Stock markets

![]() This week the mainstream press has been busy focusing on remembering the 'start' of the financial crisis of September 2008 "Lehman's Brother Collapse" that most of whom never saw coming. In act the financial crisis actually began much earlier than September 2008 with the first obvious signs of a credit crisis brewing being the collapse of two Bear Stearns hedge funds during July 2007, but it would take the mainstream financial press another year before they started to connect the dots for the train wreck well in motion.

This week the mainstream press has been busy focusing on remembering the 'start' of the financial crisis of September 2008 "Lehman's Brother Collapse" that most of whom never saw coming. In act the financial crisis actually began much earlier than September 2008 with the first obvious signs of a credit crisis brewing being the collapse of two Bear Stearns hedge funds during July 2007, but it would take the mainstream financial press another year before they started to connect the dots for the train wreck well in motion.

31 Jul 2007 - Hedge Fund Subprime Credit Crunch to Impact Interest Rates

Why Hedge Funds are Failing ?

Hedge funds, deploy leverage to enhance their exposure to markets, When things are moving in the right direction this results in phenomenal profits. However as is eventually the case, the 'bets' get bigger and bigger and its only a matter of time before the 'gamblers' find themselves on the wrong side of the market. This is what happened with Two of Bear Stearns Hedge funds, which placed highly leveraged bets on packages of subprime mortgage derivative products. When the value and credit worthiness of these bond packages called collateralized debt obligation (CDO') was cut due to the subprime defaults.

The effect of this was to virtually wipe out the total value of the funds that had previously been rated as low risk. The problem here is that they should NOT have been rated as low risk. The CDO packaging enabled institutions to mix good risk and bad risk debt all in one pot and label it as good risk. Therefore the financial institutions earned a higher rate of return on what seemed like a relatively low risk CDO package. that was priced in the market price as low risk debt upon which hedge funds such as Bear Stearns leveraged to the hilt.

And here were talking about the Subprime Experts getting wiped out !

The Impact of Hedge Fund Losses ?

The Hedge fund failures has two key effects.

1. A Financial Shock to the System - Results in a re-rating of risk across the board, as financial institutions during the boom period have loaded themselves up with similar CDO packages, which are now expected to be worth much less than previously thought. As the market is pricing them at a much higher level of risk.

2. Derivatives Ripple Effect - Bear Stearns weren't the only people betting on the subprime mortgage market using highly leveredged derivatives. Many 'less experienced' hedge fund gamblers and other financial institutions also have exposure, and we can expect many more failures in the market place as people try to rush for the exit to cut exposure. It is unknown how much damage will be done. But the mark down of the financial sector in advance of bad debt provisions is a clue that were talking about in the hundreds of billions of dollars and there in lies the credit squeeze.

Effects of the Credit Squeeze.

As financial institutions are forced to 'cover their bets' by making provisions for bad debts, and losing their high interest rate / 'low' risk subprime cash cows. They are in effect withdrawing liquidity from the market place and making it more difficult for borrowers across the board of all shapes and sizes to borrow money for whatever economic activity. This means that this will impact on the economy and thus depress the US housing market further which results in more foreclosures and more squeezing of credit to cater for this.

