Stock and bond prices were both down today - adding up to the worst combined day since 12/2

Source: Bloomberg

US Major equity indices were all lower on the day, despite a valiant attempt at a bounce...

Source: Bloomberg

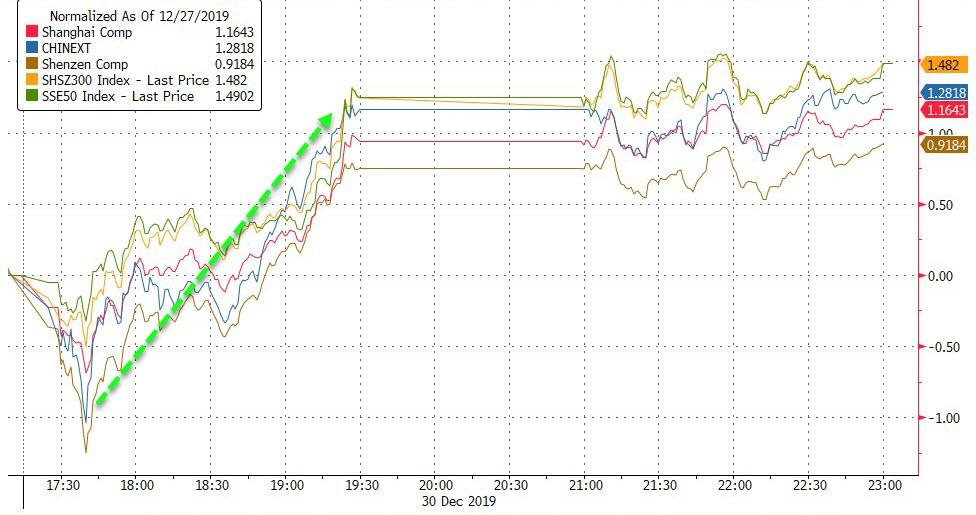

Chinese markets were higher overnight...

Source: Bloomberg

European stocks were lower today...

Source: Bloomberg

US markets perfectly reflected AAPL today as the buyback machine lifted the market then stalled...

US Majors also broke the December uptrend line today...

And Nasdaq fell (for the 2nd day) back below the key 9,000 level...

FANG stocks have erased last week's gains (biggest daily drop in six weeks)...

Shorts were squeezed as Europe closed, and managed to lift Small Caps to green, but could not hold it...

Source: Bloomberg

A 'mini' rotation today from TSLA into NIO?

VIX and stocks continued to decouple...

Source: Bloomberg

Credit and equity protection majorly decoupled...

Source: Bloomberg

Bond yields (up) and stocks (down) recoupled today after the decoupling from 12/20...

Source: Bloomberg

Once again the old pattern of EU selling and US buying is back for bonds...

Source: Bloomberg

The 30Y Yield ramped (illquidly) above last week's highs before tumbling back...

Source: Bloomberg

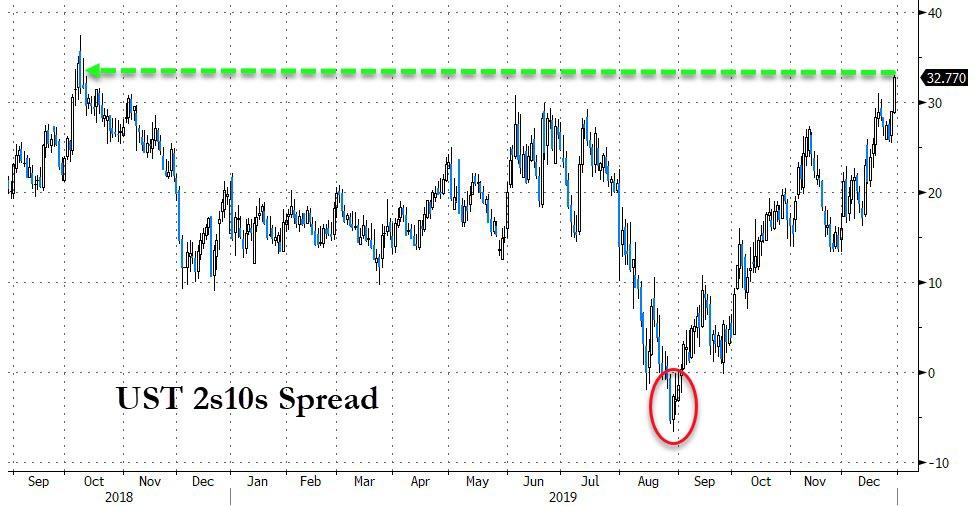

The yield curve (2s10s) pushed to its steepest since Oct 2018...

