Rates are rising once again.

Over 90% of investors focus almost exclusively on stocks. This is a mistake. The reality is that everything happening in stocks since 2008 has been the direct result of Central Banks creating a bubble in bonds.

Because our current financial system is debt-based in nature (meaning sovereign debt, not gold or some other asset is the bedrock of the financial system) when Central Banks did this, they effectively created a bubble in everything (including in stocks).

Put simply, it is BONDS, not stocks, that concern Central Banks the most. If stocks collapse, it's a big deal for investors. If bonds collapse, it's a big deal for entire countries/ the financial system.

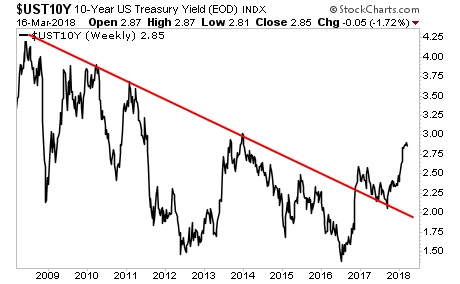

With that in mind, consider that bonds have begun to collapse, with US Treasury bond yields rising sharply above their downtrends.

THIS is what triggered the February meltdown.

And by the look of things, we're not done yet. Instead of falling hard, rates have found support and are preparing to breakout to the upside again.

Nessun commento:

Posta un commento