Economic commentaries, articles and news reflecting my personal views, present trends and trade opportunities. By F. F. F. Russo (PLEASE NO MISUNDERSTANDING: IT'S FREE).

That was fun. Since mid-December gold has behaved like a tech stock, jumping from $1,240/oz to $1,337 and carrying a long list of gold mining stocks along for the ride.

Now everybody's asking the same question: Is this finally the start of the long-overdue run at gold's (and silver's) 2011 record high, or just a case of futures speculators once again panic-buying themselves into an untenable long position, only to be fleeced by the big banks that dominate the paper markets?

The commitment of traders (COT) report is not encouraging. In the current rally, the speculators (who are, remember, usually wrong at big turning points) have jumped back in with both feet and are now enthusiastically long while the commercials (usually right at big turning points) are once again aggressively short.

The next chart shows this visually. When the two columns converge, that's bullish for gold. When they diverge that's bearish. Favorable conditions of early December have quickly morphed back to bearish.

Looking at just this one indicator, it would be reasonable to assume that gold's all-too-brief run is about to end. But on the other side of this equation is the certainty that physical demand will eventually swamp these paper games and send gold and silver up in a bitcoin-worthy arc to their intrinsic values of $5,000/oz and $100/oz, respectively.

Therein lies the gold-bug's dilemma. Precious metals will bounce around aimlessly – until they don't – but the phase change won't be obvious until after the fact. With that in mind, here are three possible approaches:

The longer this goes on, the more attractive the third option becomes.

Many people do not realize that America is not only entering a new year, but within the next month we will also be entering a new economic era. In early February, Janet Yellen is set to leave the Federal Reserve and be replaced by the new Fed chair nominee, Jerome Powell. Now, to be clear, the Fed chair along with the bank governors do not set central bank policy. Policy for most central banks around the world is dictated in Switzerland by the Bank for International Settlements. Fed chairmen like Janet Yellen are mere mascots implementing policy initiatives as ordered. This is why we are now seeing supposedly separate central banking institutions around the world acting in unison, first with stimulus, then with fiscal tightening.

However, it is important to note that each new Fed chair does tend to signal a new shift in action for the central bank. For example, Alan Greenspan oversaw the low interest rate easy money phase of the Fed, which created the conditions for the derivatives and credit bubble and subsequent crash in 2008. Ben Bernanke oversaw the stimulus and bailout phase, flooding the markets with massive amounts of fiat and engineering an even larger bubble in stocks, bonds and just about every other asset except perhaps some select commodities. Janet Yellen managed the tapering phase, in which stimulus has been carefully and systematically diminished while still maintaining delusional stock market euphoria.

Now comes the era of Jerome Powell, who will oversee the last stages of fiscal tightening, the reduction of the Fed balance sheet, faster rate increases and the final implosion of the 'everything' bubble.

As I warned before Trump won the election in 2016, a Trump presidency would inevitably be followed by economic crisis, and this would be facilitated by the Federal Reserve pulling the plug on fiat life support measures which kept the illusion of recovery going for the past several years. It is important to note that the mainstream media is consistently referring to Jerome Powell as "Trump's candidate" for the Fed, or "Trump's pick" (as if the president really has much of a choice in the roster of candidates for the Fed chair). The public is being subtly conditioned to view Powell as if he is an extension of the Trump administration.

This could not be further from the truth. Powell and the Fed are autonomous from government. As Alan Greenspan openly admitted years ago, the Fed does not answer to the government and can act independently without oversight. So, why is the media insisting on misrepresenting Powell as some kind of Trump agent? Because Trump, and by extension all the conservatives that support him, are meant to take the blame when the 'everything' bubble vaporizes our financial structure. Jerome Powell is "Trump's guy" at the Fed; so any actions Powell takes to crush the recovery narrative will also be blamed on the Trump administration.