Source: Bloomberg

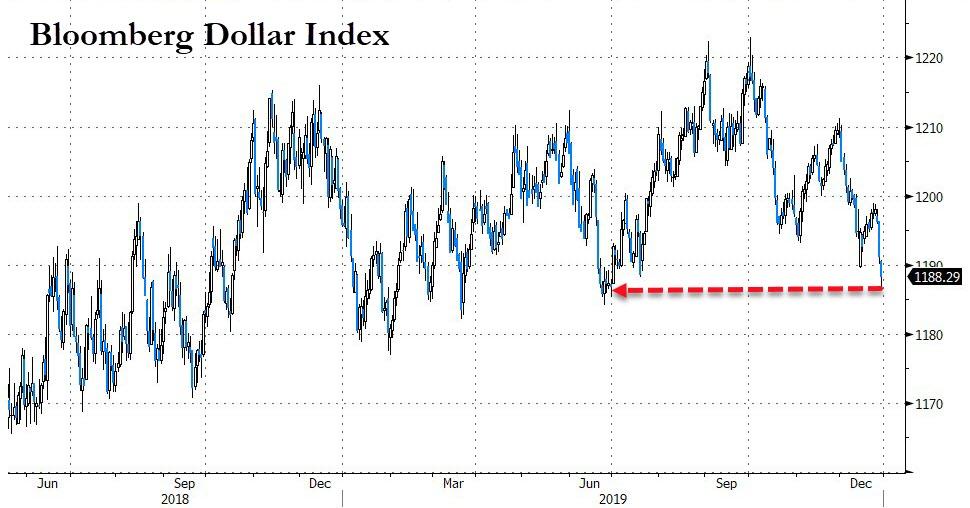

The Dollar accelerated lower again today with a small rebound after Europe closed...

Source: Bloomberg

The Dollar hit 6-month lows...

Source: Bloomberg

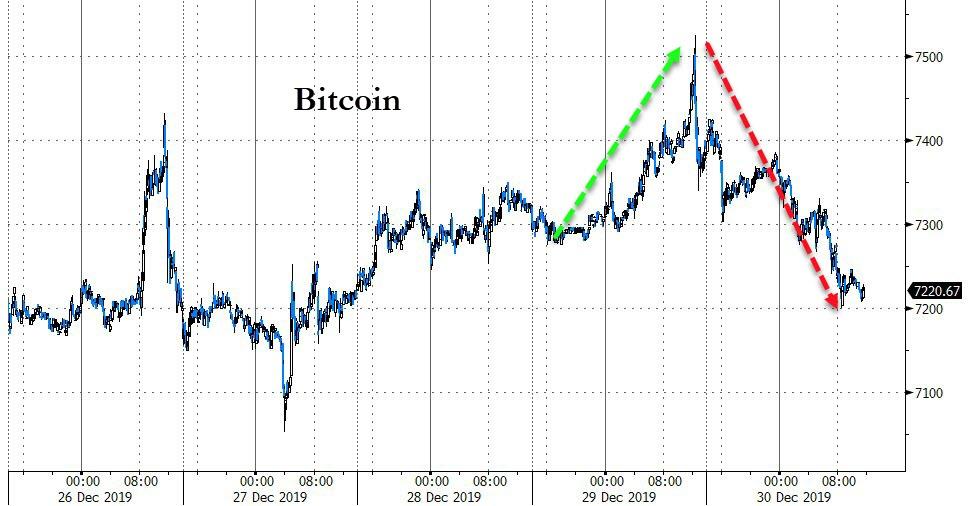

Cryptos gave back their weekend gains today (but Ethereum remains higher)...

Source: Bloomberg

Bitcoin topped $7500 over the weekend but slipped back to $7200 intraday today...

Source: Bloomberg

Silver had another good day as copper and crude lagged (despite an implicit rate cut in China)...

Source: Bloomberg

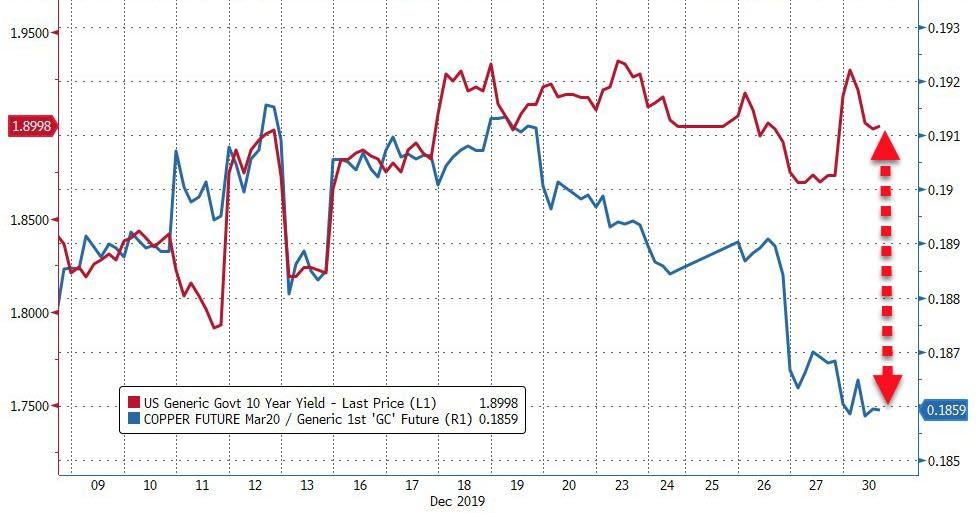

According to the commodity complex (copper/gold), Treasury yields should be notably lower...

Source: Bloomberg

What does gold know about a resurgence in global negative-yielding debt?

Source: Bloomberg

Finally, Ed Yardeni's Fundamental Stock Market Indicator is signaling the S&P is 20% rich to reality...

Source: Bloomberg