Forget about normalization, the Fed is terrified.

The Fed officially began Quantitative Tightening in October. To date, the Fed has shrunk its balance sheet by less than $40 billion. And already Fed officials are so spooked by stocks falling, that they're promising more QE down the road… including an implicit purchasing of stocks.

To whit, on Friday, Boston Fed President Eric Rosengren stated the following:

If LSAPs (read: QE used to buy debt instruments) are indeed not effective, then the Fed may need to take other measures"

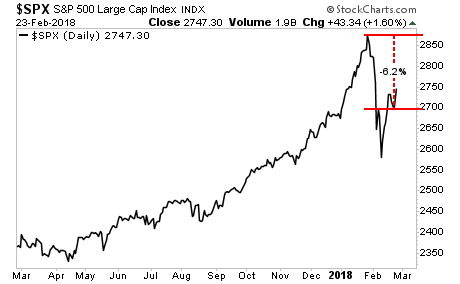

Let's be clear here... a major Fed official is implying the Fed should consider monetizing other assets, possibly even stocks... at a time when stocks are a mere 6% off ALL.TIME.HIGHS.

Just how vulnerable the US financial system that the Fed can't even stomach a NORMAL 10% correction without talking about QE again?

Let's be clear here. The Fed is terrified of the Everything Bubble bursting. And we're a lot closer to a crisis than most realize.

Nessun commento:

Posta un commento