But, is it a certainty that Powell will put the final nail in the coffin of "economic recovery?" Yes. Last Friday the Fed finally released the transcripts of its monetary policy meetings in 2012, and in those transcripts are some interesting admissions from Powell himself. After reading these transcripts I am fully convinced that Powell is the man who will stand as the figurehead of the central bank during the final phase of U.S. decline.

Here are some of the most astonishing quotes by Powell from those transcripts along with my commentary. These quotes are yet another piece of evidence that vindicates my position on the Fed as an economic saboteur and my position on the historic market bubble the bank has created:

Powell: "I have concerns about more purchases. As others have pointed out, the dealer community is now assuming close to a $4 trillion balance sheet and purchases through the first quarter of 2014. I admit that is a much stronger reaction than I anticipated, and I am uncomfortable with it for a couple of reasons.

First, the question, why stop at $4 trillion? The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated. And we will be able to tell ourselves that market function is not impaired and that inflation expectations are under control. What is to stop us, other than much faster economic growth, which it is probably not in our power to produce?"

Assessment: By all indications the Fed did do more, MUCH more. Including QE3, various stimulus packages and incessantly low interest rates for years, the Fed has essentially stepped in every time stock markets in particular were about to crash back to their natural state of decline. Powell is being rather honest in his estimation here that these stopgaps are in fact temporary and that the Fed cannot produce true economic growth to support the market optimism they have created through their interventions. He is stating openly that markets will only remain optimistic so long as they are assured that the Fed will continue to intervene.

This is probably why it took almost six years before these transcripts were released.

Powell: "When it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it's not so much the sale, the duration; it's also unloading our short volatility position."

Assessment: And here we have Powell's shocking admission, clarifying his previous point — the "strong response" that Powell is referring to is a market reversal, or bubble implosion. He even admits the existence of the Fed's "short position on volatility." This explains the strange behavior of the VIX index, which has plunged to record lows as "someone" continually shorts VIX stocks in order to interfere with any decline in markets.

This interference in the VIX has conjured an aberration, a market calm and investor confidence that is artificial. Such overconfidence, when optimism turns into mania, has happened before. In fact, the end of the Greenspan era was awash in such exuberance. And this delusion always ends the same way — with crisis.

I would also like to mention here that I have seen some disinformation being planted on Powell's statements in 2012, asserting that he was "not talking about stock markets" specifically. Obviously he is, as you will see in other parts of his statement, but to reinforce the point, here is a quote from another Fed member who spilled the beans, Richard Fisher:

"What the Fed did — and I was part of that group — is we front-loaded a tremendous market rally, starting in 2009.

It's sort of what I call the "reverse Whimpy factor" — give me two hamburgers today for one tomorrow."

Fisher went on to hint at his very reserved view of the impending danger:

"I was warning my colleagues, Don't go wobbly if we have a 10 to 20 percent correction at some point… Everybody you talk to… has been warning that these markets are heavily priced." [In reference to interest rate hikes]

So, what happens when the Fed stops shorting volatility and ends the easy money being pumped into markets? Well, again, I think Powell and Fisher have just told you what will happen, but let's continue.

Powell: "My third concern — and others have touched on it as well — is the problems of exiting from a near $4 trillion balance sheet. We've got a set of principles from June 2011 and have done some work since then, but it just seems to me that we seem to be way too confident that exit can be managed smoothly. Markets can be much more dynamic than we appear to think.

When you turn and say to the market, "I've got $1.2 trillion of these things," it's not just $20 billion a month — it's the sight of the whole thing coming. And I think there is a pretty good chance that you could have quite a dynamic response in the market."

Assessment: The Fed balance sheet is being reduced NOW, and Powell as chairman will only continue the process if not expedite it. Some people may argue that Powell is displaying an attitude that would suggest he is not on board with tightening policies. I disagree. I believe Powell will make the argument that the band-aid must be ripped off and that stock markets need some "tough love".

In fact, Fed members including Yellen and former member Alan Greenspan (is there such a thing as a "former" member of the Fed?) have already been fielding the notion that stock markets are suffering from "irrational exuberance" and that something must be done to "temper inflation."

