The attempts to mask inflation are reaching truly ludicrous proportions.

Bloomberg reports that the "guts of the US CPI show key inflation weakest in years."

What are the "guts?"

Housing rents… which the CPI claims are falling.

That's interesting, because:

1) Apartment rents rose in 89% of US cities in January.

2) Rents as a percentage of income are at their highest levels ever.

3) The supposed "drop" in rents actually consisted of rents rising 2.7% Year over Year. The fact that it was the slowest rise in years is somehow supposed to mean rents fell.

At some point, someone needs to point out the obvious: that the entire reason the Fed uses CPI as an inflation measure is to HIDE, not accurately portray inflation.

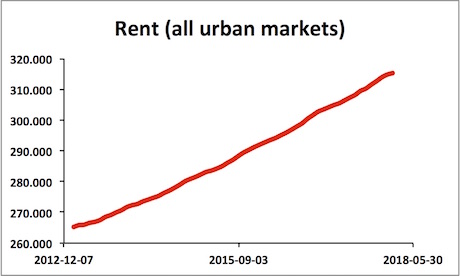

Here's a chart of Rents for all Urban Markets in the US. If you believe that the trend is DOWN here I have a bridge to sell you.

The fact is that the Fed is desperately "massaging" the data to hide the reality that the inflation genie is out of the bottle.

The $USD has already figured this out, which is why it has been dropping like a brick, falling nearly 14% over the last 15 months.

Who are you going to believe? The $USD or Fed economic forecasts?

Nessun commento:

Posta un commento