The many new integrated non-USD platforms devised and constructed by China finally have critical mass. They threaten the King Dollar as global currency reserve. Clearly, the USDollar cannot be displaced in trade and banking without a viable replacement for widespread daily usage. Two years ago, critics could not point to a viable integrated system outside the USD realm. Now they can. The integration of commercial, construction, financial, transaction, investment, and even security systems can finally be described as having critical mass in displacing the USDollar. The King Dollar faces competition of a very real nature. The Jackass has promoted a major theme in the last several months, that of the Dual Universe. At first the USGovt will admit that it cannot fight the non-USD movement globally. To do so with forceful means would involve sanctions against multiple nations, and a war with both Russia & China. Their value together is formidable in halting the financial battles from becoming a global war. The United States prefers to invade and destroy indefensible nations like Libya, Iraq, Ukraine, Syria, and by proxy Yemen. The USMilitary appears formidable against undeveloped nations, seeking to destroy their infra-structure and their entire economies, in pursuit of the common Langley theme of destabilization. In the process, the USMilitary since the Korean War has killed 25 million civilians, a figure receiving increased publicity. The Eastern nations and the opponents to US financial hegemony will not tolerate the abuse any longer. They have been organizing on a massive scale in the last several years. Ironically, the absent stability can be seen in the United States after coming full circle. The deep division of good versus evil, of honest versus corrupt, of renewed development versus endless war, has come to light front and center within numerous important USGovt offices and agencies.