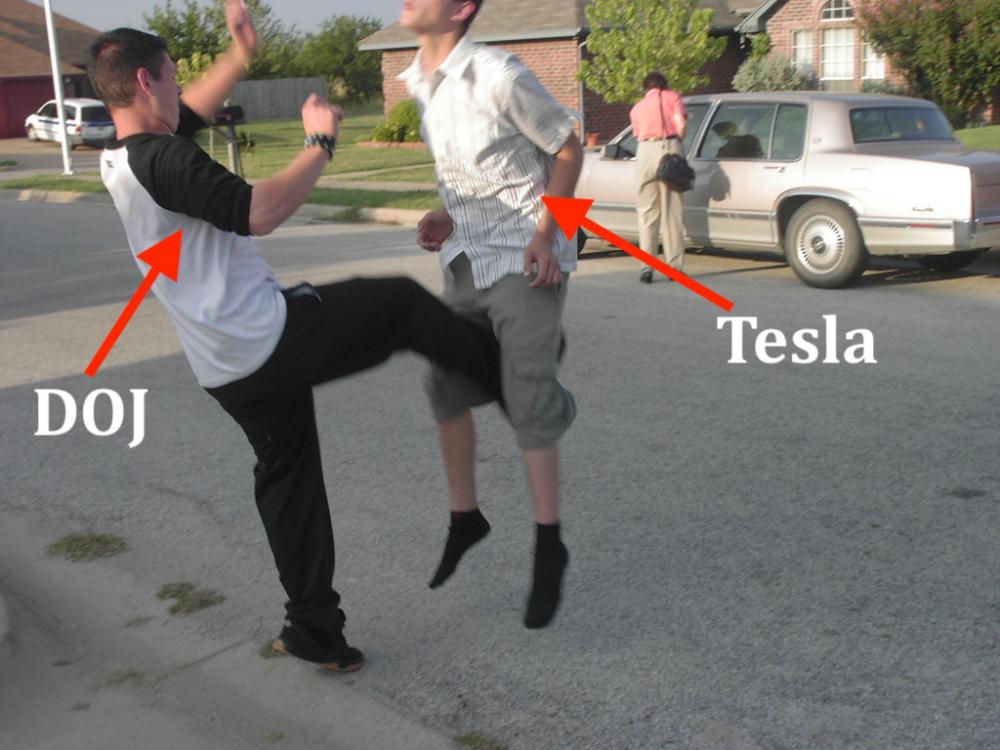

I know with the passage of time the magnitude of events can diminish so here's a clip that illustrates just how close the U.S. Financial System came towards total collapse. At 2 minutes, 20 seconds into this C-Span video clip, Rep. Paul Kanjorski of Pennsylvania in February 2009 explains how the Federal Reserve told Congress members about a "tremendous draw-down of money market accounts in the United States, to the tune of $550 billion dollars." According to Kanjorski, this electronic transfer occurred over the period of an hour and threatened a further $5 trillion to be drawn out triggering a total collapse of the Financial System, which prompted Hank Paulson's emergency $700 billion TARP bailout action.

And so once more most have missed what's staring them in the face, a retail sector in a state of collapse that I have been warning of for several years that the UK retail sector and likely the US and much of the rest of the western world's was facing a perfect storm of rising producer prices, falling consumer disposable earnings whilst at the same time continuing to haemorrhage customers to the discounters and internet giants such as Amazon. All of which would culminate in increasing pressure on profit margins and balance sheets. Which ultimately warned to expect multiple Woolworth's moments, i.e. giant retailers going bust, whilst in the meantime to expect the crisis to at the very least translate into job losses and the mothballing of many unprofitable stores, the closure of huge super markets, something that was unthinkable to most has fast been becoming a reality as distressed retailers attempt to bolster profit margins by cutting costs by closing stores that are no longer able to operate at a profit as the following video from April 2017 illustrates.

And earlier still I warned that not even Britain's largest retailer Tesco was not immune to the consequences of the unfolding retail crisis.

John Lewis 99% Profits CRASH!

Now today some 18 months on even one of Britain's supposedly strongest retailer, the John Lewis Partnership (includes Waitrose) has felt the full force of the ongoing collapse of the retail sector, by announcing a 99% profits CRASH. Just avoiding announcing a loss with a meager profit of just £1.2 million on sales of £5.5 billion. Whilst blaming the profits collapse on price matching the heavy discounting by rivals as each distressed major retailer battles for ever diminishing footfall, a trend that has been in motion since at least 2014 that continues to reach new heights of crisis point resulting major retailers literally disintegrating before our very eyes.

![]()

So today, whilst the mainstream media focuses on remembering the collapse of the Banking sector 10 years ago that triggered the Financial Crisis. However, none of the so called analysts have even gotten around to connecting the dots to realise that the next Financial Crisis is Already underway, playing itself out not in the housing market, or the banking sector but the retail sector! This is nothing new to those who have been reading my articles for the past 4 years as I have been charting the unfolding collapse of the retailer sector right from the retail sectors giant TESCO downwards as the following excerpt illustrates.

