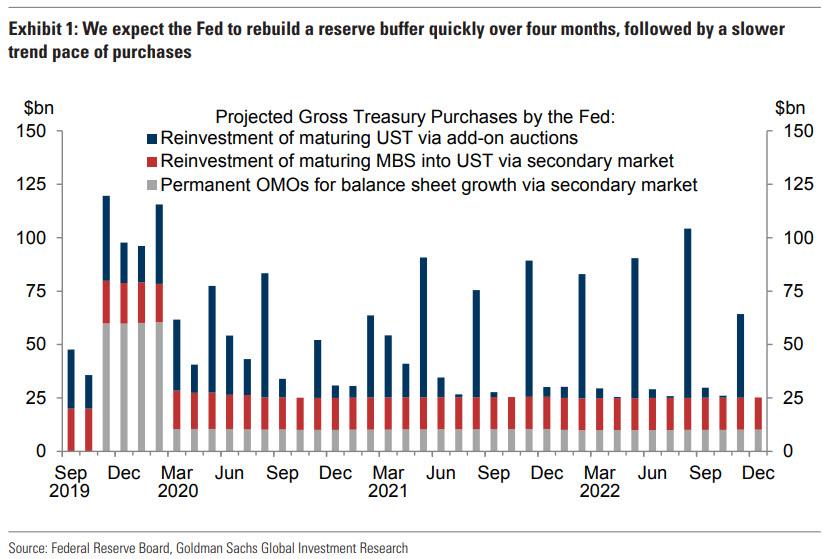

While the market has by now fully priced in that the Fed will resume "NOT A QE", i.e. POMOs, i.e., BS-expanding Treasury Purchases as soon as the October FOMC (but more likely November), with Bank of America writing today that the Fed needs a "bazooka of asset purchases," estimating that the central bank needs to add about $300BN of reserves to return to an "abundant' level", and Goldman predicting that the Fed will unleash no less than $60BN in POMO for the first 4 month of "NOT A QE"...

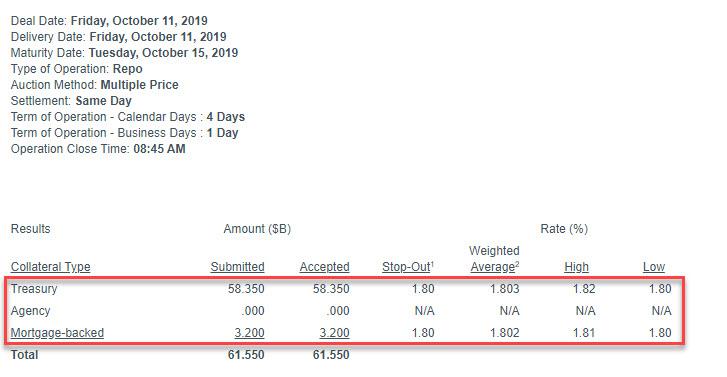

... as it seeks to rapidly blow out its balance sheet to avoid any more repo tremors of the kind observed in September that sent the overnight G/C repo rate to 9.25%, there was a modest hiccup in this best laid plan this morning, when the New York Fed unexpectedly announced that use of its overnight repo facility surged by 35% in one day, with $61.55BN in securities submitted ($58.35BN in TSYs, $3.2BN in MBS) to today's op, up sharply from yesterday's $45.5BN

While it could have been worse - the $75BN facility was not oversubscribed - it could have been better, as Wall Street indicated that the funding/reserve shortage spiked to the highest level since Sept 30, when $63.5BN in securities were submitted to the O/N repo facility.

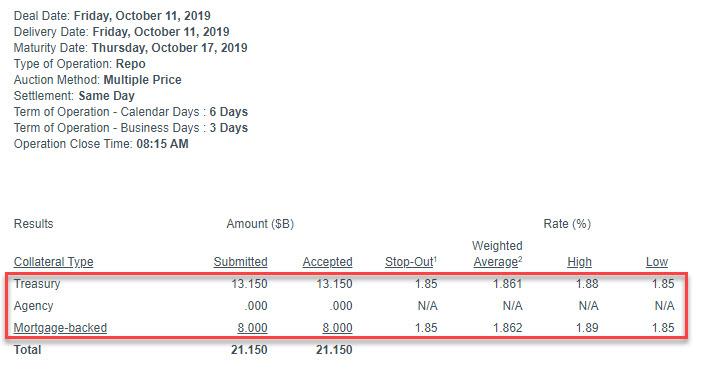

Separately, the Fed also announced that in today's 6-day Term Repo, $21.15BN in securities were submitted, or half the uptake in yesterday's 14-day repo.

What to make of this? Well, with Wall Street now more than aware that the Fed will do everything it needs to to address the ongoing funding squeeze in the repo market, which in itself should be sufficient to ease the stress in overnight funding, this has so far failed to materialize. Worse, investors are becoming increasingly concerned that even with "NOT A QE", year end could see even more dramatic repo market fireworks than those observed on December 31, 2018. In such a case, with the Fed literally throwing the "NOT A QE" kitchen sink at the problem, and the problem failing to go away, just how will Powell preserve the illusion that he knows what is causing the broken plumbing in the repo market if the Fed can's unclog it even when using its "bazooka." We will find out soon enough.

Nessun commento:

Posta un commento