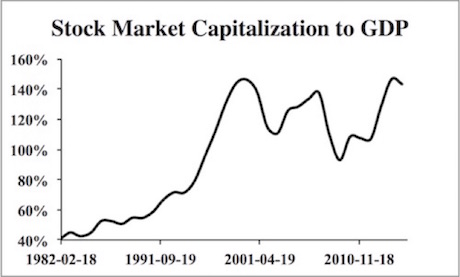

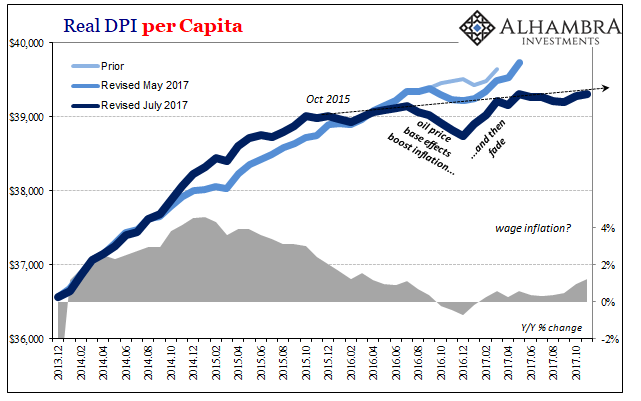

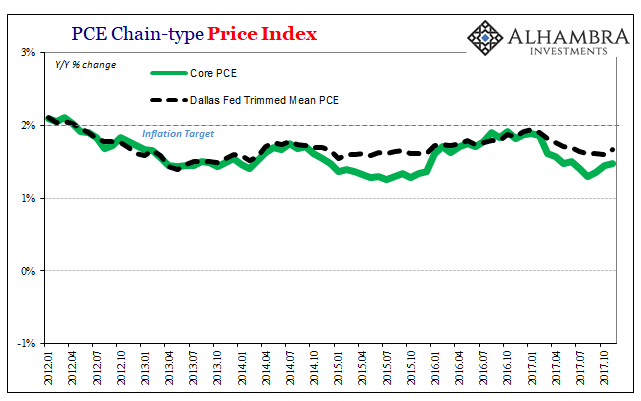

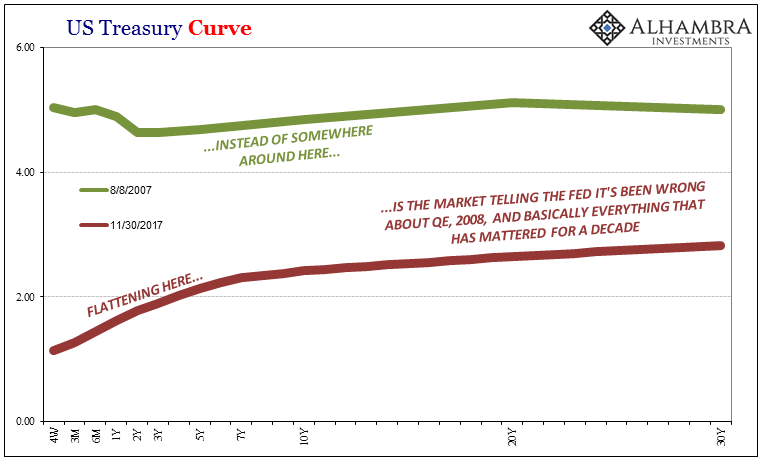

The shape of the US nation will change with the loss of the USDollar's status as global currency reserve. The starting point for the global resistance against the King Dollar was 9/11 and the onset of the War on Terror. It has been more aptly described as a war of terror waged by the USGovt as a smokescreen for global narcotics monopoly and tighter control of USD movements. Then later, following the Lehman failure (killjob by JPMorgan and Goldman Sachs) and the installation of the Zero Interest Rate Policy and Quantitative Easing as fixed monetary policies, the community of nations has been objecting fiercely. The zero bound on rates greatly distorted all asset valuations and financial markets. The hyper monetary inflation works to destroy capital in recognized steps. These (ZIRP & QE) are last ditch desperation policies designed to enable much larger liquidity for the insolvent banking structures. Without them, the big US banks would suffer failure. They also provide cover for the amplified relief efforts directed at the multi-$trillion derivative mountain. In no way, can the global financial system tolerate unbridled monetary inflation which undermines the global banking reserves.

The Eastern nations have been organizing to end the USDollar abuse, which has suffocated economic growth and financed regional wars with motive to sustain the USDollar dominance. Their many non-USD platforms finally can boast at having critical mass, and finally are integrated with the most important link of all. The Oil-RMB-Gold triangle is the death warrant to the USDollar, and the Gold Trade Note will be the dagger in its heart.

One Belt One Road Cornucopia

It is also known as the Belt & Road Initiative (BRI). China has been promoting infra-structure development, but with the BRI, they have coordinated the funding agents, the consulting groups, the construction firms, and more. They have built a gigantic table, acting as a cornucopia for funding and completing a very large group of massive projects, all over $1 billion in value. Almost none will use the USDollar except in dumped securities in order to cover the costs. It is commonly called Indirect Exchange, since no US-based party is in the mix. The many US-based firms are largely excluded from the BRI contracts. Look for European firms to clean up, especially the Germans since they make friends well and provide world-class technology. The Belt & Road Initiative can be considered the project development arena for the burgeoning newly forming Eurasian Trade Zone, often called the Eurasian Economic Union (EAEU). It will not use the USD.

Asian Infra-structure Investment Bank (AIIB)

The AIIBank serves as a gigantic funding agency among the community of nations. Their projects seem to be focused on SouthEast Asia, but not completely. The British deeply angered the Obama Admin by joining the AIIBank last year, against urgent pressure from Washington. Soon a global entity, not just Eastern. The London City (sovereign nation within England) did not wish to lose out in the financial traffic involved in the many projects. The projects will expand beyond Asia, in time to connect Europe. London strives to gain an RMB Hub for both currency exchange and bond trading. Think Panda Bonds, like for Italian Govt debt issuance in RMB terms without any currency risk for Chinese investors. The AIIBank makes the Intl Monetary Fund irrelevant. The Chinese have a newfound dominant role in the IMF, to shut it down as a funding arm, but to ensure the Chinese Yuan currency becomes a bank reserves basis. Together, the Belt & Road Initiative and the AIIBank are the most important investment platforms in retiring the USDollar from its global currency reserve status.

