from IFR:

Markets, despite their collective expertise, are apparently destined to repeat history as irrational exuberance is followed by an equally irrational despair. Periodic bouts of chaos are the inevitable result.

Financial crises have been an unfortunate part of the industry since its beginnings. Bankers and financiers readily admit that in a business so large, so global and so complex, it is naive to think such events can ever be avoided. A look at a number of financial crises over the last 30 years suggests a high degree of commonality: excessive exuberance, poor regulatory oversight, dodgy accounting, herd mentalities and, in many cases, a sense of infallibility.

William Rhodes has been involved in the industry for more than 50 years and has lived through nearly every modern-day financial crisis, many of which are detailed in his book, "Banker to the World". As he puts it, there is a common theme of countries and markets wanting to believe that they are different and that they are not as connected to the rest of the world's economy. In his view, many aspects of the Latin American debt crisis of 1982 have been repeated a number of times and there is much from this crisis that we can apply to what is currently happening in Europe and beyond.

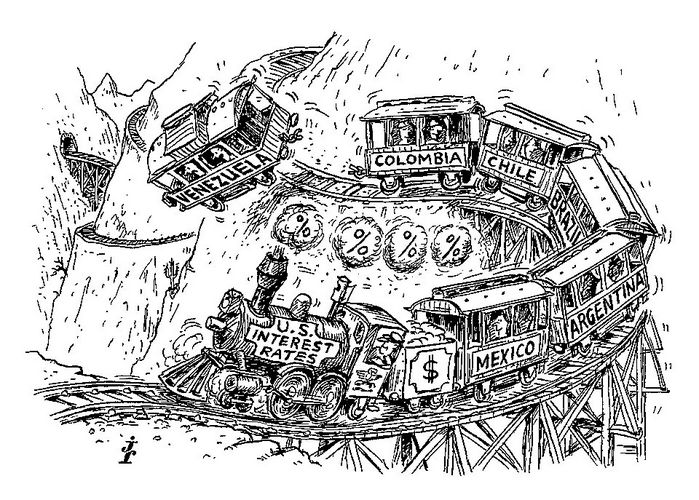

LatAm sovereign debt crisis – 1982

This crisis developed when Latin American countries, which had been gorging on cheap foreign debt for years, suddenly realised they could not repay it. The main culprits, Mexico, Brazil and Argentina, borrowed money for development and infrastructure programmes. Their economies were booming, and banks were happy to provide loans to the point where Latin American debt quadrupled in seven years. When the world's economy went into recession in the late 1970s the problem compounded itself. Interest rates on bond payments rose while Latin American currencies plummeted. The crisis officially kicked off in August 1982 when Mexico's finance minister Jesus Silva-Herzog said the country could not pay its bills.

It took years to sort out the crisis, with Latin American nations eventually turning to the IMF for a bailout in exchange for pro-market reforms and austerity programmes. It also led in 1989 to the novel creation of Brady bonds, which were designed to reduce debt in these countries by converting distressed sovereign debt into a number of different types of bonds. Furthermore, banks could exchange claims on these debts for tradable assets, which enabled them to get the debt off their balance sheets.

Rhodes recalls it as a tense period, but says that strong political leadership enabled them to get through the crisis. He laments, however, that the lessons of the crisis weren't heeded.

"Time and again, be it in the Asian crisis or the eurozone crisis, we have seen how governments have failed to draw lessons from the Latin American crisis," he said. "They have repeatedly taken the view that their countries and regions are different and unique and, therefore events in other parts of the world cannot provide any relevant lessons for them.

"And yet key developments seen in the Latin American crisis – the dangers of contagion, the need for urgent and bold political leadership, the risks of over-leveraged banks – have been characteristics of every sovereign debt crisis since then."

Savings and loans crisis – 1980s

While the solution to the Latin American crisis was being put together, a domestic one was happening right in front of the US regulators. The so-called savings and loans crisis took place throughout the 1980s and even into the early 1990s, when more than 700 savings and loan associations in the US went bust.

These institutions were lending long term at fixed rates using short-term money. As interest rates rose, many became insolvent. But thanks to a steady stream of deregulation under President Ronald Reagan, many firms were able to use accounting gimmicks to make them appear solvent. In a sense, many of them resembled Ponzi schemes.

