Economic commentaries, articles and news reflecting my personal views, present trends and trade opportunities. By F. F. F. Russo (PLEASE NO MISUNDERSTANDING: IT'S FREE).

mercoledì 7 febbraio 2018

BofA: This Was A "Minsky Moment" For The VIX

Rickards: Establishment Insiders Are Flashing Red Warning Lights

Jim says you can't get much more of a warning than insiders saying that markets look as they did right before Lehman. Here's what it means…

Barely a week after it set another record high, the Dow just suffered its worst one-day loss in its entire history. While the latest turmoil hasn't reached the crisis level by any means, I've been warning about a correction for months. Warnings about an imminent collapse of developed economy stock markets, especially the U.S. markets, have been everywhere. Whether you use Shiller's CAPE ratio, Warren Buffett's preferred market-cap-to-GDP ratio, or traditional P/E ratios, markets were overpriced and ready to fall. Of course, that did not mean they would fall anytime soon, or on anyone's timetable. As we saw in the dot.com bubble of 1996-2000, and the housing bubble of 2002-2007, so-called "irrational exuberance" can last longer than the skeptics believe. However, some warnings perhaps deserve more attention than others. Anyone can sound warnings about doom and gloom or stock market crashes. But those Cassandras are not worth listening to unless they offer facts and analysis to support their views. Opinions without something solid to back them up are just that — opinions. The warnings I pay most attention to are those from establishment insiders.

These are the kinds of individuals who attend Davos and routinely discuss market conditions with central bank heads, finance ministers and people like Christine Lagarde, head of the IMF. The credibility of such insiders is enhanced ever further when they come with serious academic credentials such as an economics Ph.D. from a top university in the field. William White is such an individual. He was former head of the OECD review board and former chief-economist for the BIS, the "central bankers central bank" based in Basel, Switzerland. In a recent interview, White flatly declared, "All the market indicators right now look very similar to what we saw before the Lehman crisis, but the lesson has somehow been forgotten." You can't get much more of a blinking red light than that. Heading into this year, I called 2018 "The Year of Living Dangerously." That description seemed odd to lot of observers. Major U.S. stock indexes kept hitting new all-time highs, which continued through the end of January. Even in strong bull market years there are usually one or two down months as stocks take a breather on the way higher. Not last year. There was no rest for the bull; it was up, up and away. The unemployment rate has been at a 17-year low. U.S. growth was over 3% in the second and third quarters of 2017. It underwhelmed in the fourth quarter at 2.6%, but it was still above the tepid 2% growth we've seen since the end of the last recession in June 2009. The U.S. hasn't been alone. For the first time since 2007, we were seeing strong synchronized growth in the U.S., Europe, China, Japan (the "big four") as well as other developed and emerging markets. In short, all has been right with the world. Or not.

To understand why I said 2018 may unfold catastrophically, we can begin with a simple metaphor. Imagine a magnificent mansion built with the finest materials and craftsmanship and furnished with the most expensive couches and carpets and decorated with fine art. Now imagine this mansion is built on quicksand. It will have a brief shining moment and then sink slowly before finally collapsing under its own weight. That's a metaphor. How about hard analysis? Here it is:

Start with debt. Much of the good news described above was achieved not with real productivity but with mountains of debt including central bank liabilities. In a recent article, Yale scholar Stephen Roach points out that between 2008 and 2017 the combined balance sheets of the central banks of the U.S., Japan and the eurozone expanded by $8.3 trillion, while nominal GDP in those same economies expanded $2.1 trillion. What happens when you print $8.3 trillion in money and only get $2.1 trillion of growth? What happened to the extra $6.2 trillion of printed money? The answer is that it went into assets. Stocks, bonds, emerging-market debt and real estate have all been pumped up by central bank money printing.

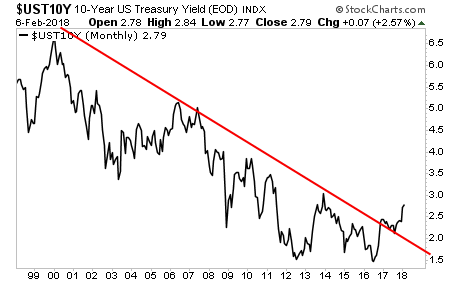

What makes 2018 different from the prior 10 years? The answer is that this is the year the central banks stop printing and take away the punch bowl. The Fed is already destroying money (they do this by not rolling over maturing bonds). Last week, the Fed reduced its balance sheet by $22 billion. While that doesn't seem like much when you're talking about a $4 trillion balance sheet, it was the Fed's largest cut to date. Funny how the market hit the skids just after this happened. But you haven't heard the mainstream media mention that. By the end of 2018, the annual pace of money destruction will be $600 billion — if the Fed under new chairman Jerome Powell stays on course. The European Central Bank and Bank of Japan are not yet at the point of reducing money supply, but they have stopped expanding it and plan to reduce money supply later this year. In economics everything happens at the margin. When something is expanding and then stops expanding, the marginal impact is the same as hrinking.

