The day ended with still no Stimulus Bill (the 1100-page plus pork-fest is 'close' reportedly), with Italy's virus-death-count resurgent (dashing optimism that they peaked), no clear indication of when the economy will reopen (despite Trump and Kudlow pushing the narrative), and a total and utter collapse in global PMIs.

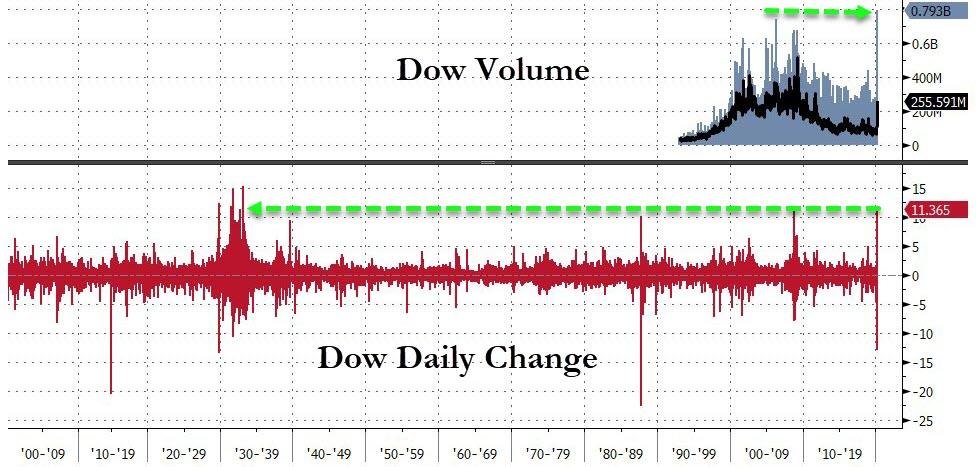

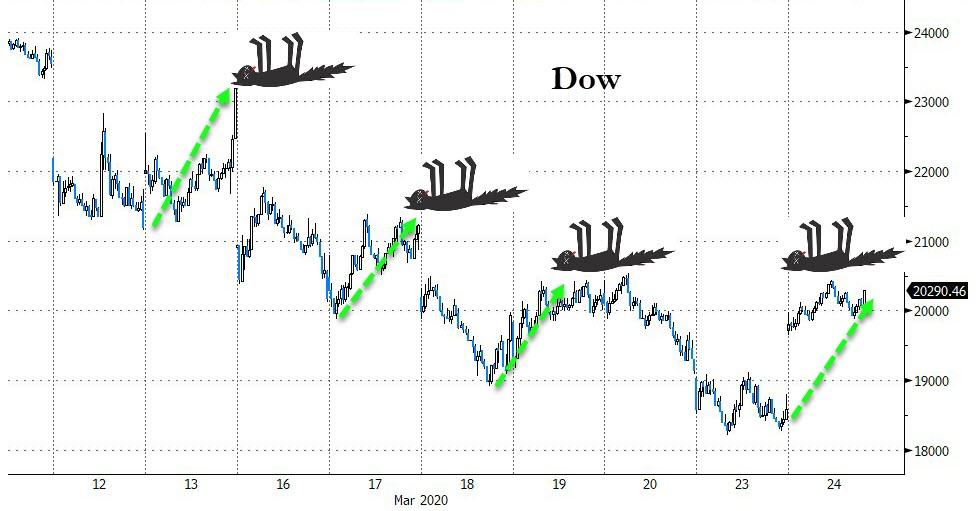

So it all makes perfect sense that stocks soared massively today - Dow +11.3% (biggest absolute point gain for The Dow ever)...