The government responded with a set of regulations called the Financial Institutions Reform, Recovery and Enforcement Act of 1989. While the act tightened up the rules on S&Ls, it also gave Freddie Mac and Fannie Mae more responsibility for supporting mortgages for lower-income individuals.

Someone who remembers the savings and loan crisis all too well is William Black. During the 1980s he served as litigation director for the Federal Home Loan Bank Board and deputy director of the Federal Savings and Loan Insurance Corp. He was instrumental in the investigation into one of the most notorious S&L villains, Charles Keating, who infamously sent a memo saying he wanted Black dead.

In Black's view, the act didn't go nearly far enough and in many ways contributed to the continuation and expansion of predatory lending that would ultimately become a huge factor in the 2008 financial crisis.

"The credit crisis is a continuation of the savings and loan crisis," he said. "It's not that they did nothing about it, it's that they undid everything that worked. They could have thought, 'we've seen this before, this is bad, this is disastrous' and we had regulations that worked and could have reinstalled."

When asked why the government's solution to the S&L crisis was to some degree to regulate the industry even less, and why people such as Keating maintain that excessive regulation was the cause of the S&L crisis, he says: "One is ideology. They hate government involvement of any kind. Second, imagine yourself answering the … question of why did none of you get this right? You're 55 years-old, are you going to say, 'sorry, everything I've ever said and written and worked on is false? And everything I've said created a criminogenic environment? And by the way, I have no useful skills'? Maybe one in 1,000 would say that, but it's not likely."

Stock market crash – 1987

Despite the shock of the savings and loans crisis, two more crises took place before the 1989 Act. The most memorable was the 1987 stock market crash. On what became known as Black Monday, global stock markets crashed, including in the US, where the Dow Jones index lost 508 points or 23% of its value. The causes are still debated. Much blame has been placed on the growth of programme trading, where computers were executing a high number of trades in rapid fashion. Many were programmed to sell as prices dropped, creating something of a self-inflicted crash.

Roger Ibbotson, a finance professor at Yale University and chairman of Zebra Capital, has written extensively about the crash. He recalls teaching a class when it was happening, and every few minutes a new student would drop in to his class saying the market had hit another low.

"The whole week was chaos," he said. "The futures market was a mess, but you could actually make good money if you were up for some risk. A lot of people tried to set up brokerage accounts to take advantage of some of the valuations."

Yet one of the oddest parts of such a significant crash, he recalls, was how little effect it seemed to have. It was ultimately a short-lived event. The market continued to fall into November, but by December it was up and it ended the year positively. Ibbotson says things basically just went back to normal. A few changes were made, notably the introduction of circuit breakers that could halt trading, but apart from that, many people just shrugged and went back to making money.

Junk bond crash – 1989

Next up was the 1989 junk bond collapse, which resulted in a significant recession in the US. There is some disagreement as to what caused it, but most point to the collapse of the US$6.75bn buyout of UAL as the main trigger. Others point to the Ohio Mattress fiasco, a deal that would become known as "burning bed" and remains widely considered to be among the worst deals in modern finance. The culmination of the crash is considered to be the collapse of Drexel Burnham Lambert, which was forced into bankruptcy in early 1990, largely due to its heavy involvement in junk bonds. At one point it had been the fifth-largest investment bank in the US.

Ted Truman, now a senior fellow at the Peterson Institute for International Economics, was then director of the international finance division at the Federal Reserve. He remembers the crisis as having similar undertones to the more recent financial and sovereign debt crises, where banks were underwater and the government had to bail out various institutions to avert further problems.

"You essentially had at the same time the last phase of the S&L crisis," Truman said. "To some degree this was the mop-up phase. There is a view out there that any time there is a rescue, it encourages people to take risks. That's the moral hazard issue. But I think that's a little unfair because most people who get rescued pay a high price in the process. The system is rescued not the perpetrators. Reputations are besmirched."

