Central Banks are in VERY serious trouble.

By creating a bubble in sovereign bonds, which some - me too - call the everything Bubble, they were hoping to corner all risk.

The problem with this, is that in order to create this bubble, they had to print trillions of dollars worth of money and use this money to buy bonds. And that money printing (now to the tune of $15 trillion) has unleashed inflation.

Why is this a problem?

Because inflation makes bond prices FALL as bond yields rise to accommodate the higher inflation rate. And when bond prices fall, the bond bubble bursts.

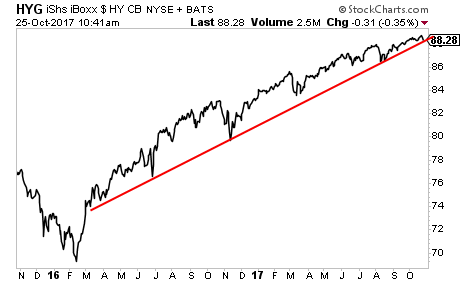

Take a look at high yield/junk bonds. We're right at the bull market trendline.

Emerging market bonds? Ditto.

Worst of all, the 10-Year Treasury has already broken its bull market trendline running back to previous credit cycle peak in 2007.

Put simply, the above charts are a MAJOR warning that the bond bubble is in serious trouble. Central Banks are now cornered: either they stop printing money and let stocks collapse... or they continue to print money, unleash inflation, and pop the bond bubble.

Either way, we're heading towards another crisis.

The time to prepare your portfolio for this is NOW before this hits truly gets out of control!

Imagine if you'd prepared your portfolio for a collapse in Tech Stocks in 2000... or a collapse in banks in 2008? Imagine just how much money you could have made with the right investments.

Nessun commento:

Posta un commento