In a striking interview with Goldman's Allison Nathan, legendary trader Paul Tudor Jones argues that US inflation is set to accelerate sharply, making bonds a very poor investment, and that the Fed must act swiftly to tackle financial bubbles created by prolonged monetary easing.

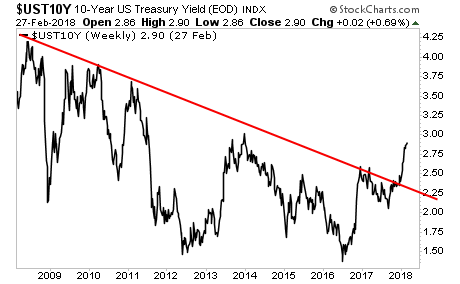

Joining such luminaries as Bill Gross and Ray Dalio, who have both claimed the bull market in bonds is over, PTJ joins the choir and warns that "markets disciplined Greece for its budget transgressions; it's just a matter of time before they discipline us" and as a result he sees the 10-year yields rising to 3.75 percent by year-end as a "conservative" target amid the now traditional and widely discussed bogeymen: supply outweighing demand, economic momentum outpacing the monetary policy response, and "glaring" bond valuations. Oh, and central banks ending the party, of course:

Beginning next September, when the ECB concludes its asset purchases, the aggregate balance sheet of the main central banks will start contracting after nearly a decade of expansion. That will be a major data break, making it a horrible time to own bonds.

PTJ also pours cold water on the repeated suggestion that higher yields will lead to more buying from pension funds: "Bond pension buying, for example, is very pro-cyclical. When stock prices rise, pensions reallocate their capital gains from stocks into bonds. As we've seen, this depresses the term premium and fuels more gains in the stock market. If and when the Fed raises rates enough to stop and reverse the stock market rise, that virtuous circle predicated on increasing capital gains will reverse, and bonds and stocks will decline together like they did in the 1970s."

The biggest factor, however, which is preventing PTJ from owning any risk assets is today's unnaturally low rates: "with rates so low, you can't trust asset prices today. And if you can't tell by now, I would steer very clear of bonds."

There is another reason PTJ is not deploying capital: last month's vol shock was just the beginning:

In my view, higher volatility is inevitable. Volatility collapsed after the crisis because of central bank manipulation. That game's over.With inflation pressures now building, we will look back on this low-volatility period as a five standard- deviation event that won't be repeated.

When would Tudor buy stocks? "When would I want to buy stocks? When the deficit is 2%, not 5%, and when real short-term rates are 100bp, not negative"... in other words not for a while.

So what is he buying: "I want to own commodities, hard assets, and cash... The S&P GSCI index is up more than 65% from its trough two years ago. In fact, relative to financial assets, the GSCI is at one of its lowest points in history. That has historically been resolved by commodities putting on a stunner of a show, stoking inflation. I wouldn't be surprised if that happened again."

In other words, PTJ and Gundlach agree on two things: stay away from bonds, and buy commodities.

But the most notable part of the interview, and where PTJ's most apocalyptic sentiment shines through, is his description of where he sees Fed Chair Powell right now: as General Custer before the Battle of Little Big Horn, a battle which - at least in the history books - was lost.

Let me describe to you where I think Jerome Powell is right now as he takes the reins at the Fed. I would liken Powell to General George Custer before the Battle of the Little Bighorn, looking down at an array of menacing warriors. On the left side of the battlefield are the Stocks—the S&P 500s, the Russells, and the NASDAQs—which have grown, relative to the economy, to their largest point not just in US history, but in world history. They have generally been held at bay and well-behaved, but they are just spoiling to show their true color: two-way volatility. They gave you a taste of that in early February. Look to the middle and there waits the army of Corporate Credit, which is also larger than ever relative to the economy, as ultra-low rates have encouraged it to gain in size, stature, and strength. This army is a little more docile right now, but we know its history, and it can be deadly when stressed. And then on the right are the Foreign Currency Fighters, along with the Crypto Tribe, an alternative store of value that only exists because of the games central banks are playing; the opportunity cost of Crypto is so low, why not own some? The Foreign Currency Fighters have strengthened by 10% over the past year. Compounding the problem, they have a powerful, ascending leader, the renminbi, to challenge the US dollar's hegemony as the reserve currency. All of these forces have been drawn to the battlefield because of our policy experiment with sustained negative real rates.

So Powell looks behind him to retreat. But standing there is none other than Inflation Nation, led by the fiercest warmongers of them all: the Commodities. He might take comfort that he is not alone on the battlefield. But then he looks over at the Washington, DC, fiscal battalion and realizes they are drunk on 5% deficit beer. That's what Powell is facing, whether he recognizes it or not. And how he navigates this is going to be fascinating to watch.

* * *

His full must read interview is below:

Interview with Paul Tudor Jones

Allison Nathan: You've said that you would rather hold a burning coal than a 10-year Treasury. Why?

