It is clear stocks are in a massive bubble based on their Price to Sale (P/S valuation).

What about the economy?

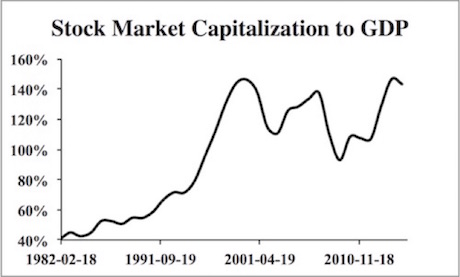

Warren Buffett once famously stated that his favorite means of valuing stock was the stock market capitalization to GDP ratio.

Below is a chart for this metric. As you can see, the stock market today is as overvalued relative to the economy as it was at the peak of the 1999 Tech Mania.

So stocks are overvalued based on the most reliable corporate data point (revenues) and they are also overvalued relative to the economy. Scratch that, they're not overvalued… they're trading at 1999-Tech Bubble insanity levels.

We all remember what came after that...

Nessun commento:

Posta un commento