BRICS New Development Bank (NDB)

This platform went quiet in the last couple years, as the AIIBank took away the attention for development. However, the BRICS are organizing better in the last several months. Their projects are entirely focused on BRICS nations, plus their neighbors in connection. The Jackass theory was that South Africa was suffering from high level political corruption, while India was suffering from high level financial collusion. Expect the SA problem to continue, but the Indian independence to come forth in a survival gesture. The BRICS NDBank is pressing forward, with renewed emphasis given by Russia & China for the purpose of gaining momentum. Another Jackass theory is that the New Development Bank will become a primary center for conversion of Western sovereign bonds into Gold bullion for bank reserves purposes. Refer to USTreasury Bonds primarily, but also to EuroBonds, UKGilts, and Jap Govt Bonds. Imagine the power of a central window for conversion of fiat major nation bonds into gold, after the USDollar is well recognized as having lost its global reserve currency status. The implication would be for fast removal of the USTBonds in the global banking system, replaced by Gold bullion. The NDBank could become an important catalyst.

Asian Development Fund

This fund is small and new, but is gaining traction fast, run independently from the USGovt for the benefit of Asian nations, mostly in the SouthEast Asian region. It is competing directly with the Asian Development Bank, led by the USGovt. The Asians do not wish for the United States to run their business development any longer, since assistance comes with a stranglehold and considerable coercion. It is no longer wanted.

Cross-Border Interbank Payment System (CIPS)

This payment system is a direct frontal assault on the SWIFT transaction payment system, as in bank to bank transfers. The USGovt has abused this system for political purposes like a financial weapon, causing severe repercussions and backlash. The Society for Worldwide Interbank Financial Telecommunication has a new rival, a strong one with stress test success. The CIPS does not stand for Chinese Interbank Payment System, but it is led and run by the Chinese. It will feature lower fees, faster transfers, and no interference with political motive. It is ramping up in volume, with numerous commitments for its future usage. The USGovt will lose its financial weapon used and abused to isolate nations which do not wish to trade (primarily energy products) using the USDollar.

Shanghai Oil-Gold futures contract

This contract came into being last August, but has not really gotten off the ground yet. It needed a link to the RMB fortress. Now that link has arrived. This contract served as a harbinger of linkage of the two most important commodities for commerce and currency with existing systems. It served as notice for the planned imminent death of the Petro-Dollar. It required completion of the triangle for its full effect.

Shanghai RMB-Oil futures contract

This contract completes the triangle, and will serve as the executioner for the USDollar death warrant. With the triangle completed, nations like Russia can sell China its crude oil (by whatever path or delivery method), accept RMB in payment, then quickly convert to Gold bullion within the same city of Shanghai. Think one-stop shopping that undermines the Petro-Dollar system at its core. Expect China to require many of its oil suppliers to use the Shanghai system for managing the forward price contracts, with implicit pressure. The key region to watch is the Gulf Region where the Saudis and their neighbor oil monarchies will line up to use these contracts in oil sales and payment systems. Most assuredly, rival Iran will use the triangle with high volume oil sales to China, keeping the oil price down in the process. However, as important as this triangle is for displacing the King Dollar from the financial catbird seat, more lies ahead. The Oil-RMB-Gold triangle will in all likelihood be used as the foundation for the upcoming Gold Trade Note, which will remove the USTBill as standardized payment instrument for Asian trade. The Gold Trade Note will have an equity placement in gold, a promise of gold payment upon product delivery, and a net settlement feature. If the Oil-RMB-Gold triangle is the death warrant, the Gold Trade Note is the dagger in the USDollar heart with respect to the global reserve currency role. The role has two sides: trade payment (led by oil market) and bank reserves (led by USTBond).

