Après moi, le déluge

~ King Louis XV of France

A hard rain's a-gonna fall

~ Bob Dylan (the first)

As the Federal Reserve kicked off its second round of quantitative easing in the aftermath of the Great Financial Crisis, hedge fund manager David Tepper predicted that nearly all assets would rise tremendously in response.

"The Fed just announced: We want economic growth, and we don't care if there's inflation... have they ever said that before?"

He then famously uttered the line "You gotta love a put", referring to the Fed's declared willingness to print $trillions to backstop the economy and financial makets.

Nine years later we see that Tepper was right, likely even more so than he realized at the time.

The other world central banks followed the Fed's lead. Mario Draghi of the ECB declared a similar "whatever it takes" policy and has printed nearly $3.5 trillion in just the past three years alone. The Bank of Japan has intervened so much that it now owns over 40% of its country's entire bond market. And no central bank has printed more than the People's Bank of China.

It has been an unprecedented forcefeeding of stimulus into the global system. And, contrary to what most people realize, it hasn't diminished over the years since the Great Recession. In fact, the most recent wave from 2015-2018 has seen the highest amount of injected 'thin-air' money ever:

In response, equities have long since rocketed past their pre-crisis highs, bonds continued rising as interest rates stayed at historic lows, and many real estate markets are now back in bubble territory. As Tepper predicted, financial and other risk assets have shot the moon.

And everyone learned to love the 'Fed put' and stop worrying.

But as King Louis XV and Bob Dylan both warned us, what's coming next will change everything.

The Deluge Approaches

This halcyon era of ever-higher prices and consequence-free backstopping by the central banks is ending.

The central banks, desperate to give themselves some slack (any slack!) to maneuver when the next recession arrives, have publicly committed to 'tightening monetary policy' and 'unwinding their balance sheets', which is wonk-speak for 'reversing what they've done' over the past decade.

Most general investors today just don't appreciate how gargantuanly significant this is. For the past 9 years, we've become accustomed to a volatily-free one-way trip higher in asset prices. It's been all-glory with no risk while the 'Fed put' has had our backs (along with the 'EBC put', the 'BOJ' put, the 'PBoC put', etc). Anybody going long, buying the (few, minor) dips along the way, has felt like a genius.

That's all over.

Based on current guidance from the central banks, "global QE" is expected to drop precipitously from here:

With just the relatively tiny amount of QE tapering so far, 2018 has already seen more market price volatility than any year since 2009. But we've seen nothing so far compared to the volatility that's coming later this year when QE starts declining in earnest.

In parallel with this tightening, global interest rates are rising after years of flatlining at all-time lows. And it's important to note that our recent 0% (or negative) yields came at the end of a 35-year secular cycle of declining interest rates that began in the early 1980s.

Are we seeing a secular cycle turn now that rates are creeping back up? Will rising interest rates be the norm for the foreseable future?

If so, the world is woefully unprepared for it.

Countries and companies are carrying unprecendented levels of debt, as are many households. Rising interest rates increases the cost of servicing that debt, leaving less behind to invest or to meet basic operating needs.

Simon Black reminds us that, mathematically, rising interest rates result in lower valuations for stocks, bonds and housing. But so far, Wall Street hasn't gotten the message (chart courtesy of Charles Hugh Smith):

(Source)

So we're presented with a simple question: What happens when the QE that's grossly-inflating markets stops at the same time that interest rates rise?

The answer is simple, too: Prices fall.

They fall commensurate with the distortion within the system. Which is unprecendented at this stage.

But Wait, There's More!

So the situation is dire. But it gets worse.

Our debt that's getting more expensive to service? Well, not only are we (in the US) adding to it at a faster rate with our newly-declared horizon of $1+ trillion annual deficits, but we're increasingly antagonizing the largest buyers of our debt.

This is most notable with China (the #1 Treasury buyer), whom we've dragged into a trade war and just announced $50 billion in tariffs against. But Japan (the #2 buyer) is also materially reducing its Treasury purchases. And not to be outdone, Russia recenty dumped half of its Treasury holdings, $47 billion worth, in a single fell swoop.

Should this trend lead, understandably, to lower demand for US Treasurys in the future, that only will put further pressure on interest rates to move higher.

And this is all happening at a time when the stability of the rest of the world is fast deteriorating.

Developing (EM) countries are getting destroyed as central bank liquidity flows slow and reverse -- as higher interest rates strengthen the USD against their home currencies, their debts (mostly denominated in USD) become more costly while their revenues (denominated in local currency) lose purchasing power.

Fault lines are fracturing across Europe as protectionist, populist candidates are threatening the long-standing EU power structure. Italy's economy is struggling to remain afloat and could take the entire European banking system down with it. The new tit-for-tat tariffs with the US aren't helping matters.

And China, trade war aside, is seeing its fabled economic momentum slow to multi-decade lows.