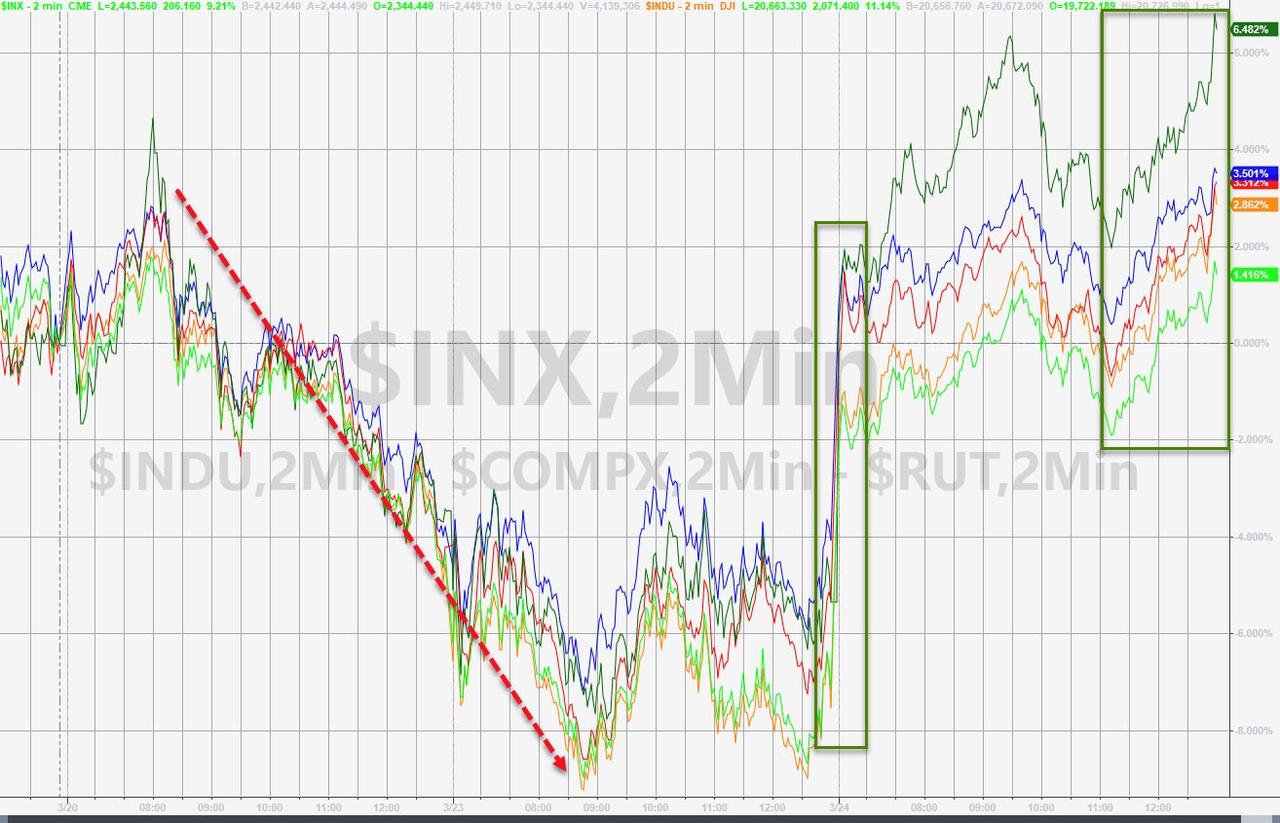

...erasing Friday and Monday's losses...

Futures were limit-up overnight, and extended panic-buy gains - just like last week - at the open and into the close...

For the Dow, this was the best day for The Dow since 1933 (and the heaviest volume ever)