BRICS Gold Platform

This platform has just recently been introduced, promoted for usage by the lead team of Russia & China. They have promoted their plans and objectives for running the platform. They openly deride the usage of paper price discovery methods, which have corrupted the COMEX beyond any recognition of a gold mart where metal is bought and paid for. The COMEX has no metal delivery, but the BRICS Gold Platform will indeed have direct metal delivery. The new platform will feature gold bullion sales with immediate delivery, and thus an honest price system. Expect the eventual merger with their New Development Bank, if their intention ever becomes realized to provide the fulfilled role in conversion of sovereign bonds to Gold bullion bars.

Russian Gold Exchange

Another gold exchange which will likely merge with the BRICS Gold Platform, it will be based in Moscow. Expect this exchange to connect with the Russian Sverbank, and in particular with the Shanghai gold market.

Holy Grail Energy Deal

In the year 2014, the Chinese cut a deal worth $250 billion for delivery of Russian oil & gas, including the construction of delivery pipeline systems. The deal is the largest in the history of the energy market and spans over 10 years in time. To label the deal in USD terms is fully legitimate, even though a bilateral Russia-Chinese contract, because China will pay the great majority of the bill for crude oil, natural gas, and pipeline construction in the form of USTreasury Bonds, in a grand dumping exercise. Yet more Indirect Exchange which will reduce the Chinese Govt official USD holdings. Expect to hear next that the Russians will use the USTBonds to buy RMB currency, and with it convert to Gold bullion in Shanghai in a sudden sequence. In doing so, the Russians will essentially be converting Chinese-held USTBonds into Gold bullion for reserves.

Shanghai Cooperative Organization (SCO)

The SCO is growing in membership beyond the Russia + Former Soviet Republics. The most recent member nation signed on is Iran, which had been given provisional status earlier. By taking its current form in 2001, the SCO organization is designed for cultural, political, economic, security, and other purposes. In 2017, SCO's eight full members account for approximately half of the world's population, a quarter of the world's GDP, and about 80% of the Eurasian landmass. Expect the SCO to rival NATO in an offsetting role toward pursuit of global balance.

Union Pay Credit Card

The Chinese credit card has more subscribers than MasterCard and Visa combined. Just as SWIFT has been sidestepped for any politically-based obstruction, Union Pay can sidestep any Western credit card abuse in obstructions across the Asian Economies. There is precedent for MC/Visa obstructions in Asian countries.

Dagong Credit Rating Agency

The Chinese have created an independent credit rating agency, free from the West, which will be used to provide ratings for bonds and firms. The Western credit agencies of Standard & Poors, Moodys, and Fitch have each become deeply politicized. They ignore the Third World nature of USGovt debt, which is actually worse than the Greek Govt debt. The USTreasury Bond still has a AAA rating, despite $trillion annual deficits without hope of remedy. In recent years, the Big Three Ratings firms have taken on a political motive in downgrades of Russia debt, despite the fact that Russia has exited its foreign-held debt and whose finances have never looked better.

IRONY ON DATES & GOLD RESERVES

Official gold reserves match important dates for Russia and China in their national history. The dates give a message which should be heard, since no such coincidences could have occurred with these important dates. Russia claims 1801 tons right now in their official gold reserves. The year 1801 in Russian history is when Alexander I took reign. He was one of the greatest czars in a millennium for their nation. He devoted himself to foreign policy, well known in the annals for defeating Napoleon. China claims 1842 tons right now in their official gold reserves. Note the irony in Chinese history for that year. The year 1842 marked a time of total embarrassment and weakness to China. In 1842, the Qing Dynasty was compelled to sign the Treaty of Nanking, the first of what the Chinese later called the unequal treaties. It granted an indemnity and extra-territoriality to Britain, opened five treaty ports to foreign merchants, and ceded the Hong Kong Island to the British Empire. The failure of the treaty to satisfy British goals of improved trade and diplomatic relations led to the Second Opium War (1856-1860) in disgusting vile retaliation. The Qing defeat resulted in social unrest within China. That ugly war is considered by the Chinese to the beginning of modern Chinese history.