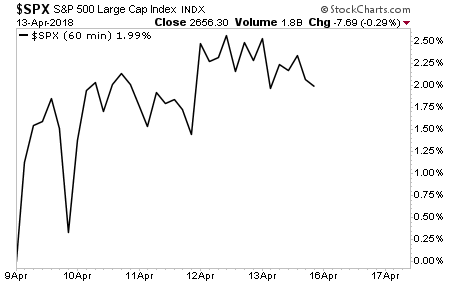

A major geopolitical event takes place and stocks (and risky assets) surge while bonds (and safe havens) slide...

As former fund manager Richard Breslow says in his latest letter, "I see it and, unfortunately, it's all too familiar not to be believed."

Via Bloomberg,

The world is a safe place, it is being put about, as traders reassess the dangers from the Middle East and every other global hot spot. Friday night was spent watching and wondering about missiles, sanctions and retaliation. The weekend was full of verbal clashes with a strong dose of one and done messaging mixed in. And on Monday morning, European stocks were being led higher by the travel and leisure sector. So much for an abundance of caution.

This recurring pattern inevitably leads to the tedious discussion of what haven assets are or aren't doing in response. The answer is nothing. It is a noble but futile exercise to try to explain events by finding something that has moved a bit and imparting some greater meaning to it other than randomness.

Safe havens are hedges. And we all know, no one hedges anymore. It just hasn't proven to be worth the cost. Being lectured by yet another central bank, as the chorus was joined by the Reserve Bank of Australia in their latest Financial Stability Review, doesn't help. Or change anyone's behavior.

Investors realize that monetary authorities are just as deeply into these trades as they are. And the current zeitgeist built up over the entirety of the post-financial crisis world expects policy-makers to be the ones responsible for keeping the balls in the air. No pain, no gain became gain with no pain. It has been just too great a strategy to call the bluff of those advising caution.

EUR/CHF, a haven fave, has been trending the last two months, no matter the news. The problem is the direction has been up.

History isn't on the side of this being a sleep well at night position should rates rise or growth slow, let alone trade falter.

Just selling the dollar sounds great, but hasn't worked since the end of January. But the position continues to grow. Good luck with that.

About the only hedge, other than doing nothing, that has been consistently working is the flattening yield curve.

Famous last words, perhaps, but it feels like at this point it is risk additive, not reducing. Credit has had a nice little run of late, but February and March should have been teensy reminders that spreads don't always go in the same direction. Although, to be fair, buying the IG dip at last November's wides proved once again a great trade and technically flawless. So perhaps, I doth protest too much?

I hate to admit it, but I'm quite curious to hear all of the policy speeches on this week's docket. But the latest dot plot update is probably the last thing I want to hear about.