Source: Bloomberg

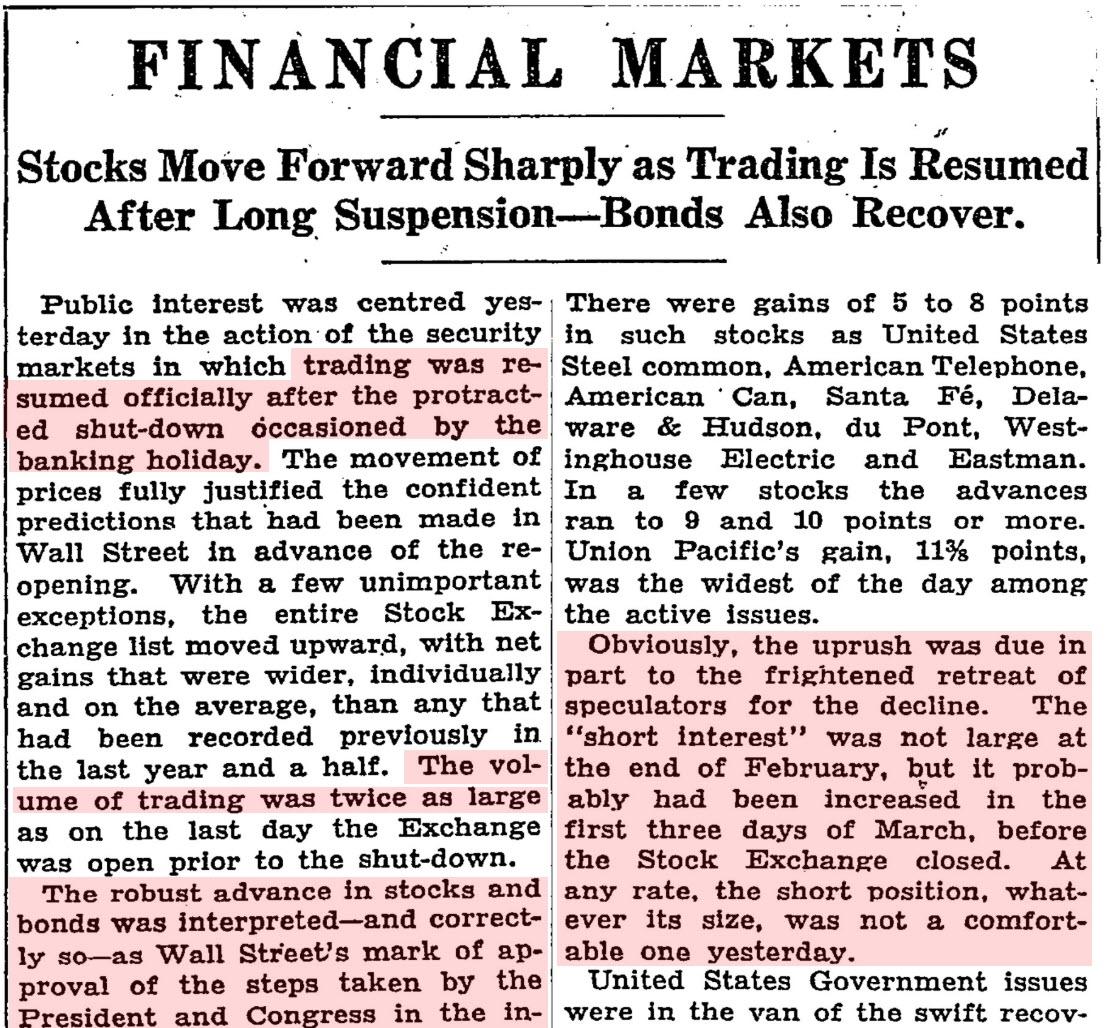

And here's what The New York Times said on that day in 1933 - a response after markets were shutdown, massive volume, thanks to President/Congress' actions, and massive short-squeeze - sounds FAMILIAR!!

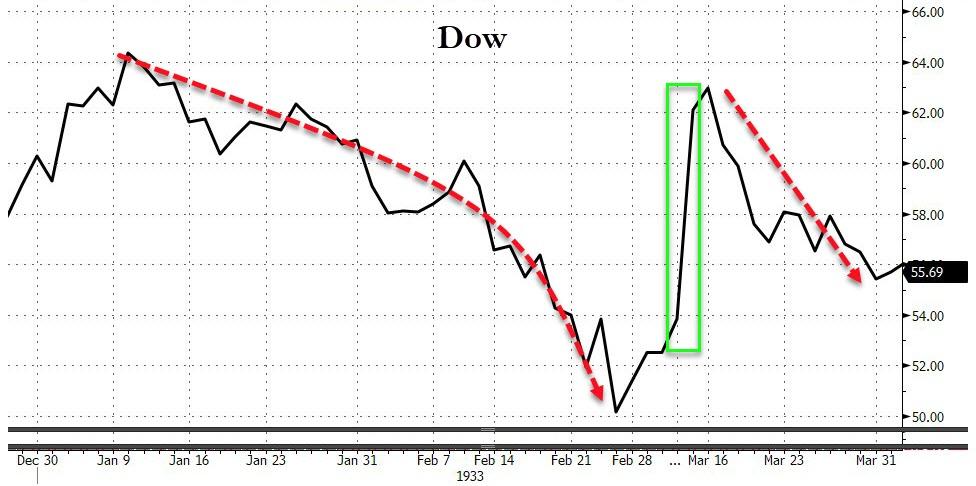

Here's what happened the last time The Dow rallied this much...

Source: Bloomberg

And another huge dead-cat-bounce...

Source: Bloomberg

We've seen this before...

Source: Bloomberg

The S&P tested back up to the Dec 2018 lows...

Source: Bloomberg

European stocks explode higher too (Euro Stoxx up 8.4% - the most since Nov 2008) and DAX's 11% surge is also the biggest since Nov 2008...

Source: Bloomberg

This was the biggest short-squeeze day ever in US markets - with "Most Shorted" stocks soaring 11%!!!

Source: Bloomberg

VIX notably decoupled from stocks exuberance today...

