In the peak days of the European financial crisis, when Spanish banks were on the verge of collapse and were desperate for depositor funding as the ECB scrambled to come up with a viable rescue scheme, one bank - the soon to be insolvent Bankia - had a "clever" idea: offer a Spiderman Beach Towel in exchange for a €300 deposit.

Fast forward 7 years when the cash-strapped banks of another country have come up with a similar trick to entice depositors: a growing number of small local banks across China have conceived of a "brilliant" scheme to lure new depositors: handing out servings of expensive pork as a reward for opening an account, the SCMP reports.

As we discussed in recent months, China's smaller banks were hit by a perfect storm of falling rates and declining state support, which culminated in bank runs and the nationalization of several small and medium banks. And since there is little hope that the status quo will change any time soon, Chinese banks - which on top of everything are facing a $400 billion liquidity shortfall in January - are forced to go to greater lengths to attract new deposits, since they generally earn less money from lending and have fewer funding options than their larger peers.

Unlike Spain, Chinese banks are offering a product which is in great demand for the nation that is reeling as a result of "pig ebola": pork. Indeed, as SCMP adds, the fact that pork could be seen as a desirable reward for opening a bank account also speaks to the country's massive shortage of its favorite staple meat.

Who knew the intersection of the supply and demand curves would be marked by a pound of pork.

On Monday, clients who deposited 10,000 yuan (US$1,430) or more in a three-month time deposit at the Linhai Rural Commercial Bank in Duqiao in Zhejiang province were then eligible to enter a lottery to win a portion of pork ranging from 500 grams (18 ounces) to several kilograms.

"The money is still my own, and the interest is good. I'm happy to receive a piece of pork in addition," one female client, who deposited around 20,000 yuan (US$2,900), was quoted as saying by the Metropolitan Express. Unfortunately for said client, she failed to grasp that any bank that is resorting to such ham-headed measures to boost depositor interest will likely not be around for long, and her entire deposit will likely vaporize in the coming weeks.

In any case, the gimmick is working: according to the Express, the bank distributed 1,097 deposit rewards on Monday after scores of mostly elderly clients queued up in front of the bank from early that morning.

"It was quite a good idea and very popular among locals, especially the elderly," said a bank staff member, who did not offer his name. He also refused to comment on how much money the bank had received in new deposits due to the promotion.

In retrospect, it is a brilliant solution: instead of offering higher rates which only accelerate the banks insolvency as these require higher payouts on deposits, the bank is instead making a one-time payment, and the novelty of the "handout" is enough to get substantial new deposits.

Other rural commercial banks in northern China's Hebei province and western China's Guizhou province have also launched similar pork rewards programs. Dushan Rural Commercial Bank, located in the remote mountainous county in Guizhou, offered a coupon for 10 yuan (US$1.4) worth of pork for every 10,000 yuan of new deposits.

