Let's cut through the BS about Central Bank Balance Sheet reduction.

Once a Central Bank begins to employ ZIRP and QE for years at a time, there is no going back. If you don't believe me, take a look at Japan.

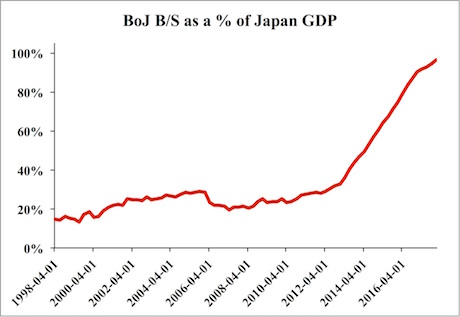

Japan is ground zero for Central Bank monetary insanity. The Fed first employed ZIRP and QE in 2008. Japan went to ZIRP in 1999. It launched its first QE program in 2000.

And it never looked back.

There were brief periods in which the Bank of Japan would NOT employ QE. But as soon as Japan's economic data turned south… you guessed it… MORE QE… and not for a month or two… this has been going on for 18 years.

The end result is that today the Bank of Japan's balance sheet is roughly the size of the country's GDP.

Nessun commento:

Posta un commento