Economic commentaries, articles and news reflecting my personal views, present trends and trade opportunities. By F. F. F. Russo (PLEASE NO MISUNDERSTANDING: IT'S FREE).

MARKET FLASH:

mercoledì 25 ottobre 2017

Can We have an ETF Meltdown?

Suppose there is a sudden rush for the exits in the high yield bond market. Those in the cash bonds know the drill. They will put in orders with the bank/dealer market makers. For a while those high yield bond trading desks will buy the bonds and hold them in inventory. But it won't take long for the trading desks to reach their capacity. After that point, they won't be buyers. They will act as agent -- also knows as riskless principal -- and look for someone on the other side of the trade. In the meantime the seller has to bide its time. The point is that on the cash bond side, it is not an intraday sort of a transaction. It can take days to find the other side for the trade. And anyone who is active in the high yield bond market knows that, so they structure their leverage and liquidity accordingly.

However, those in the ETFs by and large have no inkling that this is the way the market for high yield bonds works. As far as they can tell, the ETFs trade like an S&P 500 stock. You put in an order to sell, and you are done in minutes.

The reason there is typically high liquidity in the ETFs is that there is typically good two-way flow. And beyond the buyers and sellers are what are called authorized participants. The authorized participants keep the ETFs linked to the underlying cash bonds. They can create ETFs by buying up and bundling the underlying bonds, and they can take in the ETFs and unbundle them and sell the underlying bonds. In a functioning, two-way market, this all works the way arbitrage does for equities indexes. If the ETFs are at too high a price relative to the cash bonds, they grab the cash bonds to create and sell ETFs. If the ETFs are at too low a price relative to the cash bonds, they buy the ETFs and take the bonds to sell in the bank/dealer market.

It sounds simple, but it can't really be foolproof. You know there must be something that can go wrong when you have an instrument -- the high yield bond ETF -- that is as liquid as water even though the bonds it contains are almost the definition of an illiquid security. There is something akin to trying to cheat the law of conservation of momentum. And we all know that anytime something depends on some notion of arbitrage, things can go off the rails. I was in the middle of the portfolio insurance problems that led to the market crash in October, 1987. I knew all about option theory, but when the market was in free fall and the bid-offer spread for the S&P 500 futures was over a dollar, no one was in the mood to try to keep prices in line by doing delta hedging. Options traded in their own world. Implied volatilities were 80% and higher. The option market went into rotation -- trading one stock at a time throughout the day.

For the ETFs, things can go off the rails if the authorized participants can't do their job. If there is not a two-way market, and if the authorized participants' inventory is filled up with ETFs, and if they see that it will take days to get the bonds off of their hands, at the very time that prices are going crazy, they will be stepping away. At that point there is nothing tethering the ETFs to the cash market. The ETF market and the high yield bond market will each trade as their own thing, based on who needs to sell and who is there to buy. At that point it might as well be one market for Martian gravel and another for Enceladian ice cones.

Sure, that is taking it a little too far. There will be some real money investors who will finally step in and keep things from moving into a totally imaginary world. But for the time being the ETF market will, for all practical purposes, shut down. And, getting to the next chapter in this story, it is the "for all practical purposes" that matters.

A clear-thinking, experienced investor in, say, an ETF on an equity market index or gold or currency will not be bothered much by the failure of the high yield bond ETFs. They will get the point that the high yield ETF was creating a fiction of liquidity when there wasn't any, whereas in these equity and currency and commodity markets the underlying markets trade with pretty much the same liquidity as the ETF. But for many investors, all they will hear is that ETFs are in trouble. In the face of the major market dislocation in which the high yield bond problems are likely to be embroiled, people are already going to be in risk-off mode, and if they smell some sort of structural risk with these "newfangled ETFs" they will sell them, period. And there will be plenty of sources out there ready to spread the view that something is amiss.

And, getting to Soros's theory of reflexivity, the changing expectations that come from people in the market buying into this view means that those clear-thinking experienced investors will get out of these more liquid ETFs themselves. And if the authorized participants are still up for doing their job in those markets, that selling will feed back to drop the underlying markets in equities, currencies, and commodities.

Stocks Slide On Report House Considering Capping 401(k) Plans Despite Trump Vow

Central Banks Just Printed the Equivalent of Germany's GDP

The world's Central Banks have finally succeeded in unleashing an inflationary storm.