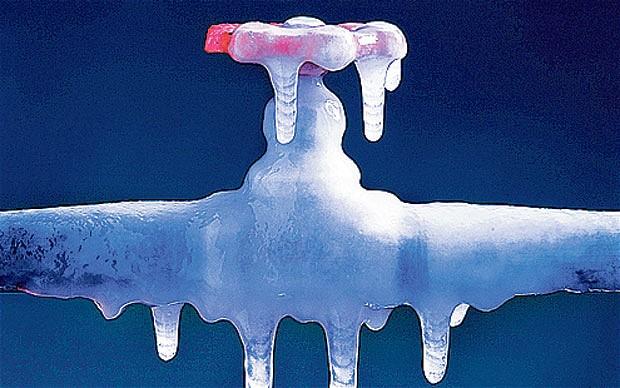

Tequila crisis – 1994

In 1994 a sudden devaluation of the Mexican peso triggered what would become known as the Tequila crisis, which would become a massive interest rate crisis and result in a bond rout. Analysts regard the crisis as being triggered by a reversal in economic policy in Mexico, whereby the new president, Ernesto Zedillo, removed the tight currency controls his predecessor had put in place. While the controls had established a degree of market stability, they had also put an enormous strain on Mexico's finances.

Prior to Zedillo, banks had been lending large amounts of money at very low rates. With a rebellion in the poor southern state of Chiapas adding to Mexico's risk premium, the peso's value fell by nearly 50% in one week.

The US government stepped in with a US$50bn bailout in the form of loan guarantees. Yields on Mexican debt shot up to 11%, and capital markets activity ground to a halt not only in Mexico but across the entire region, especially in Argentina – where yields went as high as 20%. It also hit markets across the developed world.

Eventually, the Mexican peso stabilised and the country's economy returned to growth. Three years later it was able to repay all of its US Treasury loans.

Martin Egan, global head of primary markets and origination at BNP Paribas, as well as the firm's UK head of fixed income, says that of the moments of crises he has experienced, this one sticks out particularly strongly.

"1994 is still quite vivid. Numerous rate increases including a 0.75 basis point upward movement on November 16 as the Fed attempted to control inflationary pressures resulted in a dramatic collapse of market activity," Egan said.

"If you look at what happens now, sensitivity to rate changes is always around and markets like to have visibility. Back then we knew rates needed to go up, but the speed and swiftness of the move derailed the market for a long time and we saw a dramatic collapse in volumes, and serious strains in the financial system.

"Confidence started to rebuild eventually, but it was brutal because it dragged the markets into an awfully defensive mode. It was one of the most problematic years ever in fixed income. It was a reminder to all participants that this is the real world and the real economy at stake."

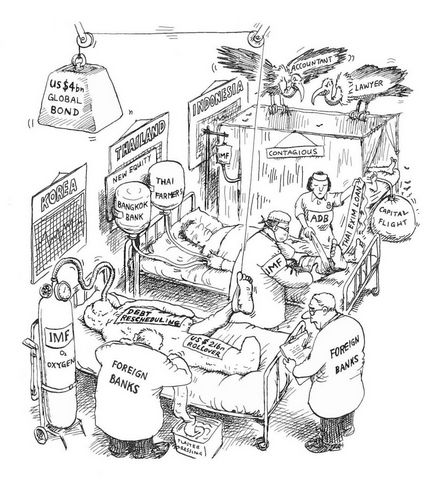

Asia crisis – 1997 to 1998

More than 15 years after the Latin American debt crisis of 1982, history would indeed repeat itself in Asia. In July 1997 Thailand's currency, the baht, collapsed when the government was forced into floating it on the open market. The country owed a huge amount of debt to foreign entities that it couldn't pay even before the currency plummeted. Similarly to what was experienced in Latin America in the 1980s and present-day Europe, the crisis spread across the region, with South Korea, Indonesia, Laos, Hong Kong and Malaysia also affected. Rhodes says he spent considerable time warning Asian governments about the risks they faced, but that his concerns were largely ignored.

"I was told by the Asians: 'We're different from Latin America because we have Asian values and because we work harder and have a savings culture'," Rhodes said. "But they were involved in the same practices of overlending to the consumer area and in real estate. There is a similar phenomenon in all of these crises, which is that people like to think they are different and that experiences elsewhere do not apply to them."

