold would need some additional work, but is another possibility.

Own some VIX calls – it hasn't worked, and we would wait to see sentiment get a bit more extreme on the 'volatility is dead' side of things before entering.

Short equities, progressively. As CenBan is losing grip on POMO or losing it on Bond Market (tertium non datur).

As mentioned earlier, we will do full update on the fixed income and credit side of things next and will add some additional Macro Asset classes in the coming weeks.