What’s

the last big toy you buy when things have been good for a really long time and

you already have all the other toys? An RV, of course. A dubious thing to own

if you already have a house, but when the good times seem likely to roll on

forever, why the hell not?

And

what’s the first thing you sell when you lose your job and your stocks are

tanking? That very same RV. Which makes new RV sales a useful indicator of our

place in the business cycle.

What

does it say now? Here you go:

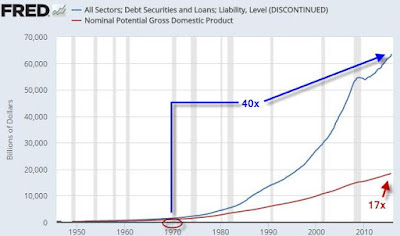

Notice

the mini-spike in the late 1990s and the major spike in mid-2000s, both of

which were followed by corrections. Now note the mega-spike from 2010 and 2016.

And

how are things going so far this year? Well, the space is on fire:

‘The RV space is

on fire’: Millennials expected to push sales to record highs

(CNBC) – RV shipments are expected to surge to their highest

level ever, according to a forecast from the Recreation Vehicle Industry

Association.

It

would be the industry’s eighth consecutive year of gains.

Thor

Industries and Winnebago Industries posted huge growth in their most recent

earnings report.

Those

shipments are accelerating, and should grow even more next year, the group

said. Sales in the first quarter rose 11.7 percent from 2016.

Much

of the growth can be attributed to strong sales of trailers, smaller units that

can be towed behind an SUV or minivan, which dominate the RV market. The

industry also is drawing in new customers.

As

the economy has strengthened since the Great Recession, and consumer confidence

improved, sales have picked up, said Kevin Broom, director of media relations

for RVIA.

Two

of the major players in the industry, Thor Industries and Winnebago Industries,

both manufacturers of RVs, reported huge growth in their most recent earnings

report. Thor saw sales skyrocket 56.9 percent to $2.02 billion fromlast year.

Winnebago’s surged 75.1 percent last quarter to $476.4 million.

Gerrick

Johnson, an analyst at BMO Capital Markets, attributed much of that growth to

acquisitions. Thor bought Jayco, then the No. 3 player in the industry, last

June; Winnebago bought Grand Design in October.

Thor

stock has experienced strong growth over the past year of almost 40 percent.

Winnebago tells an even better story: Its shares are up 56 percent over the

past 12 months.

“They’ve

done massively well because they’ve made massively creative acquisitions,” said

Johnson. “Wall Street didn’t realize how creative those deals were. Each

quarter they came through. The RV space is on fire, and the demand metrics are

quite positive.”

What

we have here is another classic short. During the past couple of recessions, RV

stocks plunged as everyone came to their senses and stopped buying $60,000

motel rooms. Based on the above chart that’s a pretty good bet to repeat going

forward. Let’s revisit this play in a couple of years.