The crisis certainly took many by surprise. Most Asian governments believed they had the right economic and spending policies in place, but nonetheless the crisis necessitated a US$40bn bailout by the IMF. Only one year later, in 1998, a nearly carbon-copy crisis happened in Russia.

Dotcom bubble – 1999 to 2000

Markets would yet again forget the lessons of the past in the dotcom bubble and subsequent crash in 2000. As in most crises, it was preceded by a bull rush into one sector. In this case it was technology and internet-related stocks. Individuals became millionaires overnight through companies such as eBay and Amazon. The hysteria reached such a pitch that the inconvenient fact that few of these companies made any money scarcely mattered. By 2000, however, the game was up. The economy had slowed and interest rate hikes had diluted the easy money that was propping up these companies. Many dotcoms went bust and were liquidated.

Kay Steffen, head of syndication and corporate broking at DZ Bank, was involved in bringing more than 80 of these companies to the market. He believes the dotcom crash was simply a case of a feeding frenzy that went out of control, and was a symptom of the market's underlying irrationality.

"Everyone knew this was something that was not sustainable, but it's not always easy to take that view and resist all the different groups that want in on the market," he said. "I feel this is just the natural behaviour of people. We see this happen every few years in various market segments. We see it happening today in some bonds. People are looking for yield and if they see a 7% coupon they neglect what is behind it."

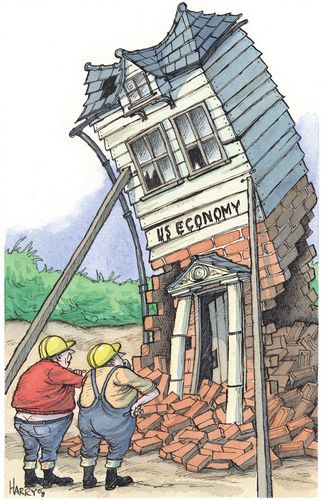

Global financial crisis – 2007 to 2008

It was only a few years later that an even nastier crisis would hit the entire world's financial markets. In many ways it has still has not ended, with the billions in losses and slowing global economy manifesting themselves in the current European sovereign debt crisis. It resulted in the collapse of a number of large financial institutions and is considered by many economists to be the worst crisis since the Great Depression. While the causes are numerous, the main trigger is considered to be the crash of the US housing market.

Jean-Pierre Mustier was at the forefront of the crisis as the head of Societe Generale's corporate and investment bank, and had to manage the aftermath of rogue trader Jerome Kerviel's €4.9bn trading losses. In his mind, the crisis has changed banking for the better, and he is a supporter of the new regulations as well as simpler business structures.

"To a certain extent, people became too dependent on models," says Mustier, who is now head of CIB at UniCredit. "Suddenly, the crisis showed that you should not rely on models only and more on common sense. What you do has to be connected to reality. I think the combination of the Basel III approach and leverage ratio is actually a good thing, but I also think the lesson we learned is, let's use our common sense and not blindly accept models."

Lessons learnt?

Is financial history destined to repeat itself? It would appear to be something of a result of the way markets function. A boom creates excessive interest and lofty prices. The ensuing crash results in "never-again" style regulations, only for another crisis to pop up, sometimes as soon as the next year. Most recently, the world has had to cope with the European sovereign debt crisis, a problem that never seems able to go away entirely and seems to get worse with each ensuing multi-billion dollar bailout.

Rhodes argues that many of these incidents are avoidable, but in many ways what is more important is how they are resolved. Above all, he sees strong political leadership as one of the most crucial elements, along with a competent plan that the populace will understand as being good in the long term.

"One of the things that is clear in all of the crises is that strong leadership is crucial," he says. "To take some international examples, such as Brazil in 1994, South Korea in 1998 and Turkey in 2001, the heads of state and finance ministers sold their programmes to their citizens saying that while these included tough measures, they were well planned and would lead to growth – and they did. This kind of leadership is missing in Europe."

<object id="__symantecPKIClientMessenger" style="display: none;" data-extension-version="0.4.0.129" data-install-updates-user-configuration="true"></object>