Paul Tudor Jones: The bear market in bonds is the natural upshot of the bull market in monetary and fiscal laxity. My view on bonds is based on three major factors. First, there is a huge flow of funds imbalance with supply overwhelming demand. We are in a unique historical situation with the Fed stepping away from the market while the US government is significantly increasing its auction sizes. I assume bonds will fall until the peak in full Treasury auction sizes, which I don't think will be before 2Q2019. At the current pace, next February we might have a quarterly auction of $20bn 30-years vs. $15bn recently. That is so big it will only clear at substantially lower prices.

Second, economic momentum is now overwhelming the pace of the monetary policy response. We're in the third-longest economic expansion in history. Yet we've somehow managed to pass a tax cut and a spending bill, which together will give us a budget deficit of 5% of GDP—unprecedented in peacetime outside of recessions. This reminds me of the late 1960s when we experimented with low rates and fiscal stimulus to keep the economy at full employment and fund the Vietnam War. Today we don't have a recession, let alone a war. We are setting the stage for accelerating inflation, just as we did in the late '60s.

Finally, and most importantly, adverse valuations are becoming more glaring. Bonds are the most expensive they've ever been by virtually any metric. They're overvalued and over-owned. Valuations haven't been that relevant in recent years because of central bank manipulation outside of the US, but with the Fed in motion and the US economy in fifth gear, they start to matter a lot. I believe we're at that critical threshold right now.

Allison Nathan: Inflation expectations have been very well-anchored; does that make history a less useful guide?

Paul Tudor Jones: No. I think we're experiencing a hysteresis effect in global groupthink, led by the Fed, believing that we can depress term and risk premia without consequences for inflation or financial stability. That may have been the case for the past six to seven years. When it comes to inflation, you need to be careful what you wish for. At the end of other big asset price booms—Japan in 1989 or the US in 1999—inflation did not increase in a measured way. Rather, it accelerated in a non-linear fashion until the central bank had to come in and stop it with substantially higher real rates than we have today.

Allison Nathan: Is the market underestimating commodity-related inflation today?

Paul Tudor Jones: Absolutely. The S&P GSCI index is up more than 65% from its trough two years ago. In fact, relative to financial assets, the GSCI is at one of its lowest points in history. That has historically been resolved by commodities putting on a stunner of a show, stoking inflation. I wouldn't be surprised if that happened again.

Allison Nathan: Some argue that it will be difficult to overcome structural deflationary forces, like technological progress or demographic change. You don't agree?

Paul Tudor Jones: On technology, what I've seen during this disinflationary period is the concentration of economic power into a few corporate hands. Once they have cleared the playing field of their competitors, they could ratchet up prices to decompress margins.So I am not sure these technological disruptions will continue to bring disinflation. In terms of demographics, economists at the Bank for International Settlements (BIS) have shown that it is the relative size of the working-age population that influences long-term trends in inflation.Unlike the prior decade, the share of the working-age population globally is beginning to shrink, and that would argue for inflation trending up.

Allison Nathan: Does all of this just boil down to the Fed being behind the curve?

Paul Tudor Jones: Central banks love to look in the rearview mirror. They typically operate by waiting for the most obvious moment they can to make a decision to fight yesterday's battles. Heck, the ECB hiked rates in July 2008! It is why price targeting is such a bad idea in rate decisions, as is its first cousin, gradualism. There is little in human nature that is linear, so why should rate policy be that way?

But the elephant in the room—the most important point that doesn't get discussed enough—is the level of real interest rates. The peacetime 10-year real interest rate that has determined the efficient allocation of capital averaged 3½% since 1790 and 2½% in modern times. Yet in 2018, with the economy operating at full employment, our real 10-year rate is 0.64%, well below historical averages. Why? It seems the reason is the Fed is trying to bring core inflation from a smidge below 2% to a smidge above it. But since 1790, US inflation has averaged 1.3% in peacetime. And yet somehow we have this magical 2% inflation target.It's a unicorn we keep chasing at the expense of everything else.

Sitting where we are today, this grand experiment with negative real rates might seem successful: We have the strongest economy in 40 years, at full employment. The mood is euphoric. But it is unsustainable and comes with costs such as bubbles in stocks and credit. Navigating these bubbles will be one of the most difficult jobs any Fed chair has ever faced.

Allison Nathan: Is the Fed up to the task?

Paul Tudor Jones: Let me describe to you where I think Jerome Powell is right now as he takes the reins at the Fed. I would liken Powell to General George Custer before the Battle of the Little Bighorn, looking down at an array of menacing warriors. On the left side of the battlefield are the Stocks—the S&P 500s, the Russells, and the NASDAQs—which have grown, relative to the economy, to their largest point not just in US history, but in world history. They have generally been held at bay and well-behaved, but they are just spoiling to show their true color: two-way volatility. They gave you a taste of that in early February. Look to the middle and there waits the army of Corporate Credit, which is also larger than ever relative to the economy, as ultra-low rates have encouraged it to gain in size, stature, and strength. This army is a little more docile right now, but we know its history, and it can be deadly when stressed. And then on the right are the Foreign Currency Fighters, along with the Crypto Tribe, an alternative store of value that only exists because of the games central banks are playing; the opportunity cost of Crypto is so low, why not own some? The Foreign Currency Fighters have strengthened by 10% over the past year. Compounding the problem, they have a powerful, ascending leader, the renminbi, to challenge the US dollar's hegemony as the reserve currency. All of these forces have been drawn to the battlefield because of our policy experiment with sustained negative real rates.