The first pickup has only just begun to be felt. But this time next year, when inflation is well north of 4% globally and the big price moves have already occurred, everyone will be screaming "INFLATION!"

How did this happen?

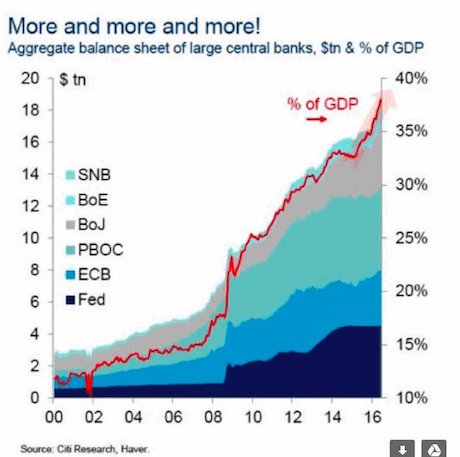

Globally, Central Banks are now printing over $120 BILLION per month. Andthis is happening at a time when most major economies are out of harm's way.

Put another way, the economies of the EU, Japan, and the US are all growing rather than contracting… but Central Banks are printing MORE money today than they were during the depths of the last systemic crisis (the EU crisis of 2012-2013).

------------------------------

Are You Ready For the Next Crisis?

Is the Everything Bubble About to Burst?

Central Banks Are Now Officially Cornered

Central Banks are in VERY serious trouble.

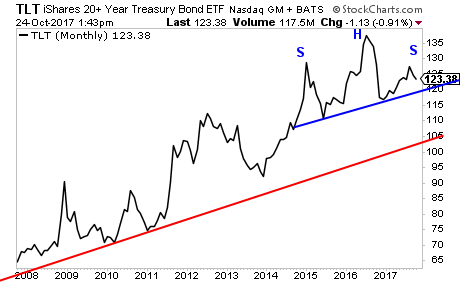

By creating a bubble in sovereign bonds, which some - me too - call the everything Bubble, they were hoping to corner all risk.

The problem with this, is that in order to create this bubble, they had to print trillions of dollars worth of money and use this money to buy bonds. And that money printing (now to the tune of $15 trillion) has unleashed inflation.

Why is this a problem?

Because inflation makes bond prices FALL as bond yields rise to accommodate the higher inflation rate. And when bond prices fall, the bond bubble bursts.

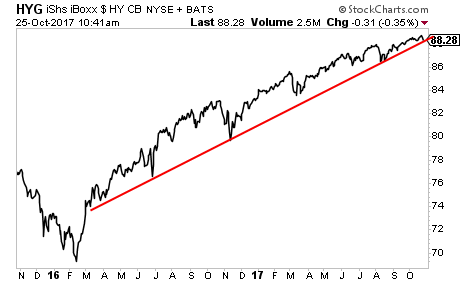

Take a look at high yield/junk bonds. We're right at the bull market trendline.

Emerging market bonds? Ditto.

Worst of all, the 10-Year Treasury has already broken its bull market trendline running back to previous credit cycle peak in 2007.

Put simply, the above charts are a MAJOR warning that the bond bubble is in serious trouble. Central Banks are now cornered: either they stop printing money and let stocks collapse... or they continue to print money, unleash inflation, and pop the bond bubble.

Either way, we're heading towards another crisis.

The time to prepare your portfolio for this is NOW before this hits truly gets out of control!

Imagine if you'd prepared your portfolio for a collapse in Tech Stocks in 2000... or a collapse in banks in 2008? Imagine just how much money you could have made with the right investments.

Why the Setup is Ripe for Another Debt Implosion

When individuals borrow more money than they can pay back, this can result in a personal financial crisis, perhaps bankruptcy.

When a lot of people take on more debt than they can handle, this can lead to a systemic financial crisis, like what happened between 2007 and 2009, when many people bought more house than they could afford.

Our addressed this concern:

Numerous measures of debt, including auto-loan debt, student-loan debt, real-estate debt at commercial banks (though not overall), consumer debt, margin debt and total debt, have soared to all-time highs, indicating exceptional recklessness among lenders, borrowers and investors.