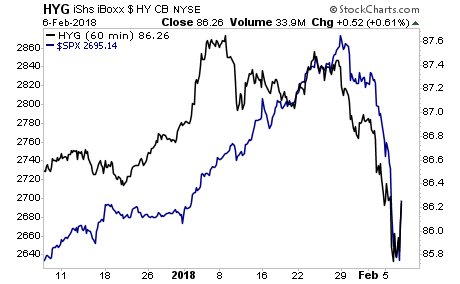

Apart from money supply, all of the major central banks are planning rate hikes, and some, such as those in the U.S. and U.K., are actually implementing them. Reducing money supply and raising interest rates might be the right policy if price inflation were out of control. But despite a recent uptick in some inflation measures, prices have mostly been falling. The "inflation" hasn't been in consumer prices; it's in asset prices. The impact of money supply reduction and higher rates will be falling asset prices in stocks, bonds and real estate — the asset bubble in reverse.

And as the past few days show, the problem with asset prices is that they do not move in a smooth, linear way. Asset prices are prone to bubbles on the upside and panics on the downside. Small moves can cascade out of control (the technical name for this is "hypersynchronous") and lead to a global liquidity crisis worse than 2008. This will not be a soft landing. The central banks — especially the U.S. Fed, first under Ben Bernanke and later under Janet Yellen — repeated Alan Greenspan's blunder from 2005–06. Greenspan left rates too low for too long and got a monstrous bubble in residential real estate that led the financial world to the brink of total collapse in 2008.

Bernanke and Yellen also left rates too low for too long. They should have started rate and balance sheet normalization in 2010 at the early stages of the current expansion when the economy could have borne it. They didn't. Bernanke and Yellen did not get a residential real estate bubble. Instead, they got an "everything bubble." In the fullness of time, this will be viewed as the greatest blunder in the history of central banking. Not only that, but Greenspan left Bernanke some dry powder in 2007 because the Fed's balance sheet was only $800 billion. The Fed had policy space to respond to the panic of 2008 with rate cuts and QE1. Today the Fed's balance sheet is over $4 trillion. If the current rout becomes a full-blown panic, or even if it is delayed until later, the Fed's capacity to cut rates is only 1.5%. And its capacity to expand the balance sheet is basically nil, because the Fed would be pushing the outer limits of an invisible confidence boundary. This conundrum of how central banks unwind easy money without causing a recession (or worse) is just one small part of a risky mosaic. For now, think of 2018 as the year of living dangerously. Smart investors should prepare now with reduced exposure to stocks and increased allocations to cash and gold.

The Bull Market in stocks is dead, to be precise it will be after next historical max, until this happens

Is the 9-Year Long Dead Cat Bounce Finally Ending?

Stock Market Plunge Protection Team Spotted Atop Mount Everest!

When You Buy Your Own Supply: The Fed's Plunge Protection Team

What happens when there are almost no organic stock market buyers left? When the valuations are so inflated and fear is so great that the freefall can't find a bottom? Well, that's when the federal government steps in and buys. Fake economic growth, meet fake stock market demand. Enter the Plunge Protection Team.

As futures were crashing in after-market trading, the question of who will step in to turn the market around should be pretty obvious. I'm betting on a buyer with unlimited access to new funds and a buyer unconcerned with profit motive. That the PPT or Plunge Protection Team would be deployed soon seems pretty likely.

If you're unfamiliar, per Investopedia:

"Plunge Protection Team" was the nickname given to the Working Group on Financial Markets by TheWashington Post in 1997. The team consists of the Secretary of the Treasury, the Chairman of the Board of Governors of the Federal Reserve, the Chairman of the SEC and the Chairman of the Commodity Futures Trading Commission.

It was initially perceived by some to have been created solely to shore up the markets or even manipulate them. The team was created in response to the 1987 market crash.

The theory is that the team manipulates markets by executing trades on several exchanges when the market isn't behaving as it would like. It is said to only work with big banks such as Goldman Sachs and Morgan Stanley, only to report to the President, and to keep no records of trades.

Profit of PTT action stay long for a while but, as technical indicators flash red go back shorting market!