So Powell looks behind him to retreat. But standing there is none other than Inflation Nation, led by the fiercest warmongers of them all: the Commodities. He might take comfort that he is not alone on the battlefield. But then he looks over at the Washington, DC, fiscal battalion and realizes they are drunk on 5% deficit beer. That's what Powell is facing, whether he recognizes it or not. And how he navigates this is going to be fascinating to watch.

Allison Nathan: So, what should Powell do?

Paul Tudor Jones: Unlike his predecessors, he needs to be symmetrically fearless. Policy unorthodoxy needs to be reversed as quickly as it was deployed. After Alan Greenspan ignored the NASDAQ bubble, it crashed and led to this incredible foray into negative real rates. That created the mortgage bubble, which was initially ignored by Ben Bernanke and ultimately spawned the financial crisis, leading us to fiscal and monetary measures that were unfathomable 20 years ago.

Today, we need a Fed chair who is proactive, not reactive. Policy-wise, that means moving as quickly as possible to raise rates and restore appropriate risk premia so as to promote the long-term, efficient allocation of capital. While this will hurt a bit in the short run, it is better than the intergenerational theft that is being perpetrated now with the combination of low rates and high deficits. And it definitely will promote a more stable long-term economic equilibrium.

It also means having honest discussions about financial stability. A "symmetrical" way to signal that our policy path is unsustainable is to conventionally use what has now become an unconventional tool through its disuse: raise margin

requirements on stock borrowing. Whether you're an individual or a corporation, now is not the time to be aggressively leveraging your balance sheet. In fact, for individuals, given the record-low personal savings rate, now is the time to be doing the exact opposite. Remember, saving is the seed corn of future investment and worthy of as much discussion as inflation. If the Fed doesn't change its course, the systemic threat to the economy will only increase, making the eventual unwind that much more painful.

Allison Nathan: You've repeatedly mentioned fiscal policy. Can you elaborate on your views on that?

Paul Tudor Jones: I think the recent tax cuts and spending increases are something we will all look back on and regret. And I lay them firmly at the feet of the Fed for encouraging such a fiscal transgression by pursuing this experiment with negative real rates at full employment. With central banks globally experimenting with negative rates, zero rates, quantitative easing, and price targeting, it is easy to see how central governments could feel green-lighted to pursue unconventional fiscal policies. Certainly, central banks are not in a position to criticize them… If real rates had been at their long-term averages, would we have enacted a $1.5tn tax cut? My guess is the Congressional Budget Office's scoring of the increased interest burden would have nixed it.

Allison Nathan: In this context, what do you want to own?

Paul Tudor Jones: I want to own commodities, hard assets, and cash. When would I want to buy stocks? When the deficit is 2%, not 5%, and when real short-term rates are 100bp, not negative. With rates so low, you can't trust asset prices today. And if you can't tell by now, I would steer very clear of bonds. Just think, Greece will have a budget deficit below 2% of GDP by the time ours grows to 5%-plus. The markets disciplined Greece for its budget transgressions; it's just a matter of time before they discipline us. I think that time could be starting now with 10-year Treasuries rising to 3.75%, and 30-years to 4.5%, by year-end, and those are conservative targets.

Allison Nathan: Won't easier monetary policy in Europe and Japan cap the rise in US yields?

Paul Tudor Jones: I don't think so. Beginning next September, when the ECB concludes its asset purchases, the aggregate balance sheet of the main central banks will start contracting after nearly a decade of expansion. That will be a major data break, making it a horrible time to own bonds.

Allison Nathan: Won't rising yields attract some buyers?

Paul Tudor Jones: No. Bond pension buying, for example, is very pro-cyclical. When stock prices rise, pensions reallocate their capital gains from stocks into bonds. As we've seen, this depresses the term premium and fuels more gains in the stock market. If and when the Fed raises rates enough to stop and reverse the stock market rise, that virtuous circle predicated on increasing capital gains will reverse, and bonds and stocks will decline together like they did in the 1970s.

Allison Nathan: You are well-known for calling Black Monday. Is the recent surge in volatility behind us?

Paul Tudor Jones: In my view, higher volatility is inevitable. Volatility collapsed after the crisis because of central bank manipulation. That game's over. With inflation pressures now building, we will look back on this low-volatility period as a five standard- deviation event that won't be repeated.

Source:

Source:  Westpac Banking Corp (orange); ANZ Banking Group (purple); Commonwealth Bank (green)

Westpac Banking Corp (orange); ANZ Banking Group (purple); Commonwealth Bank (green)