More specifically, we asked what might happen in the event the inflationary pressures the labor market seems to be telegraphing finally show up in the headline numbers just as crude prices get off the mat.

Given that, to quote Goldman, "the most frequent contributors to modern recessions have been monetary policy tightening and oil price shocks, with the former in response to inflation that often gained momentum from the latter," we suggested that in the event the labor market is "right" and inflation eventually moves higher at the same time the crude market rebalances, it could set the stage for a rapid tightening effort from a Fed that, by virtue of keeping rates so low, for so long, would find itself further behind the curve than it's ever been.

Well, in the BIS's latest annual report (which we expected earlier today), the bank discusses that possibility. They, like everyone else, think that some disinflationary dynamics have become structural, a development which makes it unlikely that DM central banks would be forced into a panicked tightening episode that would choke off the global expansion.

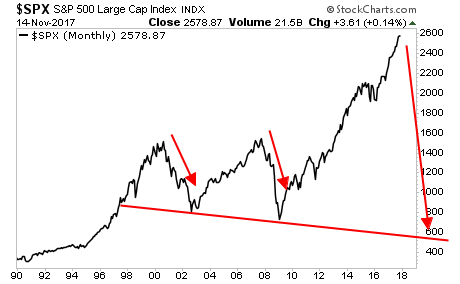

Rather, the BIS thinks the end of the current expansion might "more closely resemble a financial boom gone wrong."

More specifically, the bank looks at where debt/credit has spiraled out of control and like past reports, the BIS also warns that the buildup of USD debt in EMs poses a significant risk. More below…

Via BIS

With slack diminishing or vanishing, and not just in some of the major economies, it is only natural to ask whether an inflation flare-up might force central banks to tighten and thus smother the expansion. After all, this has been the most common pattern for much of the postwar era. Still, such concerns may be overdone. The link between domestic measures of slack and inflation has proved surprisingly weak and elusive for at least a couple of decades now. Wage pressures remain remarkably subdued. And increases in unit labour costs have not been very helpful in predicting inflation in advanced economies. The reasons for these developments are not well understood. We have suggested that globalisation, and possibly technology, have played an underappreciated role: they have made labour and product markets much more contestable and hence reduced the likelihood of a repeat of the wage-price spirals of the past. If those deep forces have not yet fully run their course, the end of the current expansion may be different.

That end may come to resemble more closely a financial boom gone wrong, just as the latest recession showed, with a vengeance. Leading indicators of financial distress point to financial booms that in a number of economies look qualitatively similar to those that preceded the GFC.

The countries involved are not those that were at the centre of the crisis: there, the financial cycle expansion is younger. Rather, the countries affected comprise a number of emerging market economies (EMEs), including some of the largest, and some advanced economies largely spared by the GFC. In this group, protracted strong credit expansion, often alongside rising property prices, signals the build-up of risks. That said, so far unusually low interest rates have generally kept debt service ratios below critical thresholds.

The strong post-crisis growth of foreign currency debt adds to vulnerabilities in some countries.Indeed, given the dominant global role of the US dollar, dollar funding remains a potential pressure point in the international monetary and financial system.

Maturing financial cycles and high debt levels raise the risk of potential weakness in consumption and, in some cases, investment. In many economies, the expansion has been consumption-led. The empirical evidence indicates that such expansions are less sustainable. Our analysis suggests that a number of economies where household debt is historically high can be vulnerable, especially should interest rates rise considerably.

As with consumption, the level of debt can affect investment. Rising interest rates would push up debt service burdens in countries with high corporate debt. Moreover, in EMEs with large shares of such debt in foreign currency, domestic currency depreciation could hurt investment. As mentioned before, an appreciation of funding currencies, mainly the US dollar, increases debt burdens where currency mismatches are present and tightens financial conditions (the exchange rate risk-taking channel). 9Empirical evidence suggests that a depreciation of EME currencies against the US dollar dampens investment significantly (Graph III.9, right-hand panel), offsetting to a large extent the positive impact of higher net exports.