Jerome Powell knows the Everything Bubble is in serious trouble.

In his prepared comments for US Congress, released yesterday, Fed Chair Jerome Powell stated:

If we do get behind and the market does, the economy does overheat... then we'll have to raise rates faster, and that raises the chances of a recession…

First and foremost, Powell is "floating" this idea because he knows full and well that the Fed IS already behind the curve on inflation. Several of the Fed's own in-house inflation metrics are already well north of 2% if not 3%.

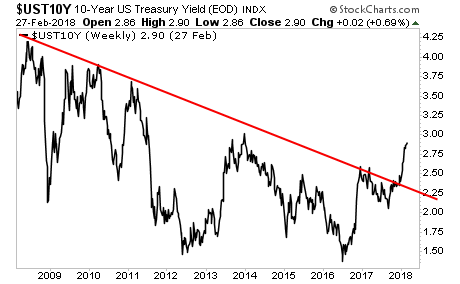

Buckle up, because Treasury yields are exploding higher having broken their long-term trendline.

Let's be clear here. The Fed is terrified of the Everything Bubble bursting. And we're a lot closer to a crisis than most realize.

Nessun commento:

Posta un commento