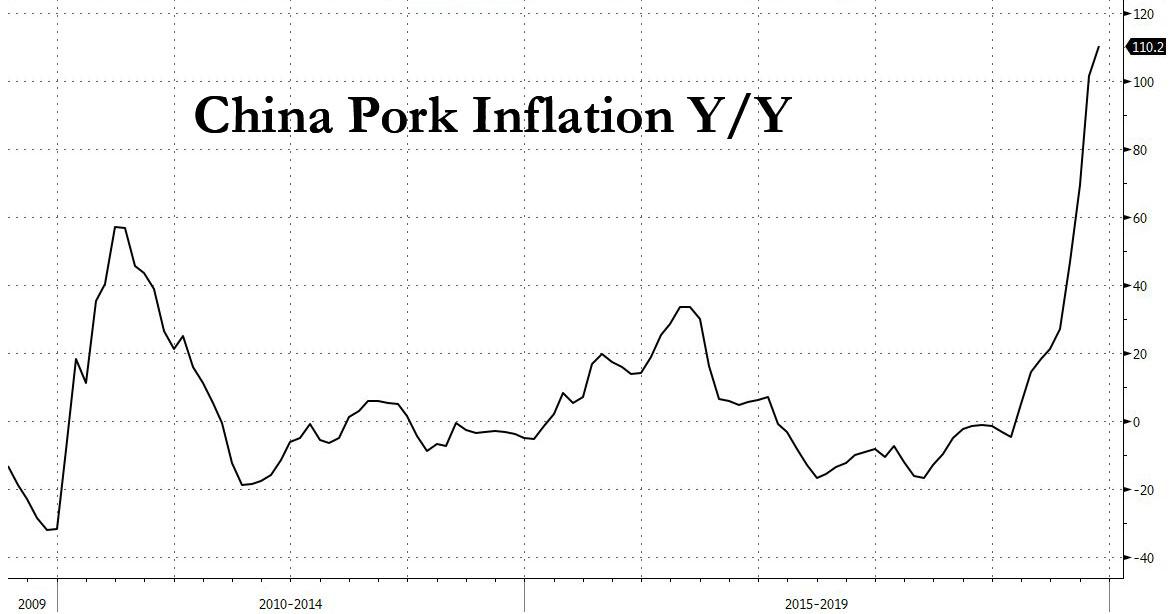

The reason behind China's infatuation with pork is familiar: the outbreak of African swine fever, which is reported to have killed over 100 million pigs in China, has sent the price of pork skyrocketing, with November's consumer price index rising 4.5 per cent from a year earlier, up from a 3.8 per cent gain in October, in large part due to a 110.2 per cent increase in the price of pork.

There were some signs of improvement: China's pig population actually expanded in November for the first time in a year, while the price of pork price has fallen in recent weeks. The pig population in 400 counties monitored by China's Ministry of Agriculture and Rural Affairs grew 2% in November from October, the first monthly rise since November 2018, while the number of breeding sows rose 4% from a month earlier. Wholesale pork prices last week fell back 0.8 per cent from the previous week, the fourth straight weekly decline, according to the latest data released by the Ministry of Commerce on Wednesday.

Wholesale pork prices last week fell back 0.8 per cent from the previous week, the fourth straight weekly decline

Wholesale pork prices last week fell back 0.8 per cent from the previous week, the fourth straight weekly decline China's pig population, though, is around 40% smaller than it was a year ago, according to data from China's agriculture ministry.

Still, despite recent signs of improvement, experts said the crisis may worsen further next year before it improves.

"It depends on what you mean on whether the worst is over because it's already killed most of [China's pigs]. There aren't as many pigs to kill as there were before," said E. Wayne Johnson, a veterinarian consultant at Enable AgTech Consulting in Beijing.

"We expect that there will be outbreaks in the wintertime because it's very difficult to clean the trucks, particularly in the north of China, and the virus is preserved by cold weather. Plus, you have the fact that the infected pigs are continuing to go into the slaughterhouses, and everybody sends their trucks to the slaughterhouse. So the disease is being spread on the highways just as it was a year ago. There's no reason to think that it's over with."

With peak seasons for pork consumption just around the corner – with celebrations for the winter solstice this week, the new year holiday on January 1 and the week-long Lunar New Year holiday starting on January 25 – the pressure on the price of pork is set to increase due to limited supplies. To alleviate the coming demand surge, on Tuesday, the government announced that it would release an additional 40,000 tonnes of frozen pork reserves on Thursday, on top of the previous round of 40,000 tonnes released a week ago.

China also announced earlier this month that it would waive import tariffs on some pork shipments from the United States. In total, China will purchase over 3 million tonnes of pork this year, more than twice as much as last year, confirmed Commerce Ministry spokesman Gao Feng at the end of last month.

Beijing has also called for a relaxation of restrictions on pig farming on land normally reserved for forests, with the land only returning to forestry production after the pork supply crisis

has been resolved, according to a document from the National Forestry and Grassland Administration dated Monday and seen by the South China Morning Post.

"These [recently announced] measures are very positive and effective moves," said Wang Zuli, a research fellow with the Chinese Academy of Agriculture Sciences. "But pork reserves have been unable to fully resolve the supply problem, so it is hard to say whether the measures are sufficient."