So, we are not surprised by the findings of a recent Northwestern Mutual survey (CNBC, Oct. 17):

Interviews with more than 2,700 adults over the age of 18 revealed that nearly three-quarters of them said they were struggling with debt, and it was a "high" or "moderate" source of anxiety for 40 percent of them. Almost half of those interviewed were carrying at least $25,000 in debt, and the average debt load was $37,000, excluding mortgages. More than 1 in 10 owed more than $100,000, and 45 percent of those carrying debt were spending half their monthly income on debt repayments.

This Federal Reserve chart shows the 10-year trend of total consumer credit outstanding:

As you can see, in November 2010, the amount was around $2.5 trillion. But, as of Oct. 6, 2017, the dollar figure had climbed to nearly $3.8 trillion.

Yet, here's what you need to know: The momentum of the growth of consumer credit is slowing.

Yes, social mood is still positive, as evidenced by the DJIA hitting 23,000 for the first time on Oct. 17.

But, when social mood turns negative, our view is that the setup is already in place for a historic debt implosion.

We expect that, soon more than later, the stock market and social mood to shift into reverse.

'The Automatic Flow That Poses The Most Immediate Risk Is VIX ETPs’: Goldman Takes On The ‘Doom Loop’

When stripped of the technicalities, the premise is pretty simple as these things go. Levered and inverse VIX ETPs would be forced to rebalance on a nominally small vol. spike and to the extent that rebalance exacerbates said spike, vol. control funds, CTAs, and risk parity could be forced to deleverage into a falling market.

This has become one of the rallying cries of the "Chicken Little" contingent and it's a topic that JPMorgan's "Gandalf" (Marko Kolanovic) has been keen on warning about for quite some time. The quant crowd isn't fond of the notion that they'll be an aggravating factor in the next plunge and the VIX ETP crowd doesn't generally understand the role they're playing in what amounts to a buildup of systemic risk.

There are plenty of people who will tell you why none of what I've just said is possible and indeed, there are some folks who will claim it doesn't make much sense at all, but I would submit that those rebuttals will one day be looked back on as something akin to "famous last words." So you know: "time stamp it."

Well in a sweeping new note out Tuesday, Goldman takes a look at this dynamic asking "would automatic flows exacerbate a potential selloff?"

"In moments of stress, products that de-risk when risk rises (including volatility control strategies and trend-following strategies) can create feedback loops," the bank notes, echoing our "doom loop" characterization. Here's some further color:

Volatility control strategies typically sell equities when vol rises above a threshold, but with vol well below-target a prolonged pickup in vol would likely be needed. The S&P 500 Managed Risk – Moderate Index, which consistently would have had 7-10% 12-month rolling realized vol in its history, has now had 5% realized vol over the past 12 months. A quick selloff would drive this index and the large funds that have similar strategies to start realizing near-target vol, rather than above-target, so we would not expect them to de-risk in an initial pickup in vol.

Growth in levered, short VIX ETPs has increased their potential feedback loop impact. Over the past few months, the combination of product inflows (to long VIX ETPs, as a hedge), strong performance (of short ETPs, following +135% YTD performance), and low VIX futures prices (allowing more futures to "fit" inside each ETP share) have brought the gross VIX ETP market size to a new high (the net size with offsetting long and short products is less long than usual).

That second paragraph underscores the notion that when it comes to the "doom loop," VIX ETPs are the biggest risk. Here's Goldman again:

The automatic flow that has changed the most of late – and that poses the most immediate risk – is VIX ETPs, after recent growth of the leveraged and inverse products.

Large levered and inverse VIX ETPs help make vol move faster. When VIX futures are rising, levered and inverse products buy VIX futures, creating a feedback loop. Levered funds buy VIX futures when they rise, because their NAVs rise twice as fast as the value of their underlying VIX futures in percentage terms, leaving the futures position insufficient for the now-larger ETPs. Similarly, inverse funds cover short VIX futures when they are rising.

A 3-point VIX futures spike in prices would drive ETP issuers to buy more than 50% of average volume of VIX futures. A 3 point jump would leave vol below-average, yet create demand for over $100mm vega (100k VIX futures), potentially driving vol up further. This number would have been around $50mm vega on a typical day in 2016. The amount of rebalancing has been boosted by low VIX futures levels, making an N-point move a larger percent of the current level of VIX futures. This effect has been largely untested in 2017 because of the lack of large SPX moves.

So there you go.

When the proverbial shit hits the fan, don't blame risk parity and the trend followers. Rather, point the finger at the "Target manager next door".