All pieces on the chessboard are weakening.

The Timing Is Becoming Clear

Yes, the financial markets are currently still near all-time highs (or at the high, in the case of the Nasdaq). And yes, expected Q2 US GDP has jumped to a blistering 4.8%.

But the writing is increasingly on the wall that these rosy heights won't last for much longer.

These next three charts from Palisade Research, combined with the above forecast of the drop-off in global QE, paint a stark picture for the rest of 2018 and beyond.

The first shows that as the G-3 central banks have started their initial (and still small) efforts to withdraw QE, the Global Financial Stress Indicator is spiking worrisomely:

Next, one of the best predictors of global corporate earnings now forecasts an imminent collapse. As go earnings, so go stock prices:

And looking at trade flows -- which track the movement of 'real stuff' like air and shipping freights -- we see clear signs that the global economy is slowing down (a trend that will be exacerbated if oil prices rise as geologist Art Berman predicts):

The end of QE, higher interest rates, trade wars at a time of slowing global trade, China/Europe weakening, EM carnage -- it's like both legs of the ladder you're standing on being sawed off, as well all of the rungs underneath you.

Conclusion: a major decline in the financial markets is due for the second half of 2018/first half of 2019.

Actions To Take

Gathering clouds deliver a valuable message: Seek shelter before the storm.

Specifically, it's time to:

- Get liquid. When the rug gets pulled out from under today's asset prices, 'flat' will be the new 'up'. Simply not losing money will make you wealthier on a relative basis -- it's the easiest, least-risky strategy for most investors to prepare for what's coming. "Cash is king" in the aftermath of a deflationary downdraft, when your dry power can be then used to purchase high-quality income-producing assets at excellent value -- fractions of their current prices. And in the interim, the returns on cash are getting better for investors who know where to look. We've recently explained how you can now get 2%+ interest on cash stored in short-term T-bills (that's 30x more than most banks will pay on cash savings). If you're sitting on cash and haven't looked seriously yet at that program, you really should review our report. With more Fed tightening expected in the future, T-bill rates are likely headed even higher.

- Get your plan for the correction into place now. In addition to your cash, how is the rest of your portfolio positioned? Do you have suitable hedges in place to mitigate your risk? Does your financial advisor even acknowledge the risks detailed in the above article? The last thing you want to do in a market downdraft is make panicked decisions. So if you haven't already put together a contingency plan for a 20-40%+ market drop, consider scheduling a consultation with the firm we endorse (it's completely free).

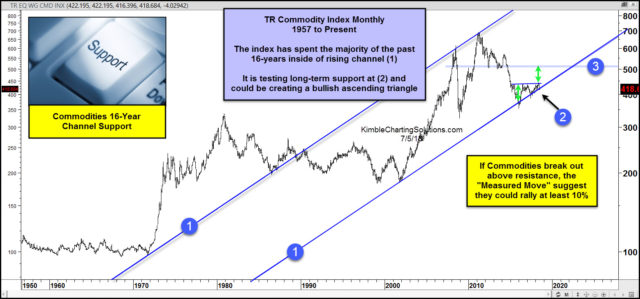

- Nibble into commodities. The commodities/equities price ratio is the lowest it has been in 47 years. That ratio has to correct some point soon. Much of that correction will be due to stocks dropping; but the rest will be by commodities holding their own or appreciating. While it's true that commodities could indeed fall as well during a general deflationary rout, that's not a guarantee -- especially given that many commodities are now selling at prices close to -- or in some cases, below -- their marginal cost of production. The easiest commodities to own yourself, the precious metals, are 'dirt cheap' right now (especially silver), as explained in our recent podcast with Ronald Stoeferle. And with today's bloodbath, they just got even cheaper.

- Assess and address your biggest vulnerabilities before the next crisis hits. Are you worried about the security of your current job when the next recession hits? Are rising interest rates causing you to struggle in deciding whether to buy or sell a home? Are you trying to come up with a plan for a resilient retirement? Are you assessing the pros and cons of relocating? Do you have homesteading questions? Are you trying to create new streams of income? Chris offers private consultations on these common questions, as well as many others. If you're wrestling with big life decisions like these, scheduling a consultation with him can prove valuable in helping you make the best choice.

We're lurching through the final steps of familiar territory as the status quo we've known for the past near-decade is ending.

The mind-bogglingly massive central bank stimulus supporting asset prices are disappearing. Interest rates are rising. It's hard to overemphasize how seismic these changes will be to world markets and the global economy.

The coming months are going to be completely different than what society is conditioned for. Time is running short to get prepared.

The currency and bond markets of five major countries are now in the danger zone, as many more teeter on the edge.

Because when today's Everything Bubble bursts, the effect will be nothing short of catastrophic as 50 years of excessive debt accumulation suddenly deflates.

A hard rain indeed is gonna fall.