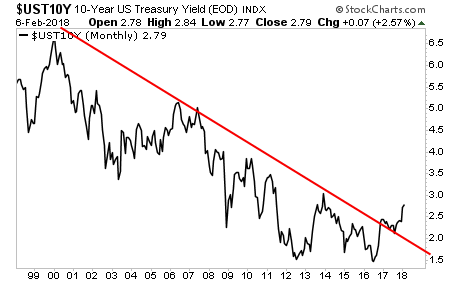

For weeks we've been pounding the table that the bond market was flashing "danger." Just about everyone else on the planet was claiming, "rising rates don't matter."

We now know how that turned out.

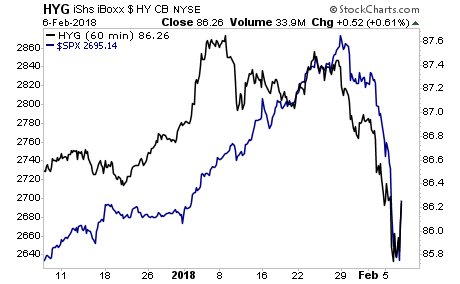

Indeed, High Yield Credit (junk bonds) peaked well before stocks did. Again, the debt markets were screaming trouble was coming. But 99% of investors were not prepared.

The truth is that the Fed is way behind the curve. Inflation is back and it's endangering the bond bubble. Until the Fed or someone else reins in the bond market, there is no significant rally coming to the markets.

Put another way, until the bond market is back under control and yields fall, the bull market in stocks is over.

Nessun commento:

Posta un commento