27 Oct 2014 - Could Tesco Go Bust? How to Save Tesco from Debt Bankruptcy Risk

Why Tesco Could Go Bust

The expected Tesco dead cat bounce for tesco's stock price may not even make into end of the year as horrendous shopping numbers start to come through by the end of December signaling Tesco's free fall towards inevitable losses had resumed that risks shaking the very fabric of Britain's supermarket culture that could result in what to many is the unthinkable that a giant such as Tesco could literally disappear over night! If you think it's impossible then maybe that's what many thought of phones4u with its 550 stores before it went bust in September, with Comet and Woolworth's before it, though some such as TJ Hughes manage to return after bankruptcy.

The reason why Tesco actually could go bust is the same reason that any entity right from an individuals to small companies to mega corporations such a Tesco or every whole nations can go bust such as the recent examples of Iceland, Greece, Cyprus illustrate which is DEBT.

To illustrate the magnitude of the crisis that Tesco faces is that a year ago when I first started to literally warn of Tesco's probable demise Tesco was worth approx £30 billion against debt and liabilities of approx £12 billion, against today Tesco is barely worth £13 billion with debt and liabilities of approx £15 billion (debt+pensions hole). The other critical factor in Tesco's debt crisis is what has happened to Tesco's profits, a couple of years ago Tesco was reporting profits of £4 billion, which was ample enough to service its debt mountain and waste on junk such as private jets for CEO's, but today that profit has been wiped out to just £112mln, and remains in a steep decline which implies LOSSES are around the corner, and when companies make losses DEBTS tend to EXPLODE higher, for it means the company needs to borrow money just to stay alive as it is unable to cover day to day activities such as paying suppliers and workers and of course debt interest of £500mln a year. What this does is to result in a quantum shift in debt vs assets in a relatively short period of time which tends to result in bankruptcy as no one is going to lend more money to a company with a ballooning debt mountain that it will increasingly be unable to service (interest payments) let alone actually repay.

Once upon a time one could focus on one major retailer at a time on a conveyor belt that would every couple of months spit out bad news for the latest retailer in distress. Instead today we have virtually EVERY major retail retailer in crisis with their managements all simultaneously pressing the panic buttons to try and get ever diminishing footfall through their doors.

This year has seen the retail sector crisis turn into a catastrophe with several popular chains such as Maplin's and Toys R Us closing down ALL of their stores, with many more chains such as New Look, Debenhams and Marks and Spencer teetering on the brink, and not even the pound stores are immune to the unfolding high street catastrophe as illustrated by the fate of Pound stretcher.

Here's what happened to just 1 major retailer during the past year as Toys R Us traveled from crisis to bankruptcy and then the total closure of all of their US and UK stores.

ToysRUs - The Trend Towards Bankruptcy

In December the British arm of Toys R Us came to within hours of going bust the followed it's american parent company's filing for bankruptcy protection in September 2017 which that triggered a downsizing programme through rapid store closures that are likely to see at least 200 of it's 866 US stores close in an attempt at reducing its $5 billion debt mountain which dates back to its leveraged buy out of 2005 that costs Toys R Us $400 billion a year in interest payments.

So it should not have come as much of a surprise that the British arm of Toys R Us with its 106 stores was heading towards a similar fate if not a 'Woolworth's' moment, as December saw the retailer teetering on the brink of collapse with the potential loss of 3200 jobs. The triggering factor for which is a £30 million black hole in its employees pension fund that had the Government Pension Protection Fund was demanding a near immediate payment of £9 million into to cover 3 years worth of past pension contributions, against which the distressed retailer was offering just £1.6 million as I covered in my following video at that time:

However, whilst Toys R US managed too get through December's crisis still remained in deep distress, whilst The Entertainer Toy Shop chain has continued to thrive with its much smaller stores more convientely located within popular shopping malls, rather than Toys R Us's huge stores in distant retail parks as the following video illustrates of one little girls birthday shopping trip to The Entertainer Toy Shop.

Unfortunately ToysRUs never stood an a chance with the crunch point being March 2018 when it appears the management threw in the towel when the bulk of ToysRUs stores were closed with Sheffield's mega store closing down in April 2018.

Here's a video once more of why the likes of Toys R Us are going bust, where basically shoppers get the whole store to themselves. How is such a large store going to survive without customers? We'll it's not! Also watching the patterns of behaviour amongst worried staff, who whilst trying to act normal were eagerly trying to find ways of intervening in attempts at pushing stock onto customers, something I am seeing repeating across the UK retailer sector from across the price range top to bottom. Retail workers are very, very worried about their jobs in virtually every high street store!