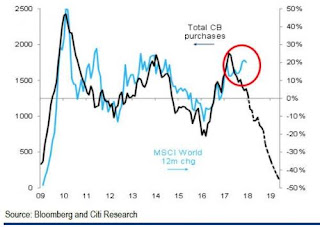

It is safe to say that one of the most popular, and important, charts of 2017, was the one showing the ongoing and projected decline across central bank assets, which from a record expansion of over $2 trillion in early 2017 is expected to turn negative by mid 2019. This is shown on both a 3- and 12-month rolling basis courtesy of these recent charts from Citi.

The reason the above charts are key, is because as Citi's Matt King, DB's Jim Reid, BofA's Barnaby Martin and countless other Wall Street commentators have pointed out, historically asset performance has correlated strongly with the change in central bank balance sheets, especially on the way up.

As a result, the big question in 2017 (and 2018) is whether risk assets would exhibit the same correlation on the way down as well, i.e. drop.

We can now say that for credit the answer appears to be yes, because as the following chart shows, the ongoing decline in CB assets is starting to have an adverse impact on investment grade spreads which have been pushing wider in recent days, in large part due to the sharp moves in government bonds underline the credit spread.

And, what is more important, is that investors appear to have noticed the repricing across credit. This is visible in two places: on one hand while inflows into broader credit have remained generally strong, there has been a surprisingly sharp and persistent outflow from US high yield funds in recent weeks. These outflows from junk bond funds have occurred against a backdrop of rising UST yields, which recently hit 2.67%, the highest since 2014, another key risk factor to credit investors.

But while similar acute outflows have yet to be observed across the rest of the credit space, and especially among investment grade bonds, JPM points out that the continued outflows from HY and some early signs of waning interest in HG bonds in the ETF space in the US has also been accompanied by sharp increases in short interest ratios in LQD (Figure 13), the largest US investment grade bond ETF...

... as well as HYG, the largest US high yield ETF by total assets,

This, together with the chart showing the correlation of spreads to CB assets, suggests that positioning among institutional investors has turned markedly more bearish recently.

Putting the above together, it is becoming increasingly apparent that a big credit-quake is imminent, and Wall Street is already positioning to take advantage of it when it hits.

So what about stocks?

Well, as Citi noted two weeks ago, one of the reasons why there has been a dramatic surge in stocks in the new years is that while the impulse - i.e., rate of change - of central bank assets has been sharply declining on its way to going negative in ~18 months, the recent boost of purchases from EM FX reserve managers, i.e. mostly China, has been a

huge tailwind to stocks.

This "intervention", as well as the recent retail capitulation which has seen retail investors unleashed across stock markets, buying at a pace not seen since just before both the 1987 and 2008 crash, helps explain why stocks have - for now - de-correlated from central bank balance sheets. This is shown in the final chart below, also from Citi.

And while the blue line and the black line above have decoupled, it is only a matter of time before stocks notice the same things that are spooking bonds, and credit in general, and get reacquainted with gravity.

What happens next? Well, if the Citi correlation extrapolation is accurate, and historically it has been, it would imply that by mid-2019, equities are facing a nearly 50% drop to keep up with central bank asset shrinkage. Which is why it is safe to say that this is one time when the bulls will be praying that correlation is as far from causation as statistically possible.

Fabrizio