Powell is also acknowledging the mass-psychological aspect of investors, now trained like Pavlovian dogs to salivate over stock tickers instead of thinking critically on the implications of equities that "can't lose". When they finally begin to realize that equities can indeed lose, and that the Fed is going to let them lose, what will the result be, I wonder?

Powell: "I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy."

Assessment: Wow! And there you have it. The new Fed chair's own prognostications. He even used the dreaded "B" word — bubble. Yes, as I have been arguing for quite some time, the Fed will continue to raise rates and cut off the low cost money supply to banks and corporations that has helped boost stock markets as well as numerous other asset classes. And now we discover after six years a Fed official, soon to be the Fed chairman, telling you EXACTLY what is about to happen within American markets, reinforcing my long held position.

Powell even mentions that "this is their strategy." Now, that could be interpreted a few ways, but I continue to hold that the Fed plans to deliberately crash markets and that this will be a controlled demolition of the U.S. economy.

Trump may actually clash with Powell over these measures in the near future, considering Trump has thoroughly taken credit for the insane stock market rally that has dominated since his election. But, this will only add to the fake drama. Imagine, the very man Trump "picked" as the new head of the Federal Reserve undermining the market bubble which Trump boasts about on his Twitter account. The Kabuki theater will be phenomenal.

All the while, the true culprits behind the bubble and the crash, the international financiers and banks, will escape almost all scrutiny as the public mindlessly follows the political soap opera played out in the mainstream media.

"So, what am I worried about?" New York Fed President William Dudley, who is considered a dove, asked rhetorically during a speech on Thursday at the Securities Industry and Financial Markets Association in New York City. "Two macroeconomic concerns warrant mention," he continued. And they are:

One: "The risk of economic overheating." He went through some of the mixed data points, including "low" inflation, "an economy that is growing at an above-trend pace," a labor market that is "already quite tight," and the "extra boost in 2018 and 2019 from the recently enacted tax legislation."

Two: The markets are blowing off the Fed. He didn't use those words. He used Fed-speak: "Even though the FOMC has raised its target range for the federal funds rate by 125 basis points over the past two years, financial conditions today are easier than when we started to remove monetary policy accommodation."

When the Fed raises rates, its explicit intention is to tighten "financial conditions," meaning that borrowing gets a little harder and more costly at all levels, that investors and banks become more risk-averse and circumspect, and that borrowers become more prudent or at least less reckless – in other words, that the credit bonanza cools off and gets back to some sort of normal.

To get there, the Fed wants to see declining bond prices and therefor rising yields, cooling equities, rising risk premiums, widening yield spreads, and the like. These together make up the "financial conditions."

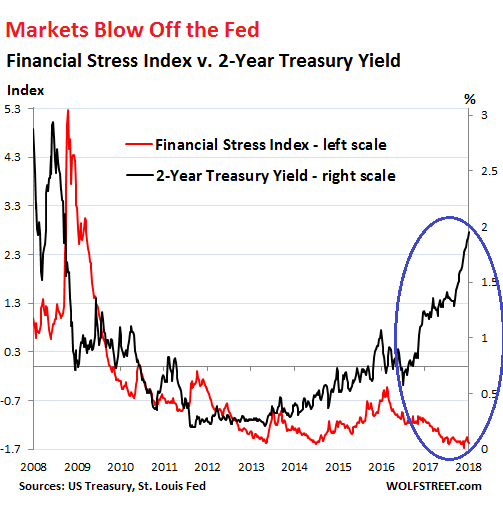

There are various methods to measure whether "financial conditions" are getting "easier" or tighter. Among them is the weekly St. Louis Fed Financial Stress Index, whose latest results were published on Thursday.

The Financial Stress Index had dropped to a historic low of -1.6 on November 3, meaning that financial stress in the markets had never been this low in the data series going back to 1994. Things were really loosey-goosey. On Thursday, the index came in at -1.57, barely above the record low, despite another rate hike and the Fed's "balance-sheet normalization.

