The markets have been gunning higher on the notion that the Trump Administration is about to unveil a huge tax reform plan.

However, the devil is in the details. And thus far the plan is focusing on corporate tax reform, with the notion that an employer will somehow "pass on" their savings to employees via raises.

First off, while the phrase "corporate taxes" is a great political prop, the reality is that nearly 50% of large corporations pay ZERO corporate income tax.

That is not a typo.

In 2012, the Government Accountability Office performed a study in which it discovered that 43% of companies with $10+ million in assets pay ZERO corporate income tax.

It's not as if the other 57% are picking up the slack either.

It is well known that large corporations go above and beyond to avoid paying the full, required tax rate. As Forbes noted earlier this year, Apple pays a 25% tax rate (the official US corporate rate is supposed to be 35%). Microsoft pays a 16% tax rate. Alphabet (Google) pays 19%. General Electric and Exxon Mobil appear to have paid no corporate income tax in 2016.

The point is this: pursuing corporate tax reform is a pointless exercise. Few if any corporations pay anywhere near the official corporate tax rate of 35%.

So what tax reform should we be talking about?

Individual tax reform.

And why aren't we talking about it?

Because any discussion of individual tax reform eventually leads to the elephant in the room: entitlements.

The US currently spends 65% of it budget on entitlement spending. Nearly half of American households receive some kind of Government assistance/outlay. Those households that DO pay taxes cover only some of this (which is why the US is running $500+ BILLION deficits every year).

The bond bubble is financing the rest of this. Anyway, politicians promise, but bond markets deliver.

Put simply, the bond bubble is what has financed the enormous entitlement spending of Governments around the world.

Take away the bubble in bonds, which permits Governments to issue debt at rates WAY below the historic average, and most major countries are bankrupt in a matter of weeks.

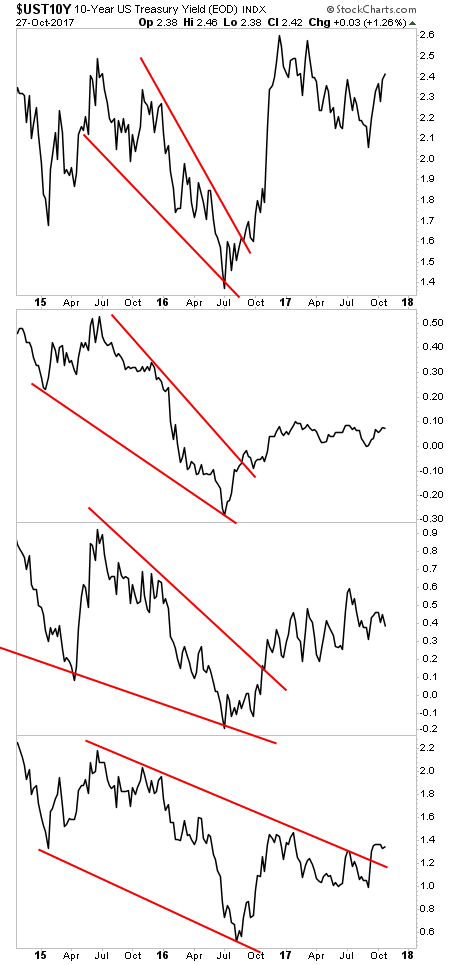

Well guess what? The bond markets are already beginning to revolt. As I write this, the bond yields on FOUR of the largest economies in the world are rising, having broken out of their downtrends of the last few years. The bond markets for US, Japan, Germany and the UK are all in revolt.

And guess what is triggering this?

INFLATION.

Inflation forces bond yields higher as the bond markets adjust to compensate for the fact that future interest payments will be worth less in real terms.

Bond yields higher= bond prices lower. Bond prices lower= the bond bubble is in serious trouble.

The above chart is telling us in very simple terms: the bond market is VERY worried about rising inflation. And if Central Banks don't move to stop hit now by ending their QE programs and hiking rates, we're in for a VERY dangerous time in the markets.

Nessun commento:

Posta un commento