Source: Bloomberg

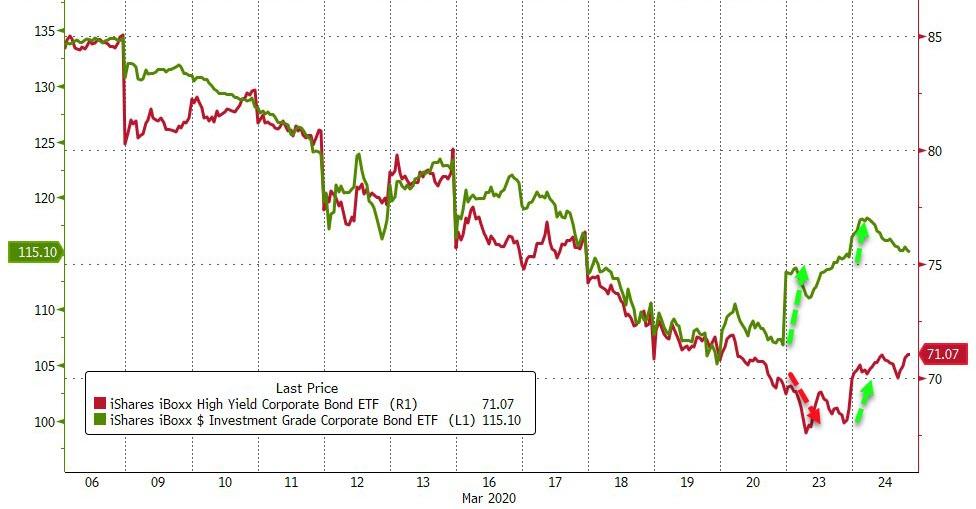

HYG and LQD were both higher today...

Source: Bloomberg

But, LQD faded notably despite the largest inflows ever in the last two days...

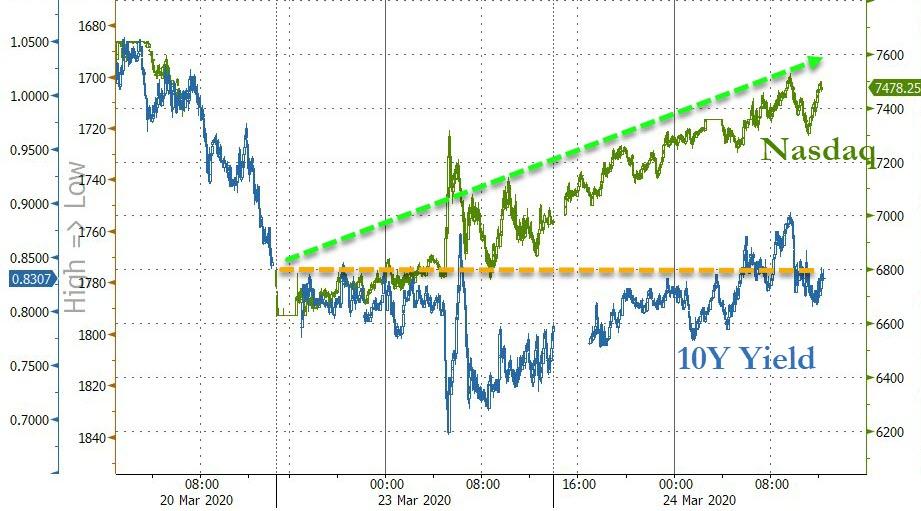

Bonds and stocks have notably decoupled once again this week...