And this rock-bottom financial stress in the markets is occurring even as short-term interest rates have rocketed higher in response to the Fed's rate hikes, with the two-year Treasury yield on Thursday closing at 1.96% for the third day in a row, the highest since September 2008.

The two-year yield and the Financial Stress Index normally move more or less in parallel. But in July 2016, when it became clearer that the Fed would finally stop flip-flopping and start raising rates, the two-year yield began to rise sharply and recently began to spike. But the Financial Street Index fell.

This chart of the St. Louis Fed's Financial Stress Index (red, left scale) and the two-year Treasury yield (black, right scale) shows this gaping crocodile-jaw disconnect:

The Financial Stress Index is made up of 18 components. A value of zero represents "normal" financial market conditions. Values below zero indicate below-average financial market stress. Values above zero indicate higher than average stress.

So with the economy facing the risk of "overheating," and with markets doing the opposite of what the Fed wants them to do – namely cooling off – Dudley warned:

This suggests that the Federal Reserve may have to press harder on the brakes at some point over the next few years. If that happens, the risk of a hard landing will increase. Historically, the Federal Reserve has found it difficult to achieve a soft landing – especially when the unemployment rate has fallen below the rate consistent with stable inflation.

In those circumstances, the Federal Reserve has been unable to both push up the unemployment rate slightly to a level that is consistent with stable inflation and avoid recession.

It was a shot before the bow – one of many – for the markets to start paying attention to the Fed. Monetary policies have no impact unless markets believe in them, react to them, and thus effectively implement them. But this might be a lot to ask, after the Fed has spent years methodically and thoroughly destroying its own credibility by flip-flopping wildly at every market squiggle, first on tapering QE while it was still going on and then on raising rates.

Eventually markets fall in line. And if I read Dudley's words correctly, he is worried that markets will fall in line too late, and only after the Fed has fired some big guns to get their attention, and then it might happen all at once, and the sudden adjustment in prices, yields, spreads, risk premiums, etc. might be too brutal for the economy to digest.

At taxpayer expense, the easiest, risk-free, sit-on-your-ass profit ever.

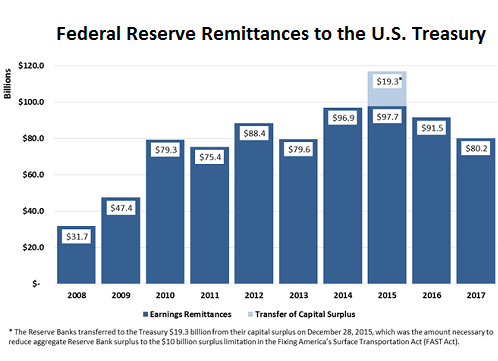

The Federal Reserve's income from operations in 2017 dropped by $11.7 billion to $80.7 billion, the Fed announced last week. Its $4.45-trillion of assets – including $2.45 trillion of US Treasury securities and $1.76 trillion of mortgage-backed securities that it acquired during years of QE – produce a lot of interest income.

How much interest income? $113.6 billion.

It also made $1.9 billion in foreign currency gains, resulting "from the daily revaluation of foreign currency denominated investments at current exchange rates."

For a total income of about $115.5 billion.

Those are just "estimates," the Fed said. Final "audited" results of the Federal Reserve Banks are due in March. This "audit" is of course the annual financial audit executed by KPMG that the Fed hires to do this. It's not the kind of audit that some members in Congress have been clamoring for – an audit that would try to find out what actually is going on at the Fed. No, this is just a financial audit.

As the Fed points out in its 2016 audited "Combined Financial Statements," the audit attempts to make sure that the accounting is in conformity with the accounting principles in the Financial Accounting Manual for Federal Reserve Banks. Given that the Fed prints its own money to invest or manipulate markets with – which makes for some crazy accounting issues – the Generally Accepted Accounting Principles (GAAP) that apply to US businesses to do not apply to the Fed.

This annual audit by KPMG reveals nothingexcept that the Fed's accounting is in conformity with the Fed's own accounting manual.

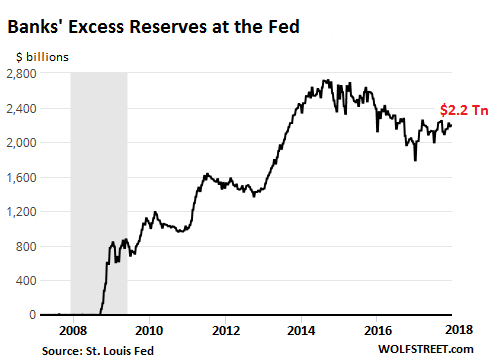

The Fed pays the banks interest on their "Required Reserves" and on their "Excess Reserves" at the Fed. Excess Reserves are the biggie: As a result of QE, they jumped from $1.7 billion in July 2008, to $2.7 trillion at the peak in September 2014. They've since dwindled, if that's the right word, to $2.2 trillion:

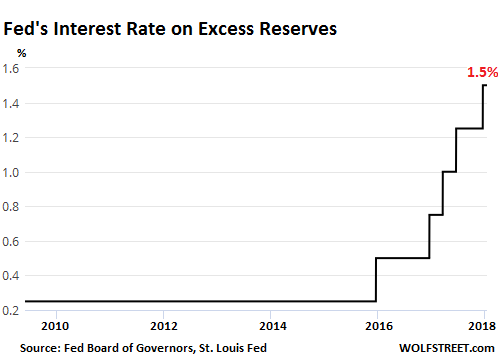

When the Federal Open Markets Committee (FOMC) meets to hash out its monetary policy, it also considers what to do with the interest rates that it pays the banks on "Required Reserves" and on "Excess Reserves." In this cycle so far, every time the Fed has raised its target range for the federal funds rate (now between 1.25% and 1.50%) it also raised the interest rates it pays the banks on "required reserves" and on "excess reserves," which went from 0.25% since the Financial Crisis to 1.5% now:

So the amount of excess reserves has fallen since 2014. But the interest rate that the Fed pays on them has been ratcheted up since December 2015. And so has the amount that the Fed pays the banks. In 2017, a year with three rate hikes, the interest that the Fed paid the US banks and foreign banks doing business in the US jumped by $13.8 billion to $25.9 billion.

That $25.9 billion is the easiest, most risk-free, sit-on-your-ass profit that banks ever made in the history of mankind. More on that in a moment – particularly out of whose pocket this comes.

The Fed also paid banks $3.4 billion in interest on securities sold under agreement to repurchase.

The 12 Federal Reserve Banks cover their own operating expenses of $4.1 billion. Plus, there are these items, among others:

The Fed paid $784 million in statutory dividends to the financial institutions that own the 12 Federal Reserve Banks.

After everything has been taken care of, the Fed had a net income of $80.7 billion, which is tax free, of which it remits an estimated $80.2 billion to the Treasury:

In the chart, note how the surging interest payments to the banks slashed into the remittances to the Treasury. If the Fed hadn't decided to pay interest on excess reserves, to benefit the banks, it could remit this money to the Treasury. In other words, every dime the banks receive comes indirectly out of the pocket of taxpayers.

The Fed will likely raise rates further this year. There is talk of four rate hikes. This would push the rate on excess reserves to 2.5% by the end of the year. Excess reserves will likely shrink as QE is being unwound, but not fast enough. And the amount that the Fed pays the banks this year might surge to $40 billion or more — a glorious and hidden subsidy extracted from taxpayer pockets.

At the same time, the Fed is shedding its income-producing assets as it unwinds QE and will make less income in 2018 than in 2017. With less money coming in, and paying more to the banks, the amounts remitted to Treasury and therefore the taxpayer will likely plunge. But at least megabank CEOs will be happy. Ka-ching.

First decline in the Bank of Japan's colossal balance sheet since 2012!