Source: Bloomberg

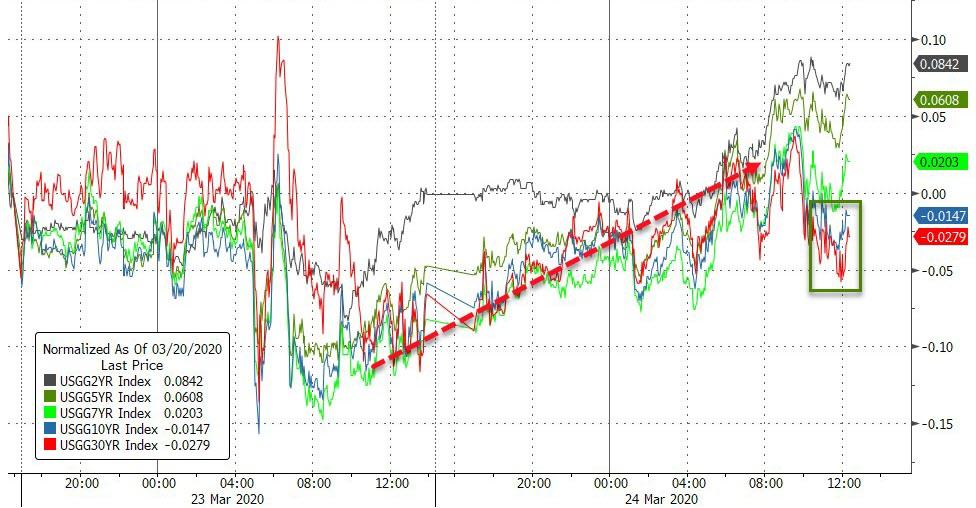

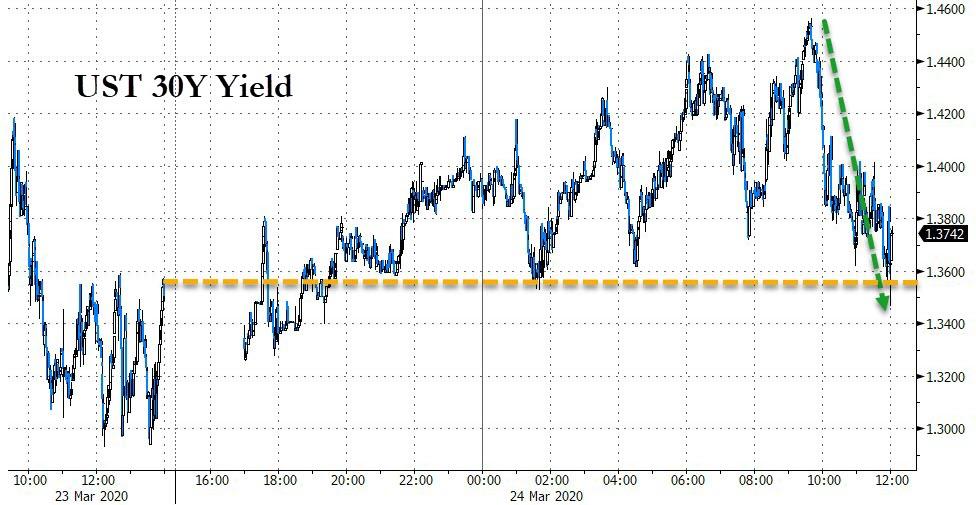

Treasury yields were higher today, led by the belly (5Y-10Y +9bps, 30Y +2bps) - but 10Y and 30Y yield are still lower on the week...

Source: Bloomberg

30Y Yields outperformed, rallying from around the time of the ugly PMIs...

Source: Bloomberg

The Dollar suffered its first drop in the last 11 days...

Source: Bloomberg

Cryptos extended their post-QEterntity gains...

Source: Bloomberg

Helped by a weaker dollar, commodities were all broadly higher today (with Precious Metals extended their gains today - silver outperfoming...

Source: Bloomberg

WTI was unable to hold gains above $24 today, ahead of tonight's API inventory data...

Gold futures soared once again, almost tagging $1700...

And notably decoupling from spot prices...

Source: Bloomberg

Silver is also rallying hard, back above $14...

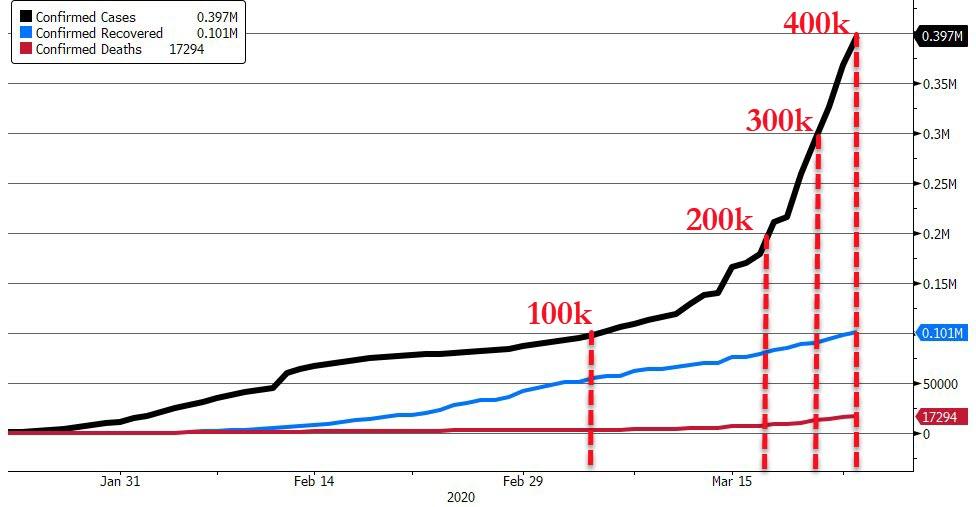

Finally, we hate to burst everyone's bubble, but this thing is accelerating dramatically...

Source: Bloomberg

But, despite the soaring cases and deaths, the "Virus Fear" trade has plunged in the last two days...

Source: Bloomberg

Nessun commento:

Posta un commento